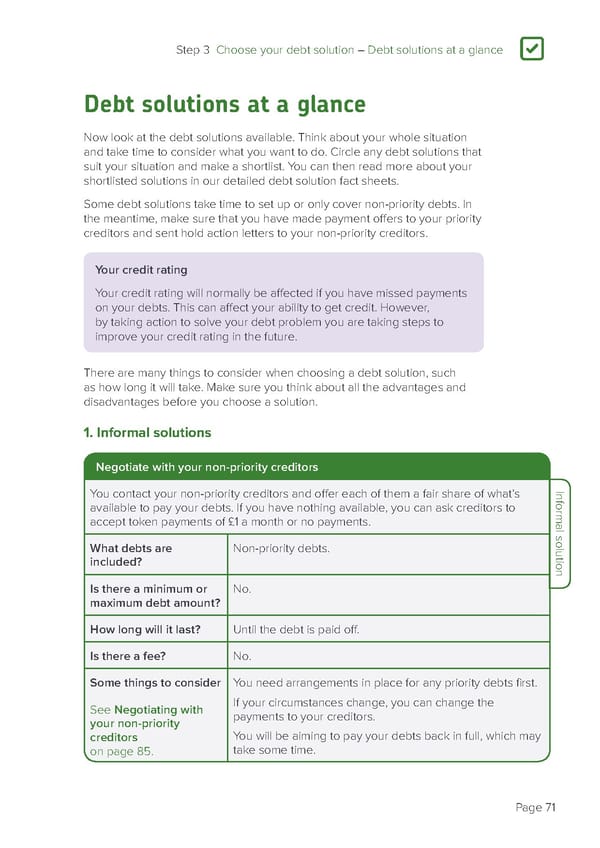

Step 3 Choose your debt solution – Debt solutions at a glance 3 Debt solutions at a glance Now look at the debt solutions available. Think about your whole situation and take time to consider what you want to do. Circle any debt solutions that suit your situation and make a shortlist. You can then read more about your shortlisted solutions in our detailed debt solution fact sheets. Some debt solutions take time to set up or only cover non-priority debts. In the meantime, make sure that you have made payment offers to your priority creditors and sent hold action letters to your non-priority creditors. Your credit rating Your credit rating will normally be affected if you have missed payments on your debts. This can affect your ability to get credit. However, by taking action to solve your debt problem you are taking steps to improve your credit rating in the future. There are many things to consider when choosing a debt solution, such as how long it will take. Make sure you think about all the advantages and disadvantages before you choose a solution. 1. Informal solutions Negotiate with your non-priority creditors You contact your non-priority creditors and offer each of them a fair share of what’s Informal solution available to pay your debts. If you have nothing available, you can ask creditors to accept token payments of £1 a month or no payments. What debts are Non-priority debts. included? Is there a minimum or No. maximum debt amount? How long will it last? Until the debt is paid off. Is there a fee? No. Some things to consider You need arrangements in place for any priority debts first. See Negotiating with If your circumstances change, you can change the your non-priority payments to your creditors. creditors You will be aiming to pay your debts back in full, which may on page 85. take some time. Page 71

how-to-deal-with-debt Page 72 Page 74

how-to-deal-with-debt Page 72 Page 74