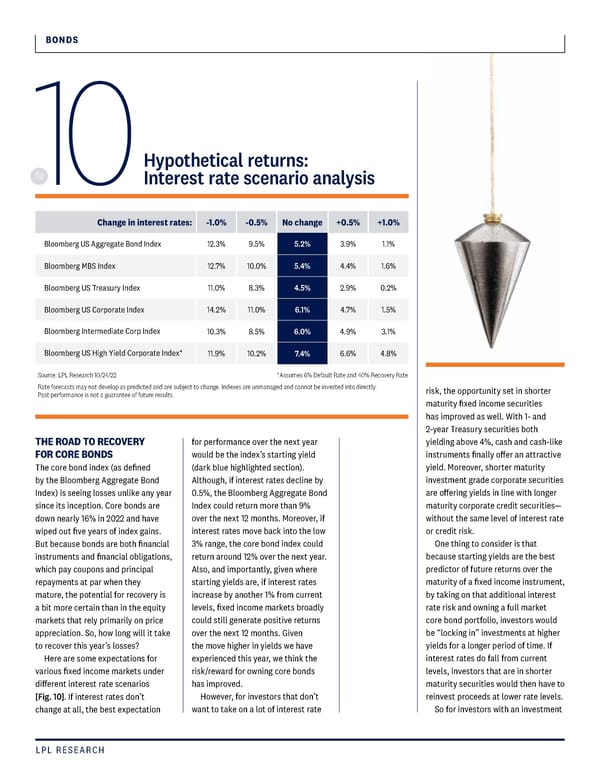

BONDS Hypothetical returns: fig. Interest rate scenario analysis 10 Change in interest rates: -1.0% -0.5% No change +0.5% +1.0% Bloomberg US Aggregate Bond Index 12.3% 9.5% 5.2% 3.9% 1.1% Bloomberg MBS Index 12.7% 10.0% 5.4% 4.4% 1.6% Bloomberg US Treasury Index 11.0% 8.3% 4.5% 2.9% 0.2% Bloomberg US Corporate Index 14.2% 11.0% 6.1% 4.7% 1.5% Bloomberg Intermediate Corp Index 10.3% 8.5% 6.0% 4.9% 3.1% Bloomberg US High Yield Corporate Index* 11.9% 10.2% 7.4% 6.6% 4.8% Source: LPL Research 10/24/22 *Assumes 6% Default Rate and 40% Recovery Rate Rate forecasts may not develop as predicted and are subject to change. Indexes are unmanaged and cannot be invested into directly. risk, the opportunity set in shorter Past performance is not a guarantee of future results. maturity fixed income securities has improved as well. With 1- and 2-year Treasury securities both THE ROAD TO RECOVERY for performance over the next year yielding above 4%, cash and cash-like FOR CORE BONDS would be the index’s starting yield instruments finally offer an attractive The core bond index (as defined (dark blue highlighted section). yield. Moreover, shorter maturity by the Bloomberg Aggregate Bond Although, if interest rates decline by investment grade corporate securities Index) is seeing losses unlike any year 0.5%, the Bloomberg Aggregate Bond are offering yields in line with longer since its inception. Core bonds are Index could return more than 9% maturity corporate credit securities— down nearly 16% in 2022 and have over the next 12 months. Moreover, if without the same level of interest rate wiped out five years of index gains. interest rates move back into the low or credit risk. But because bonds are both financial 3% range, the core bond index could One thing to consider is that instruments and financial obligations, return around 12% over the next year. because starting yields are the best which pay coupons and principal Also, and importantly, given where predictor of future returns over the repayments at par when they starting yields are, if interest rates maturity of a fixed income instrument, mature, the potential for recovery is increase by another 1% from current by taking on that additional interest a bit more certain than in the equity levels, fixed income markets broadly rate risk and owning a full market markets that rely primarily on price could still generate positive returns core bond portfolio, investors would appreciation. So, how long will it take over the next 12 months. Given be “locking in” investments at higher to recover this year’s losses? the move higher in yields we have yields for a longer period of time. If Here are some expectations for experienced this year, we think the interest rates do fall from current various fixed income markets under risk/reward for owning core bonds levels, investors that are in shorter different interest rate scenarios has improved. maturity securities would then have to [Fig. 10]. If interest rates don’t However, for investors that don’t reinvest proceeds at lower rate levels. change at all, the best expectation want to take on a lot of interest rate So for investors with an investment LPL RESEARCH

LPL Financial Outlook 2023 Page 11 Page 13

LPL Financial Outlook 2023 Page 11 Page 13