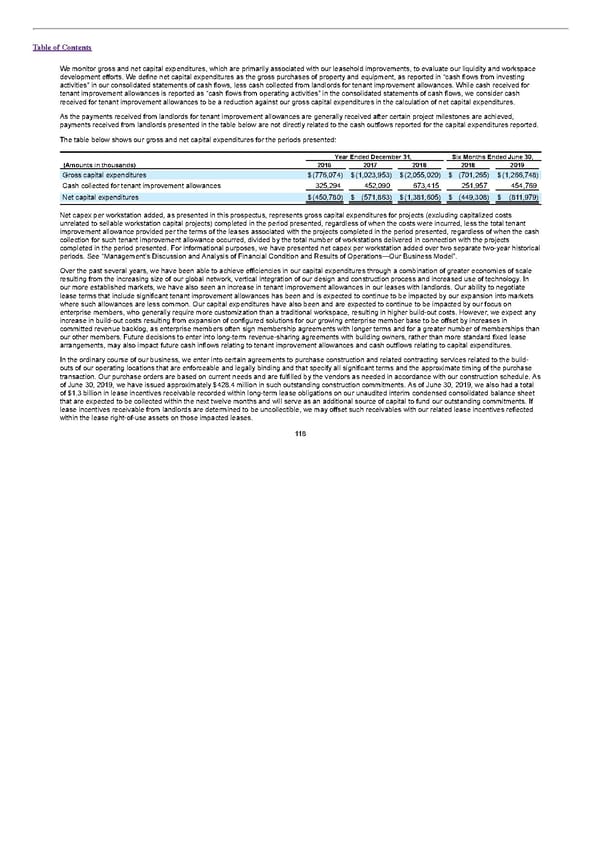

Table of Contents We monitor gross and net capital expenditures, which are primarily associated with our leasehold improvements, to evaluate our liquidity and workspace development efforts. We define net capital expenditures as the gross purchases of property and equipment, as reported in “cash flows from investing activities” in our consolidated statements of cash flows, less cash collected from landlords for tenant improvement allowances. While cash received for tenant improvement allowances is reported as “cash flows from operating activities” in the consolidated statements of cash flows, we consider cash received for tenant improvement allowances to be a reduction against our gross capital expenditures in the calculation of net capital expenditures. As the payments received from landlords for tenant improvement allowances are generally received after certain project milestones are achieved, payments received from landlords presented in the table below are not directly related to the cash outflows reported for the capital expenditures reported. The table below shows our gross and net capital expenditures for the periods presented: Year Ended December 31, Six Months Ended June 30, (Amounts in thousands) 2016 2017 2018 2018 2019 Gross capital expenditures $(776,074) $(1,023,953) $(2,055,020) $ (701,265) $(1,266,748) Cash collected for tenant improvement allowances 325,294 452,090 673,415 251,957 454,769 Net capital expenditures $(450,780) $ (571,863) $(1,381,605) $ (449,308) $ (811,979) Net capex per workstation added, as presented in this prospectus, represents gross capital expenditures for projects (excluding capitalized costs unrelated to sellable workstation capital projects) completed in the period presented, regardless of when the costs were incurred, less the total tenant improvement allowance provided per the terms of the leases associated with the projects completed in the period presented, regardless of when the cash collection for such tenant improvement allowance occurred, divided by the total number of workstations delivered in connection with the projects completed in the period presented. For informational purposes, we have presented net capex per workstation added over two separate two-year historical periods. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Our Business Model”. Over the past several years, we have been able to achieve efficiencies in our capital expenditures through a combination of greater economies of scale resulting from the increasing size of our global network, vertical integration of our design and construction process and increased use of technology. In our more established markets, we have also seen an increase in tenant improvement allowances in our leases with landlords. Our ability to negotiate lease terms that include significant tenant improvement allowances has been and is expected to continue to be impacted by our expansion into markets where such allowances are less common. Our capital expenditures have also been and are expected to continue to be impacted by our focus on enterprise members, who generally require more customization than a traditional workspace, resulting in higher build-out costs. However, we expect any increase in build-out costs resulting from expansion of configured solutions for our growing enterprise member base to be offset by increases in committed revenue backlog, as enterprise members often sign membership agreements with longer terms and for a greater number of memberships than our other members. Future decisions to enter into long-term revenue-sharing agreements with building owners, rather than more standard fixed lease arrangements, may also impact future cash inflows relating to tenant improvement allowances and cash outflows relating to capital expenditures. In the ordinary course of our business, we enter into certain agreements to purchase construction and related contracting services related to the build- outs of our operating locations that are enforceable and legally binding and that specify all significant terms and the approximate timing of the purchase transaction. Our purchase orders are based on current needs and are fulfilled by the vendors as needed in accordance with our construction schedule. As of June 30, 2019, we have issued approximately $428.4 million in such outstanding construction commitments. As of June 30, 2019, we also had a total of $1.3 billion in lease incentives receivable recorded within long-term lease obligations on our unaudited interim condensed consolidated balance sheet that are expected to be collected within the next twelve months and will serve as an additional source of capital to fund our outstanding commitments. If lease incentives receivable from landlords are determined to be uncollectible, we may offset such receivables with our related lease incentives reflected within the lease right-of-use assets on those impacted leases. 118

S1 - WeWork Prospectus Page 122 Page 124

S1 - WeWork Prospectus Page 122 Page 124