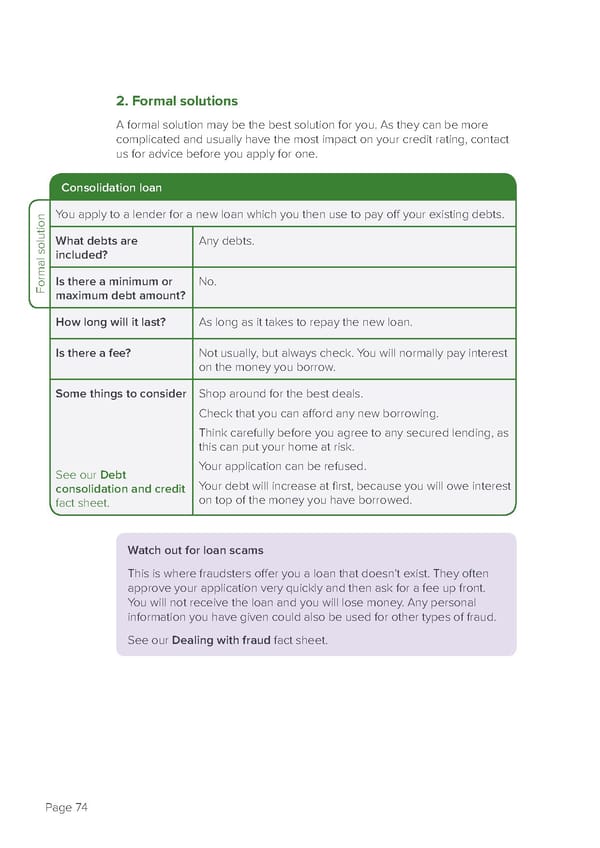

2. Formal solutions A formal solution may be the best solution for you. As they can be more complicated and usually have the most impact on your credit rating, contact us for advice before you apply for one. Consolidation loan You apply to a lender for a new loan which you then use to pay off your existing debts. What debts are Any debts. included? Formal solutionIs there a minimum or No. maximum debt amount? How long will it last? As long as it takes to repay the new loan. Is there a fee? Not usually, but always check. You will normally pay interest on the money you borrow. Some things to consider Shop around for the best deals. Check that you can afford any new borrowing. Think carefully before you agree to any secured lending, as this can put your home at risk. See our Debt Your application can be refused. consolidation and credit Your debt will increase at first, because you will owe interest fact sheet. on top of the money you have borrowed. Watch out for loan scams This is where fraudsters offer you a loan that doesn’t exist. They often approve your application very quickly and then ask for a fee up front. You will not receive the loan and you will lose money. Any personal information you have given could also be used for other types of fraud. See our Dealing with fraud fact sheet. Page 74

how-to-deal-with-debt Page 75 Page 77

how-to-deal-with-debt Page 75 Page 77