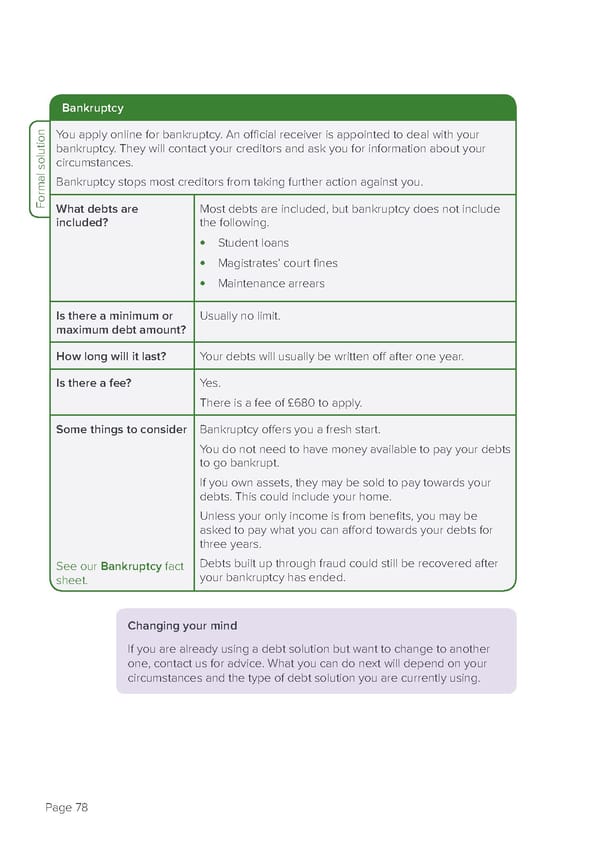

Bankruptcy You apply online for bankruptcy. An official receiver is appointed to deal with your bankruptcy. They will contact your creditors and ask you for information about your circumstances. Bankruptcy stops most creditors from taking further action against you. Formal solutionWhat debts are Most debts are included, but bankruptcy does not include included? the following. • Student loans • Magistrates’ court fines • Maintenance arrears Is there a minimum or Usually no limit. maximum debt amount? How long will it last? Your debts will usually be written off after one year. Is there a fee? Yes. There is a fee of £680 to apply. Some things to consider Bankruptcy offers you a fresh start. You do not need to have money available to pay your debts to go bankrupt. If you own assets, they may be sold to pay towards your debts. This could include your home. Unless your only income is from benefits, you may be asked to pay what you can afford towards your debts for three years. See our Bankruptcy fact Debts built up through fraud could still be recovered after sheet. your bankruptcy has ended. Changing your mind If you are already using a debt solution but want to change to another one, contact us for advice. What you can do next will depend on your circumstances and the type of debt solution you are currently using. Page 78

how-to-deal-with-debt Page 79 Page 81

how-to-deal-with-debt Page 79 Page 81