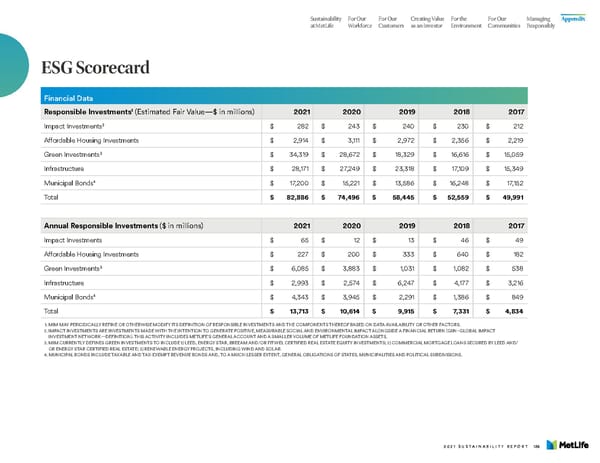

Sustainability For Our For Our Creating Value For the For Our Managing Appendix at MetLife Workforce Customers as an Investor Environment Communities Responsibly ESG Scorecard Financial Data 1 Responsible Investments (Estimated Fair Value—$ in millions) 2021 2020 2019 2018 2017 2 Impact Investments $ 282 $ 243 $ 240 $ 230 $ 212 Affordable Housing Investments $ 2,914 $ 3,111 $ 2,972 $ 2,356 $ 2,219 3 Green Investments $ 34,319 $ 28,672 $ 18,329 $ 16,616 $ 15,059 Infrastructure $ 28,171 $ 27,249 $ 23,318 $ 17,109 $ 15,349 4 Municipal Bonds $ 17,200 $ 15,221 $ 13,586 $ 16,248 $ 17,152 Total $ 82,886 $ 74,496 $ 58,445 $ 52,559 $ 49,991 Annual Responsible Investments ($ in millions) 2021 2020 2019 2018 2017 Impact Investments $ 65 $ 12 $ 13 $ 46 $ 49 Affordable Housing Investments $ 227 $ 200 $ 333 $ 640 $ 182 3 Green Investments $ 6,085 $ 3,883 $ 1,031 $ 1,082 $ 538 Infrastructure $ 2,993 $ 2,574 $ 6,247 $ 4,177 $ 3,216 4 Municipal Bonds $ 4,343 $ 3,945 $ 2,291 $ 1,386 $ 849 Total $ 13,713 $ 10,614 $ 9,915 $ 7,331 $ 4,834 1. MIM MAY PERIODICALLY REFINE OR OTHERWISE MODIFY ITS DEFINITION OF RESPONSIBLE INVESTMENTS AND THE COMPONENTS THEREOF BASED ON DATA AVAILABILITY OR OTHER FACTORS. 2. IMP ACT INVESTMENTS ARE INVESTMENTS MADE WITH THE INTENTION TO GENERATE POSITIVE, MEASURABLE SOCIAL AND ENVIRONMENTAL IMPACT ALONGSIDE A FINANCIAL RETURN (GIIN–GLOBAL IMPACT INVESTMENT NETWORK—DEFINITION). THIS ACTIVITY INCLUDES METLIFE’S GENERAL ACCOUNT AND A SMALLER VOLUME OF METLIFE FOUNDATION ASSETS. 3. MIM CURRENTLY DEFINES GREEN INVESTMENTS TO INCLUDE 1) LEED, ENERGY STAR, BREEAM AND/OR FITWEL CERTIFIED REAL ESTATE EQUITY INVESTMENTS; 2) COMMERCIAL MORTGAGE LOANS SECURED BY LEED AND/ OR ENERGY STAR CERTIFIED REAL ESTATE; 3) RENEWABLE ENERGY PROJECTS, INCLUDING WIND AND SOLAR. 4. MUNICIP AL BONDS INCLUDE TAXABLE AND TAX-EXEMPT REVENUE BONDS AND, TO A MUCH LESSER EXTENT, GENERAL OBLIGATIONS OF STATES, MUNICIPALITIES AND POLITICAL SUBDIVISIONS. 2021 SUSTAINABILITY REPORT 136

MetLife Sustainability Report Page 137 Page 139

MetLife Sustainability Report Page 137 Page 139