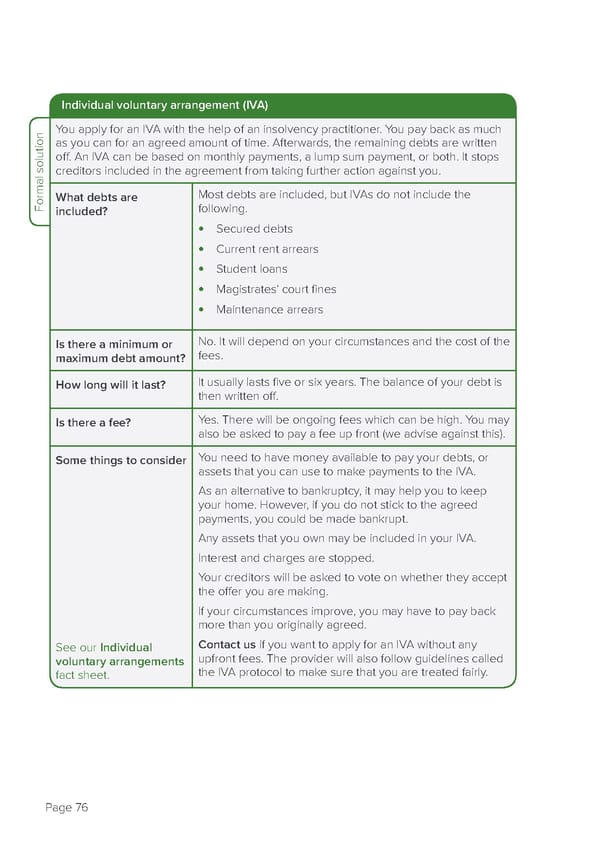

Individual voluntary arrangement (IVA) You apply for an IVA with the help of an insolvency practitioner. You pay back as much as you can for an agreed amount of time. Afterwards, the remaining debts are written off. An IVA can be based on monthly payments, a lump sum payment, or both. It stops creditors included in the agreement from taking further action against you. What debts are Most debts are included, but IVAs do not include the Formal solutionincluded? following. • Secured debts • Current rent arrears • Student loans • Magistrates’ court fines • Maintenance arrears Is there a minimum or No. It will depend on your circumstances and the cost of the maximum debt amount? fees. How long will it last? It usually lasts five or six years. The balance of your debt is then written off. Is there a fee? Yes. There will be ongoing fees which can be high. You may also be asked to pay a fee up front (we advise against this). Some things to consider You need to have money available to pay your debts, or assets that you can use to make payments to the IVA. As an alternative to bankruptcy, it may help you to keep your home. However, if you do not stick to the agreed payments, you could be made bankrupt. Any assets that you own may be included in your IVA. Interest and charges are stopped. Your creditors will be asked to vote on whether they accept the offer you are making. If your circumstances improve, you may have to pay back more than you originally agreed. See our Individual Contact us if you want to apply for an IVA without any voluntary arrangements upfront fees. The provider will also follow guidelines called fact sheet. the IVA protocol to make sure that you are treated fairly. Page 76

how-to-deal-with-debt Page 77 Page 79

how-to-deal-with-debt Page 77 Page 79