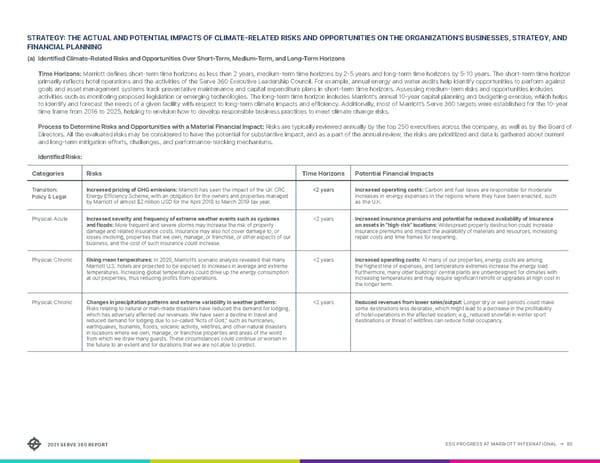

ESG PROGRESS AT MARRIOTT INTERNATIONAL → 80 2021 SERVE 360 REPORT Categories Risks Time Horizons Potential Financial Impacts Transition: Policy & Legal Increased pricing of GHG emissions: Marriott has seen the impact of the UK CRC Energy Efficiency Scheme, with an obligation for the owners and properties managed by Marriott of almost $2 million USD for the April 2018 to March 2019 tax year. <2 years Increased operating costs: Carbon and fuel taxes are responsible for moderate increases in energy expenses in the regions where they have been enacted, such as the U.K. Physical: Acute Increased severity and frequency of extreme weather events such as cyclones and floods: More frequent and severe storms may increase the risk of property damage and related insurance costs. Insurance may also not cover damage to, or losses involving, properties that we own, manage, or franchise, or other aspects of our business, and the cost of such insurance could increase. <2 years Increased insurance premiums and potential for reduced availability of insurance on assets in “high-risk” locations: Widespread property destruction could increase insurance premiums and impact the availability of materials and resources, increasing repair costs and time frames for reopening. Physical: Chronic Rising mean temperatures: In 2020, Marriott’s scenario analysis revealed that many Marriott U.S. hotels are projected to be exposed to increases in average and extreme temperatures. Increasing global temperatures could drive up the energy consumption at our properties, thus reducing profits from operations. <2 years Increased operating costs: At many of our properties, energy costs are among the highest line of expenses, and temperature extremes increase the energy load. Furthermore, many older buildings’ central plants are underdesigned for climates with increasing temperatures and may require significant retrofit or upgrades at high cost in the longer term. Physical: Chronic Changes in precipitation patterns and extreme variability in weather patterns: Risks relating to natural or man-made disasters have reduced the demand for lodging, which has adversely affected our revenues. We have seen a decline in travel and reduced demand for lodging due to so-called “Acts of God,” such as hurricanes, earthquakes, tsunamis, floods, volcanic activity, wildfires, and other natural disasters in locations where we own, manage, or franchise properties and areas of the world from which we draw many guests. These circumstances could continue or worsen in the future to an extent and for durations that we are not able to predict. <2 years Reduced revenues from lower sales/output: Longer dry or wet periods could make some destinations less desirable, which might lead to a decrease in the profitability of hotel operations in the affected location; e.g., reduced snowfall in winter sport destinations or threat of wildfires can reduce hotel occupancy. STRATEGY: THE ACTUAL AND POTENTIAL IMPACTS OF CLIMATE-RELATED RISKS AND OPPORTUNITIES ON THE ORGANIZATION’S BUSINESSES, STRATEGY, AND FINANCIAL PLANNING (a) Identified Climat e-Related Risks and Opportunities Over Short-Term, Medium-Term, and Long-Term Horizons Time Horizons: Marriott defines short-term time horizons as less than 2 years, medium-term time horizons by 2-5 years and long-term time horizons by 5-10 years. The short-term time horizon primarily reflects hotel operations and the activities of the Serve 360 Executive Leadership Council. For example, annual energy and water audits help identify opportunities to perform against goals and asset management systems track preventative maintenance and capital expenditure plans in short-term time horizons. Assessing medium-term risks and opportunities includes activities such as monitoring proposed legislation or emerging technologies. The long-term time horizon includes Marriott’s annual 10-year capital planning and budgeting exercise, which helps to identify and forecast the needs of a given facility with respect to long-term climate impacts and efficiency. Additionally, most of Marriott’s Serve 360 targets were established for the 10-year time frame from 2016 to 2025, helping to envision how to develop responsible business practices to meet climate change risks. Process to Determine Risks and Opportunities with a Material Financial Impact: Risks are typically reviewed annually by the top 250 executives across the company, as well as by the Board of Directors. All the evaluated risks may be considered to have the potential for substantive impact, and as a part of the annual review, the risks are prioritized and data is gathered about current and long-term mitigation efforts, challenges, and performance-tracking mechanisms. Identified Risks:

Serve360 ESG Report Page 79 Page 81

Serve360 ESG Report Page 79 Page 81