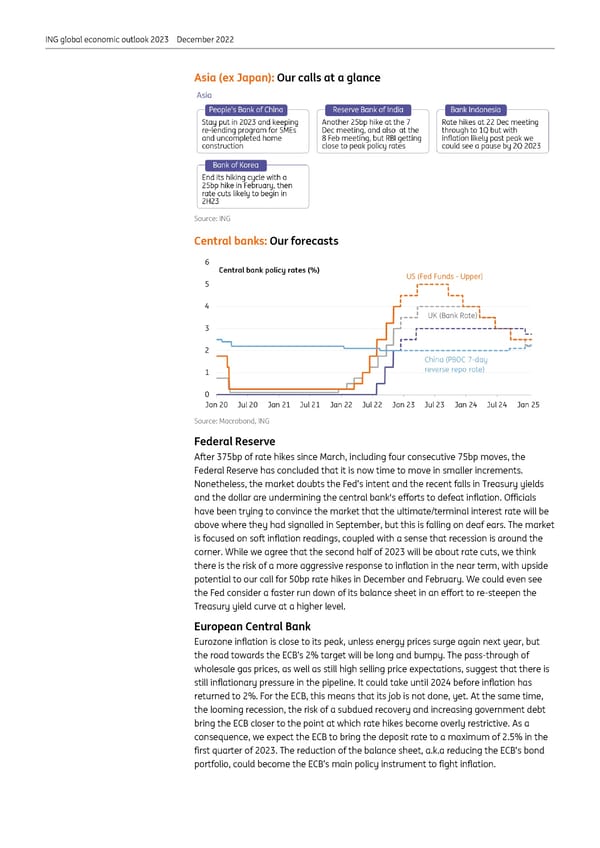

ING global economic outlook 2023 December 2022 Asia (ex Japan): Our calls at a glance Source: ING Central banks: Our forecasts Source: Macrobond, ING Federal Reserve After 375bp of rate hikes since March, including four consecutive 75bp moves, the Federal Reserve has concluded that it is now time to move in smaller increments. Nonetheless, the market doubts the Fed’s intent and the recent falls in Treasury yields and the dollar are undermining the central bank's efforts to defeat inflation. Officials have been trying to convince the market that the ultimate/terminal interest rate will be above where they had signalled in September, but this is falling on deaf ears. The market is focused on soft inflation readings, coupled with a sense that recession is around the corner. While we agree that the second half of 2023 will be about rate cuts, we think there is the risk of a more aggressive response to inflation in the near term, with upside potential to our call for 50bp rate hikes in December and February. We could even see the Fed consider a faster run down of its balance sheet in an effort to re-steepen the Treasury yield curve at a higher level. European Central Bank Eurozone inflation is close to its peak, unless energy prices surge again next year, but the road towards the ECB’s 2% target will be long and bumpy. The pass-through of wholesale gas prices, as well as still high selling price expectations, suggest that there is still inflationary pressure in the pipeline. It could take until 2024 before inflation has returned to 2%. For the ECB, this means that its job is not done, yet. At the same time, the looming recession, the risk of a subdued recovery and increasing government debt bring the ECB closer to the point at which rate hikes become overly restrictive. As a consequence, we expect the ECB to bring the deposit rate to a maximum of 2.5% in the first quarter of 2023. The reduction of the balance sheet, a.k.a reducing the ECB’s bond portfolio, could become the ECB’s main policy instrument to fight inflation.

ING Global Economic Outlook 2023 Page 14 Page 16

ING Global Economic Outlook 2023 Page 14 Page 16