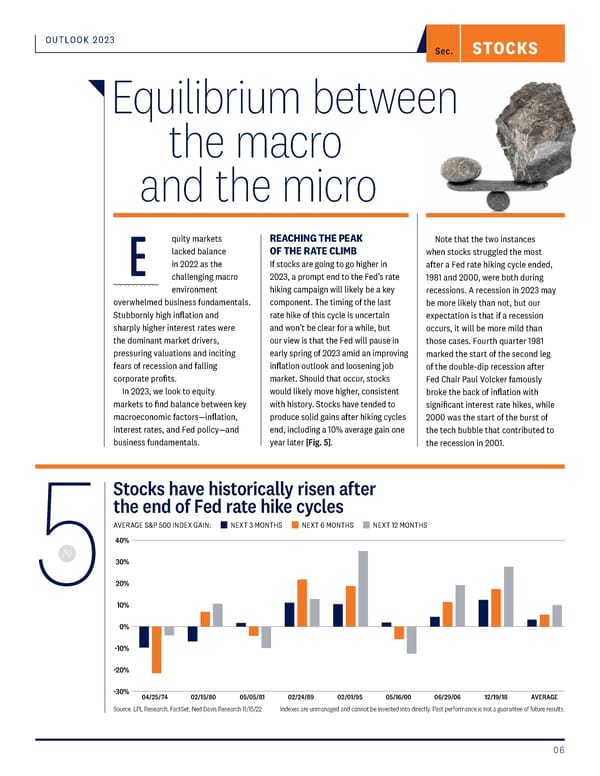

OUTLOOK 2023 STOCKS Sec. Equilibrium between the macro and the micro quity markets REACHING THE PEAK Note that the two instances lacked balance OF THE RATE CLIMB when stocks struggled the most E in 2022 as the If stocks are going to go higher in after a Fed rate hiking cycle ended, challenging macro 2023, a prompt end to the Fed’s rate 1981 and 2000, were both during environment hiking campaign will likely be a key recessions. A recession in 2023 may overwhelmed business fundamentals. component. The timing of the last be more likely than not, but our Stubbornly high inflation and rate hike of this cycle is uncertain expectation is that if a recession sharply higher interest rates were and won’t be clear for a while, but occurs, it will be more mild than the dominant market drivers, our view is that the Fed will pause in those cases. Fourth quarter 1981 pressuring valuations and inciting early spring of 2023 amid an improving marked the start of the second leg fears of recession and falling inflation outlook and loosening job of the double-dip recession after corporate profits. market. Should that occur, stocks Fed Chair Paul Volcker famously In 2023, we look to equity would likely move higher, consistent broke the back of inflation with markets to find balance between key with history. Stocks have tended to significant interest rate hikes, while macroeconomic factors—inflation, produce solid gains after hiking cycles 2000 was the start of the burst of interest rates, and Fed policy—and end, including a 10% average gain one the tech bubble that contributed to business fundamentals. year later [Fig. 5]. the recession in 2001. Stocks have historically risen after the end of Fed rate hike cycles AVERAGE S&P 500 INDEX GAIN: NEXT 3 MONTHS NEXT 6 MONTHS NEXT 12 MONTHS 40% fig. 530% 20% 10% 0% -10% -20% -30% 04/25/74 02/15/80 05/05/81 02/24/89 02/01/95 05/16/00 06/29/06 12/19/18 AVERAGE Source: LPL Research, FactSet, Ned Davis Research 11/15/22 Indexes are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results. 06

LPL Financial Outlook 2023 Page 6 Page 8

LPL Financial Outlook 2023 Page 6 Page 8