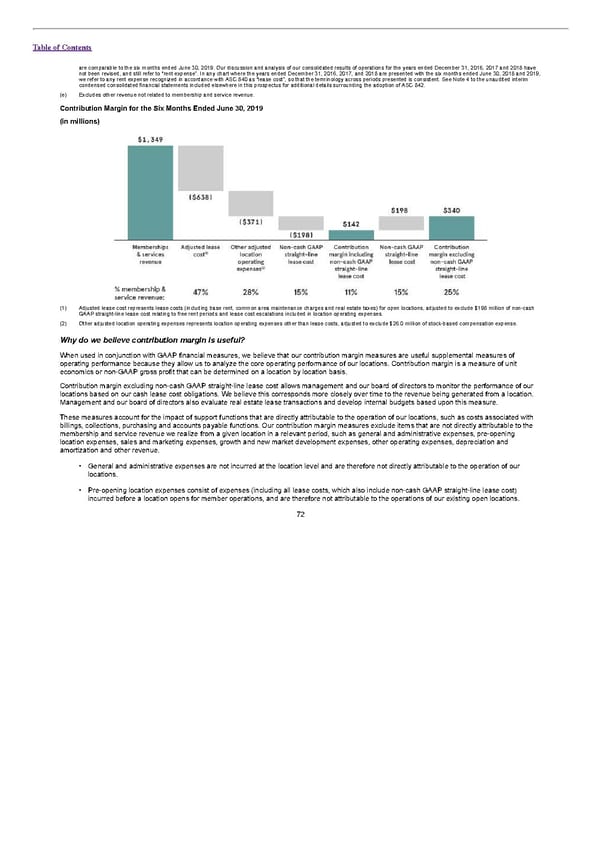

Table of Contents are comparable to the six months ended June 30, 2019. Our discussion and analysis of our consolidated results of operations for the years ended December 31, 2016, 2017 and 2018 have not been revised, and still refer to “rent expense”. In any chart where the years ended December 31, 2016, 2017, and 2018 are presented with the six months ended June 30, 2018 and 2019, we refer to any rent expense recognized in accordance with ASC 840 as “lease cost”, so that the terminology across periods presented is consistent. See Note 4 to the unaudited interim condensed consolidated financial statements included elsewhere in this prospectus for additional details surrounding the adoption of ASC 842. (e) Excludes other revenue not related to membership and service revenue. Contribution Margin for the Six Months Ended June 30, 2019 (in millions) (1) Adjusted lease cost represents lease costs (including base rent, common area maintenance charges and real estate taxes) for open locations, adjusted to exclude $198 million of non-cash GAAP straight-line lease cost relating to free rent periods and lease cost escalations included in location operating expenses. (2) Other adjusted location operating expenses represents location operating expenses other than lease costs, adjusted to exclude $26.0 million of stock-based compensation expense. Why do we believe contribution margin is useful? When used in conjunction with GAAP financial measures, we believe that our contribution margin measures are useful supplemental measures of operating performance because they allow us to analyze the core operating performance of our locations. Contribution margin is a measure of unit economics or non-GAAP gross profit that can be determined on a location by location basis. Contribution margin excluding non-cash GAAP straight-line lease cost allows management and our board of directors to monitor the performance of our locations based on our cash lease cost obligations. We believe this corresponds more closely over time to the revenue being generated from a location. Management and our board of directors also evaluate real estate lease transactions and develop internal budgets based upon this measure. These measures account for the impact of support functions that are directly attributable to the operation of our locations, such as costs associated with billings, collections, purchasing and accounts payable functions. Our contribution margin measures exclude items that are not directly attributable to the membership and service revenue we realize from a given location in a relevant period, such as general and administrative expenses, pre-opening location expenses, sales and marketing expenses, growth and new market development expenses, other operating expenses, depreciation and amortization and other revenue. • General and administrative expenses are not incurred at the location level and are therefore not directly attributable to the operation of our locations. • Pre-opening location expenses consist of expenses (including all lease costs, which also include non-cash GAAP straight-line lease cost) incurred before a location opens for member operations, and are therefore not attributable to the operations of our existing open locations. 72

S1 - WeWork Prospectus Page 76 Page 78

S1 - WeWork Prospectus Page 76 Page 78