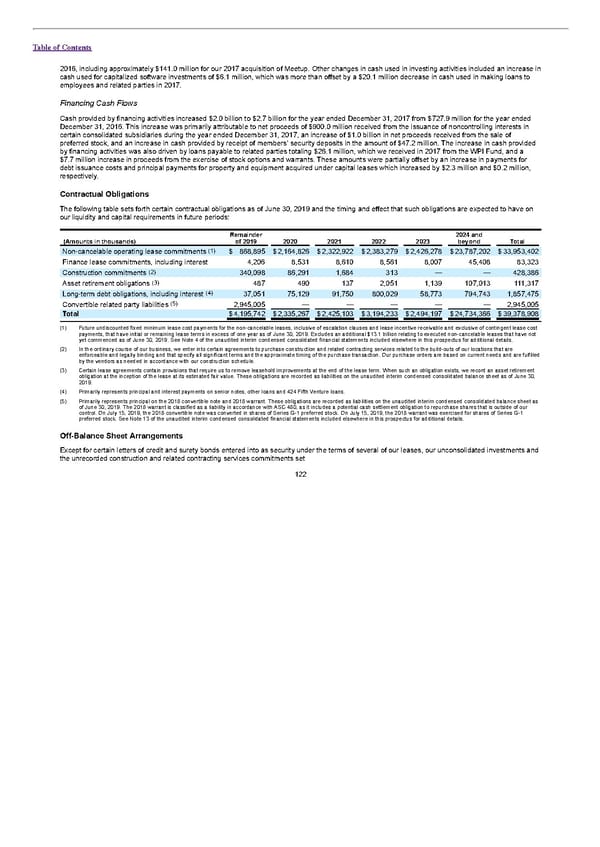

Table of Contents 2016, including approximately $141.0 million for our 2017 acquisition of Meetup. Other changes in cash used in investing activities included an increase in cash used for capitalized software investments of $6.1 million, which was more than offset by a $20.1 million decrease in cash used in making loans to employees and related parties in 2017. Financing Cash Flows Cash provided by financing activities increased $2.0 billion to $2.7 billion for the year ended December 31, 2017 from $727.9 million for the year ended December 31, 2016. This increase was primarily attributable to net proceeds of $900.0 million received from the issuance of noncontrolling interests in certain consolidated subsidiaries during the year ended December 31, 2017, an increase of $1.0 billion in net proceeds received from the sale of preferred stock, and an increase in cash provided by receipt of members’ security deposits in the amount of $47.2 million. The increase in cash provided by financing activities was also driven by loans payable to related parties totaling $26.1 million, which we received in 2017 from the WPI Fund, and a $7.7 million increase in proceeds from the exercise of stock options and warrants. These amounts were partially offset by an increase in payments for debt issuance costs and principal payments for property and equipment acquired under capital leases which increased by $2.3 million and $0.2 million, respectively. Contractual Obligations The following table sets forth certain contractual obligations as of June 30, 2019 and the timing and effect that such obligations are expected to have on our liquidity and capital requirements in future periods: Remainder 2024 and (Amounts in thousands) of 2019 2020 2021 2022 2023 beyond Total (1) Non-cancelable operating lease commitments $ 868,895 $2,164,826 $2,322,922 $2,383,279 $2,426,278 $23,787,202 $33,953,402 Finance lease commitments, including interest 4,206 8,531 8,610 8,561 8,007 45,408 83,323 (2) Construction commitments 340,098 86,291 1,684 313 — — 428,386 (3) Asset retirement obligations 487 490 137 2,051 1,139 107,013 111,317 (4) Long-term debt obligations, including interest 37,051 75,129 91,750 800,029 58,773 794,743 1,857,475 (5) Convertible related party liabilities 2,945,005 — — — — — 2,945,005 Total $4,195,742 $2,335,267 $2,425,103 $3,194,233 $2,494,197 $24,734,366 $39,378,908 (1) Future undiscounted fixed minimum lease cost payments for the non-cancelable leases, inclusive of escalation clauses and lease incentive receivable and exclusive of contingent lease cost payments, that have initial or remaining lease terms in excess of one year as of June 30, 2019. Excludes an additional $13.1 billion relating to executed non-cancelable leases that have not yet commenced as of June 30, 2019. See Note 4 of the unaudited interim condensed consolidated financial statements included elsewhere in this prospectus for additional details. (2) In the ordinary course of our business, we enter into certain agreements to purchase construction and related contracting services related to the build-outs of our locations that are enforceable and legally binding and that specify all significant terms and the approximate timing of the purchase transaction. Our purchase orders are based on current needs and are fulfilled by the vendors as needed in accordance with our construction schedule. (3) Certain lease agreements contain provisions that require us to remove leasehold improvements at the end of the lease term. When such an obligation exists, we record an asset retirement obligation at the inception of the lease at its estimated fair value. These obligations are recorded as liabilities on the unaudited interim condensed consolidated balance sheet as of June 30, 2019. (4) Primarily represents principal and interest payments on senior notes, other loans and 424 Fifth Venture loans. (5) Primarily represents principal on the 2018 convertible note and 2018 warrant. These obligations are recorded as liabilities on the unaudited interim condensed consolidated balance sheet as of June 30, 2019. The 2018 warrant is classified as a liability in accordance with ASC 480, as it includes a potential cash settlement obligation to repurchase shares that is outside of our control. On July 15, 2019, the 2018 convertible note was converted in shares of Series G-1 preferred stock. On July 15, 2019, the 2018 warrant was exercised for shares of Series G-1 preferred stock. See Note 13 of the unaudited interim condensed consolidated financial statements included elsewhere in this prospectus for additional details. Off-Balance Sheet Arrangements Except for certain letters of credit and surety bonds entered into as security under the terms of several of our leases, our unconsolidated investments and the unrecorded construction and related contracting services commitments set 122

S1 - WeWork Prospectus Page 126 Page 128

S1 - WeWork Prospectus Page 126 Page 128