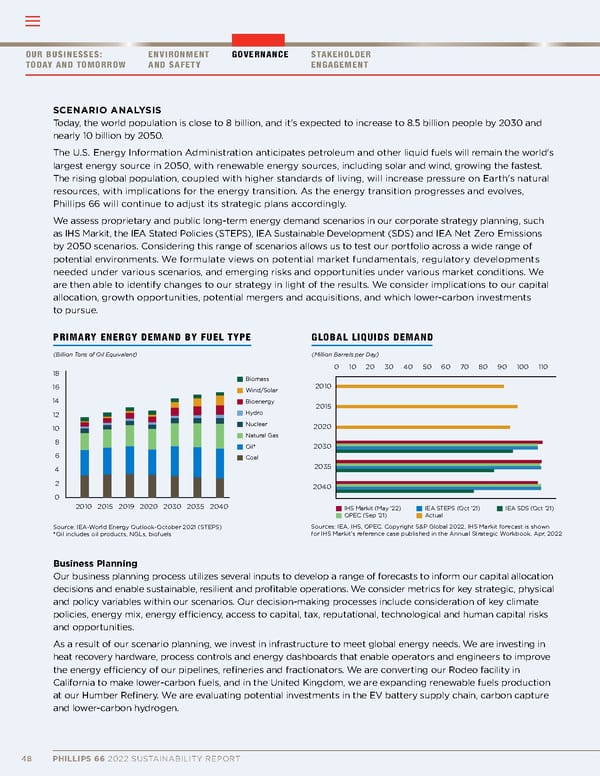

PRIMARY ENERGY DEMAND BY FUEL TYPE n Biomass n Wind/Solar n Bioenergy n Hydro n Nuclear n Natural Gas n Oil* n Coal 2010 2015 2019 2020 2030 2035 2040 18 16 14 12 10 8 6 4 2 0 (Billion Tons of Oil Equivalent) Source: IEA-World Energy Outlook-October 2021 (STEPS) *Oil includes oil products, NGLs, biofuels GLOBAL LIQUIDS DEMAND Business Planning Our business planning process utilizes several inputs to develop a range of forecasts to inform our capital allocation decisions and enable sustainable, resilient and profitable operations. We consider metrics for key strategic, physical and policy variables within our scenarios. Our decision-making processes include consideration of key climate policies, energy mix, energy efficiency, access to capital, tax, reputational, technological and human capital risks and opportunities. As a result of our scenario planning, we invest in infrastructure to meet global energy needs. We are investing in heat recovery hardware, process controls and energy dashboards that enable operators and engineers to improve the energy efficiency of our pipelines, refineries and fractionators. We are converting our Rodeo facility in California to make lower-carbon fuels, and in the United Kingdom, we are expanding renewable fuels production at our Humber Refinery. We are evaluating potential investments in the EV battery supply chain, carbon capture and lower-carbon hydrogen. SCENARIO ANALYSIS Today, the world population is close to 8 billion, and it's expected to increase to 8.5 billion people by 2030 and nearly 10 billion by 2050. The U.S. Energy Information Administration anticipates petroleum and other liquid fuels will remain the world's largest energy source in 2050, with renewable energy sources, including solar and wind, growing the fastest. The rising global population, coupled with higher standards of living, will increase pressure on Earth's natural resources, with implications for the energy transition. As the energy transition progresses and evolves, Phillips 66 will continue to adjust its strategic plans accordingly. We assess proprietary and public long-term energy demand scenarios in our corporate strategy planning, such as IHS Markit, the IEA Stated Policies (STEPS), IEA Sustainable Development (SDS) and IEA Net Zero Emissions by 2050 scenarios. Considering this range of scenarios allows us to test our portfolio across a wide range of potential environments. We formulate views on potential market fundamentals, regulatory developments needed under various scenarios, and emerging risks and opportunities under various market conditions. We are then able to identify changes to our strategy in light of the results. We consider implications to our capital allocation, growth opportunities, potential mergers and acquisitions, and which lower-carbon investments to pursue. n IHS Markit (May '22) n OPEC (Sep '21) n IEA STEPS (Oct '21) n Actual n IEA SDS (Oct '21) 2010 2015 2020 2030 2035 2040 0 10 20 30 40 50 60 70 80 90 100 110 (Million Barrels per Day) 48 PHILLIPS 66 2022 SUSTAINABILITY REPORT OUR BUSINESSES: TODAY AND TOMORROW ENVIRONMENT AND SAFETY GOVERNANCE STAKEHOLDER ENGAGEMENT Sources: IEA, IHS, OPEC. Copyright S&P Global 2022, IHS Markit forecast is shown for IHS Markit’s reference case published in the Annual Strategic Workbook, Apr, 2022

Philips 66 ESG Report Page 49 Page 51

Philips 66 ESG Report Page 49 Page 51