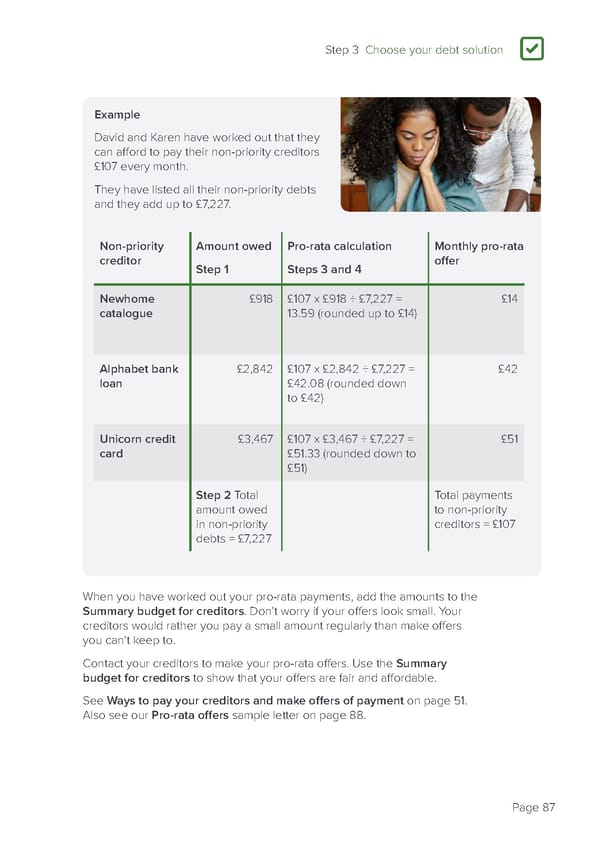

Step 3 Choose your debt solution 3 Example David and Karen have worked out that they can afford to pay their non-priority creditors £107 every month. They have listed all their non-priority debts and they add up to £7,227. Non-priority Amount owed Pro-rata calculation Monthly pro-rata creditor Step 1 Steps 3 and 4 offer Newhome £918 £107 x £918 ÷ £7,227 = £14 catalogue 13.59 (rounded up to £14) Alphabet bank £2,842 £107 x £2,842 ÷ £7,227 = £42 loan £42.08 (rounded down to £42) Unicorn credit £3,467 £107 x £3,467 ÷ £7,227 = £51 card £51.33 (rounded down to £51) Step 2 Total Total payments amount owed to non-priority in non-priority creditors = £107 debts = £7,227 When you have worked out your pro-rata payments, add the amounts to the Summary budget for creditors. Don’t worry if your offers look small. Your creditors would rather you pay a small amount regularly than make offers you can’t keep to. Contact your creditors to make your pro-rata offers. Use the Summary budget for creditors to show that your offers are fair and affordable. See Ways to pay your creditors and make offers of payment on page 51. Also see our Pro-rata offers sample letter on page 88. Page 87

how-to-deal-with-debt Page 88 Page 90

how-to-deal-with-debt Page 88 Page 90