Plan summary

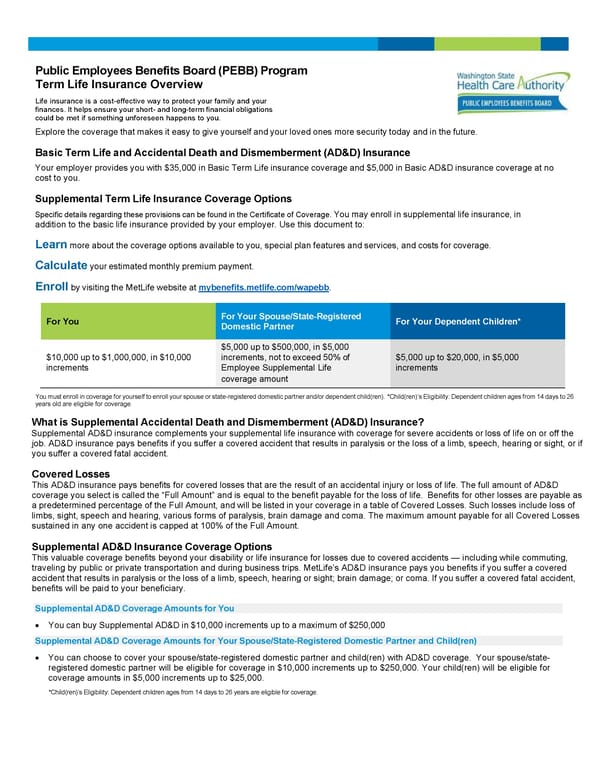

Public Employees Benefits Board (PEBB) Program Term Life Insurance Overview Life insurance is a cost-effective way to protect your family and your finances. It helps ensure your short- and long-term financial obligations could be met if something unforeseen happens to you. Explore the coverage that makes it easy to give yourself and your loved ones more security today and in the future. Basic Term Life and Accidental Death and Dismemberment (AD&D) Insurance Your employer provides you with $35,000 in Basic Term Life insurance coverage and $5,000 in Basic AD&D insurance coverage at no cost to you. Supplemental Term Life Insurance Coverage Options Specific details regarding these provisions can be found in the Certificate of Coverage. You may enroll in supplemental life insurance, in addition to the basic life insurance provided by your employer. Use this document to: Learn more about the coverage options available to you, special plan features and services, and costs for coverage. Calculate your estimated monthly premium payment. Enroll by visiting the MetLife website at mybenefits.metlife.com/wapebb. For Your Spouse/State-Registered For You Domestic Partner For Your Dependent Children* $5,000 up to $500,000, in $5,000 $10,000 up to $1,000,000, in $10,000 increments, not to exceed 50% of $5,000 up to $20,000, in $5,000 increments Employee Supplemental Life increments coverage amount You must enroll in coverage for yourself to enroll your spouse or state-registered domestic partner and/or dependent child(ren). *Child(ren)’s Eligibility: Dependent children ages from 14 days to 26 years old are eligible for coverage. What is Supplemental Accidental Death and Dismemberment (AD&D) Insurance? Supplemental AD&D insurance complements your supplemental life insurance with coverage for severe accidents or loss of life on or off the job. AD&D insurance pays benefits if you suffer a covered accident that results in paralysis or the loss of a limb, speech, hearing or sight, or if you suffer a covered fatal accident. Covered Losses This AD&D insurance pays benefits for covered losses that are the result of an accidental injury or loss of life. The full amount of AD&D coverage you select is called the “Full Amount” and is equal to the benefit payable for the loss of life. Benefits for other losses are payable as a predetermined percentage of the Full Amount, and will be listed in your coverage in a table of Covered Losses. Such losses include loss of limbs, sight, speech and hearing, various forms of paralysis, brain damage and coma. The maximum amount payable for all Covered Losses sustained in any one accident is capped at 100% of the Full Amount. Supplemental AD&D Insurance Coverage Options This valuable coverage benefits beyond your disability or life insurance for losses due to covered accidents — including while commuting, traveling by public or private transportation and during business trips. MetLife’s AD&D insurance pays you benefits if you suffer a covered accident that results in paralysis or the loss of a limb, speech, hearing or sight; brain damage; or coma. If you suffer a covered fatal accident, benefits will be paid to your beneficiary. Supplemental AD&D Coverage Amounts for You • You can buy Supplemental AD&D in $10,000 increments up to a maximum of $250,000 Supplemental AD&D Coverage Amounts for Your Spouse/State-Registered Domestic Partner and Child(ren) • You can choose to cover your spouse/state-registered domestic partner and child(ren) with AD&D coverage. Your spouse/state- registered domestic partner will be eligible for coverage in $10,000 increments up to $250,000. Your child(ren) will be eligible for coverage amounts in $5,000 increments up to $25,000. *Child(ren)’s Eligibility: Dependent children ages from 14 days to 26 years are eligible for coverage.

Plan summary Page 2

Plan summary Page 2