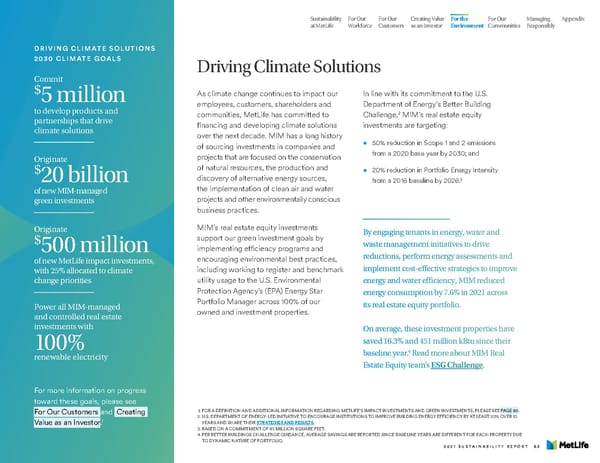

Sustainability For Our For Our Creating Value For the For Our Managing Appendix at MetLife Workforce Customers as an Investor Environment Communities Responsibly DRIVING CLIMATE SOLUTIONS 2030 CLIMATE GOALS Driving Climate Solutions Commit $ As climate change continues to impact our In line with its commitment to the U.S. 5 million employees, customers, shareholders and Department of Energy’s Better Building to develop products and 2 partnerships that drive communities, MetLife has committed to Challenge, MIM’s real estate equity climate solutions financing and developing climate solutions investments are targeting: over the next decade. MIM has a long history of sourcing investments in companies and • 50% reduction in Scope 1 and 2 emissions Originate projects that are focused on the conservation from a 2020 base year by 2030; and $ of natural resources, the production and • 20% reduction in Portfolio Energy Intensity 20 billion discovery of alternative energy sources, 3 from a 2016 baseline by 2026. of new MIM-managed the implementation of clean air and water green investments projects and other environmentally conscious business practices. Originate MIM’s real estate equity investments By engaging tenants in energy, water and $ support our green investment goals by waste management initiatives to drive 500 million implementing efficiency programs and of new MetLife impact investments, encouraging environmental best practices, reductions, perform energy assessments and with 25% allocated to climate including working to register and benchmark implement cost-effective strategies to improve change priorities utility usage to the U.S. Environmental energy and water efficiency, MIM reduced Protection Agency’s (EPA) Energy Star energy consumption by 7.6% in 2021 across Power all MIM-managed Portfolio Manager across 100% of our its real estate equity portfolio. and controlled real estate owned and investment properties. investments with On average, these investment properties have 100% saved 16.3% and 451 million kBtu since their 4 renewable electricity baseline year. Read more about MIM Real Estate Equity team’s ESG Challenge. For more information on progress toward these goals, please see For Our Customers and Creating 1. FOR A DEFINITION AND ADDITIONAL INFORMATION REGARDING METLIFE’S IMPACT INVESTMENTS AND GREEN INVESTMENTS, PLEASE SEE PAGE 90. 2. U.S. DEPARTMENT OF ENERGY-LED INITIATIVE TO ENCOURAGE INSTITUTIONS TO IMPROVE BUILDING ENERGY EFFICIENCY BY AT LEAST 20% OVER 10 1 YEARS AND SHARE THEIR STRATEGIES AND RESULTS. Value as an Investor. 3. BASED ON A COMMITMENT OF 45 MILLION SQUARE FEET. 4. PER BETTER BUILDINGS CHALLENGE GUIDANCE, AVERAGE SAVINGS ARE REPORTED SINCE BASELINE YEARS ARE DIFFERENT FOR EACH PROPERTY DUE TO DYNAMIC NATURE OF PORTFOLIO. 2021 SUSTAINABILITY REPORT 63

MetLife Sustainability Report Page 64 Page 66

MetLife Sustainability Report Page 64 Page 66