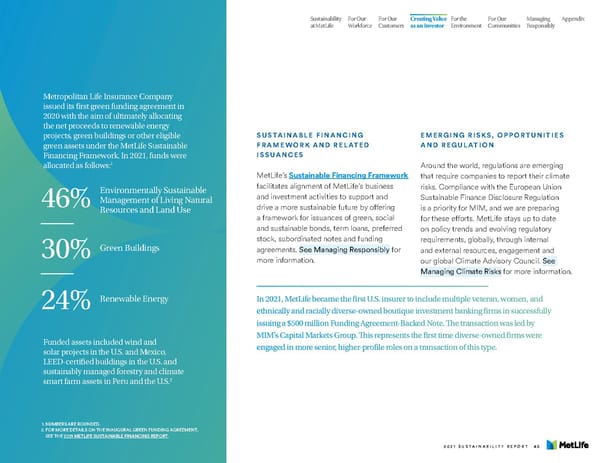

Sustainability For Our For Our Creating Value For the For Our Managing Appendix at MetLife Workforce Customers as an Investor Environment Communities Responsibly Metropolitan Life Insurance Company issued its first green funding agreement in 2020 with the aim of ultimately allocating the net proceeds to renewable energy projects, green buildings or other eligible SUSTAINABLE FINANCING EMERGING RISKS, OPPORTUNITIES green assets under the MetLife Sustainable FRAMEWORK AND RELATED AND REGULATION Financing Framework. In 2021, funds were ISSUANCES allocated as follows:1 Around the world, regulations are emerging MetLife’s Sustainable Financing Framework that require companies to report their climate Environmentally Sustainable facilitates alignment of MetLife’s business risks. Compliance with the European Union 46% Management of Living Natural and investment activities to support and Sustainable Finance Disclosure Regulation Resources and Land Use drive a more sustainable future by offering is a priority for MIM, and we are preparing a framework for issuances of green, social for these efforts. MetLife stays up to date and sustainable bonds, term loans, preferred on policy trends and evolving regulatory stock, subordinated notes and funding requirements, globally, through internal 30% Green Buildings agreements. See Managing Responsibly for and external resources, engagement and more information. our global Climate Advisory Council. See Managing Climate Risks for more information. 24% Renewable Energy In 2021, MetLife became the first U.S. insurer to include multiple veteran, women, and ethnically and racially diverse-owned boutique investment banking firms in successfully issuing a $500 million Funding Agreement-Backed Note. The transaction was led by Funded assets included wind and MIM’s Capital Markets Group. This represents the first time diverse-owned firms were solar projects in the U.S. and Mexico, engaged in more senior, higher-profile roles on a transaction of this type. LEED-certified buildings in the U.S. and sustainably managed forestry and climate 2 smart farm assets in Peru and the U.S. 1. NUMBERS ARE ROUNDED. 2. F OR MORE DETAILS ON THE INAUGURAL GREEN FUNDING AGREEMENT, SEE THE 2021 METLIFE SUSTAINABLE FINANCING REPORT. 2021 SUSTAINABILITY REPORT 45

MetLife Sustainability Report Page 46 Page 48

MetLife Sustainability Report Page 46 Page 48