At Greylock, my partners and I are driven by one guiding mission: always help entrepreneurs. It doesn't matter whether an entrepreneur is in our portfolio, whether we're considering an investment, or whether we're casually meeting for the first time.

Entrepreneurs often ask me for help with their pitch decks. Because we value integrity and confidentiality at Greylock, we never share an entrepreneur's pitch deck with others. What I've honorably been able to do, however, is share the deck I used to pitch LinkedIn to Greylock for a Series B investment back in 2004.

This past May was the 10th anniversary of LinkedIn, and while reflecting on my entrepreneurial journey, I realized that no one gets to see the presentation decks for successful companies. This gave me an idea: I could help many more entrepreneurs by making the deck available not just to the Greylock network of entrepreneurs, but to everyone.

Today, I share the Series B deck with you, too. It has many stylistic errors - and a few substantive ones, too - that I would now change having learned more, but I realized that it still provides useful insights for entrepreneurs and startup participants outside of the Greylock network, particularly across three areas of interest:

- how entrepreneurs should approach the pitch process

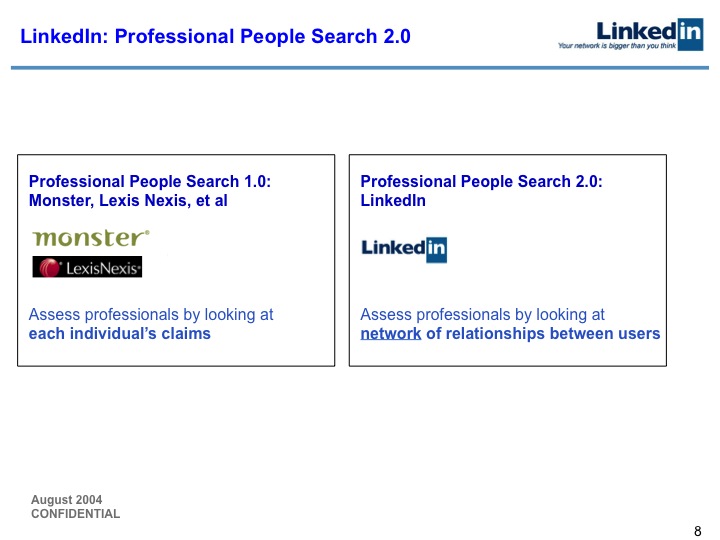

- the evolution of LinkedIn as a company

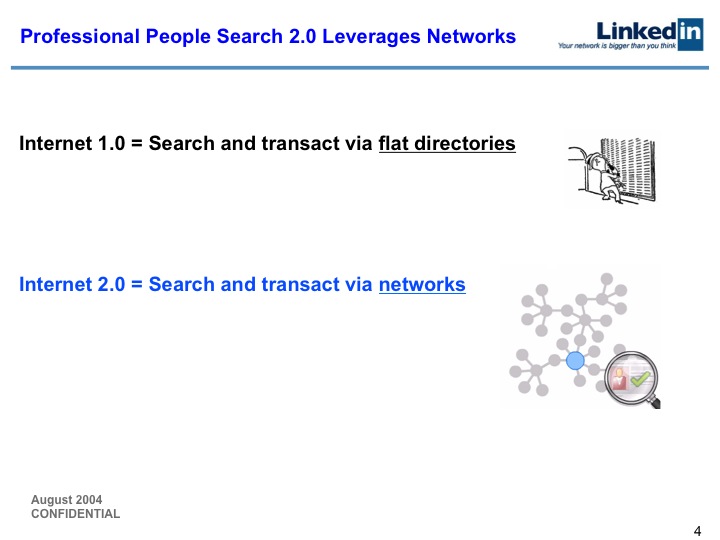

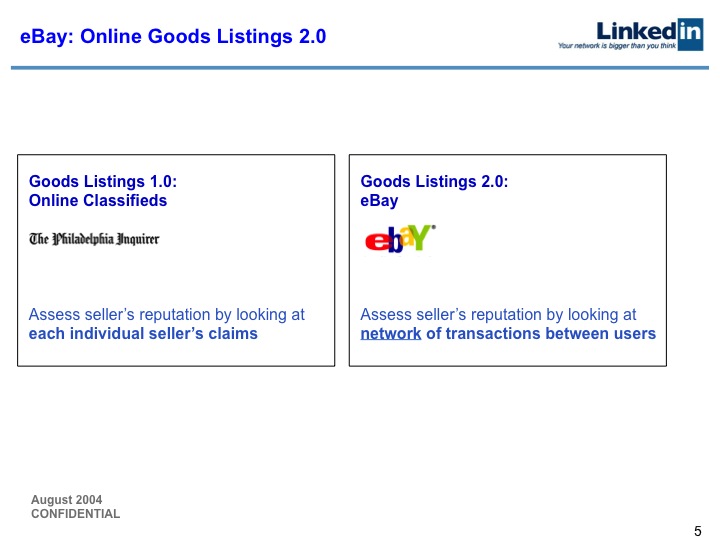

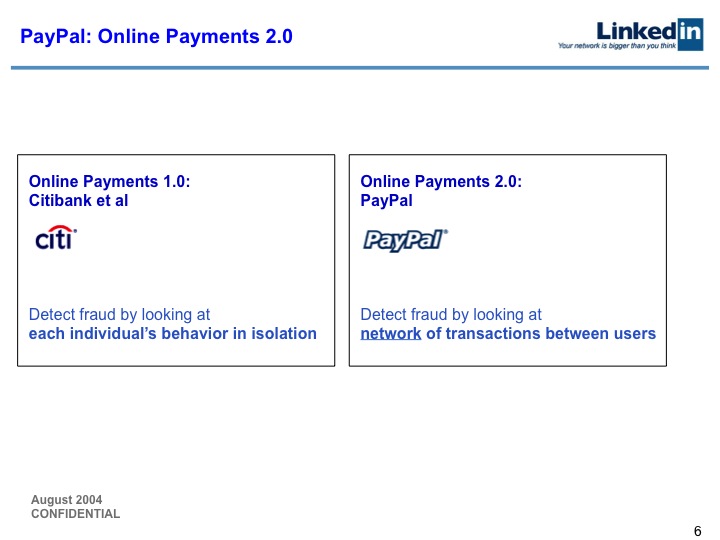

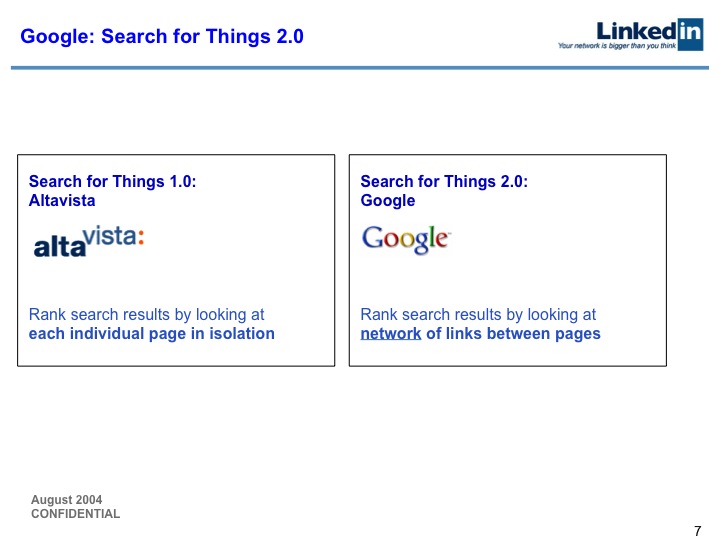

- the consumer internet landscape in 2004 vs. today

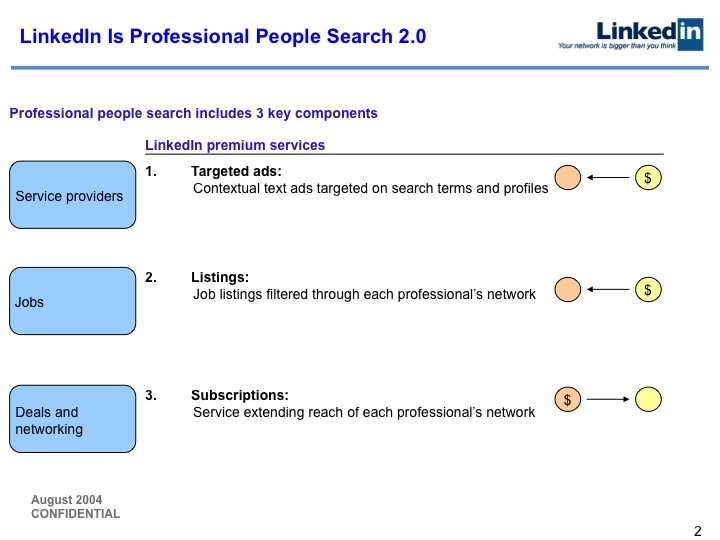

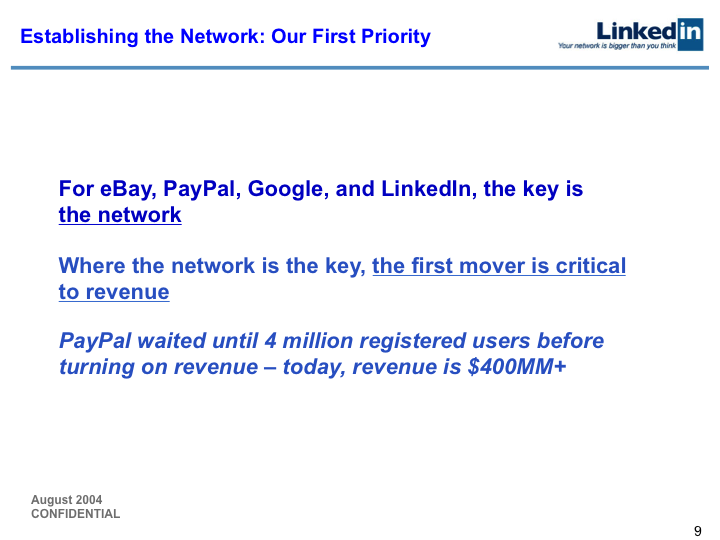

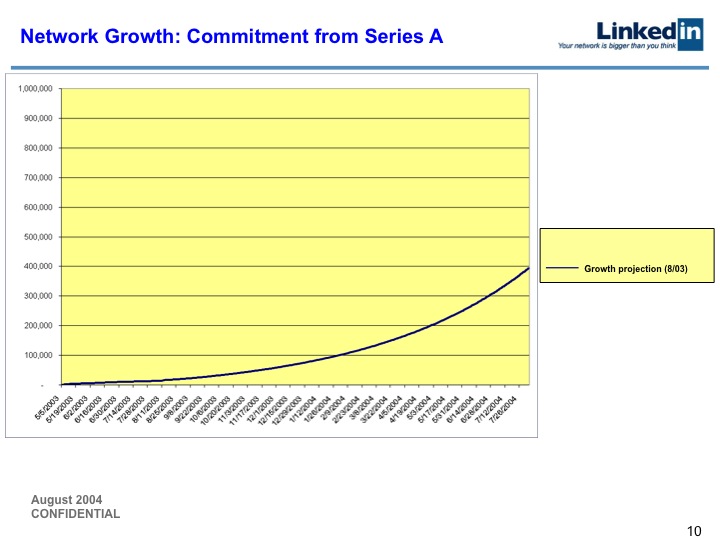

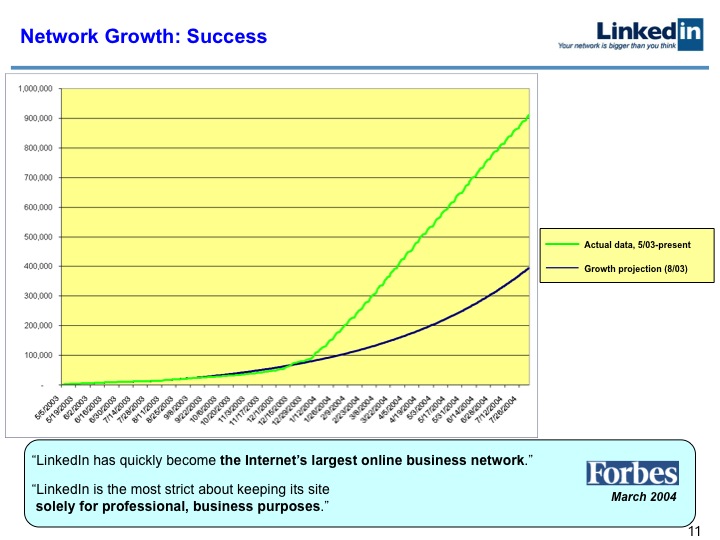

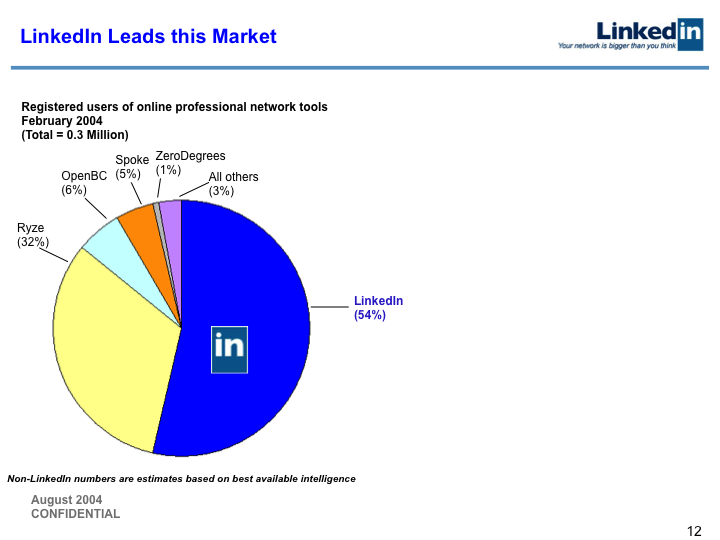

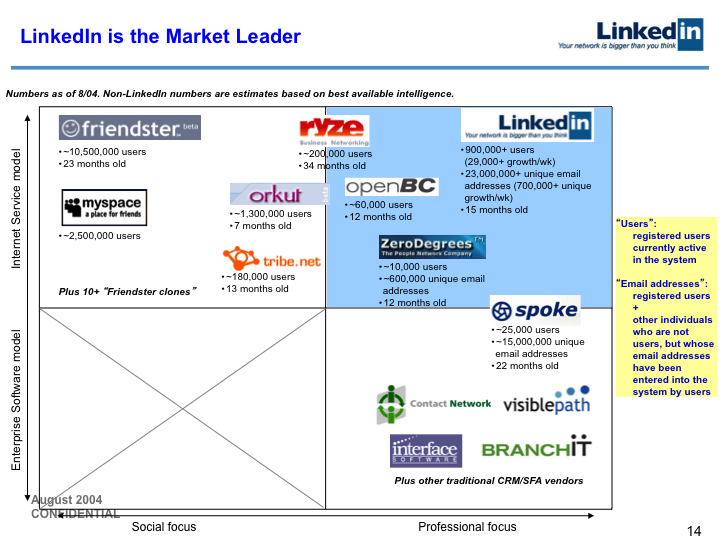

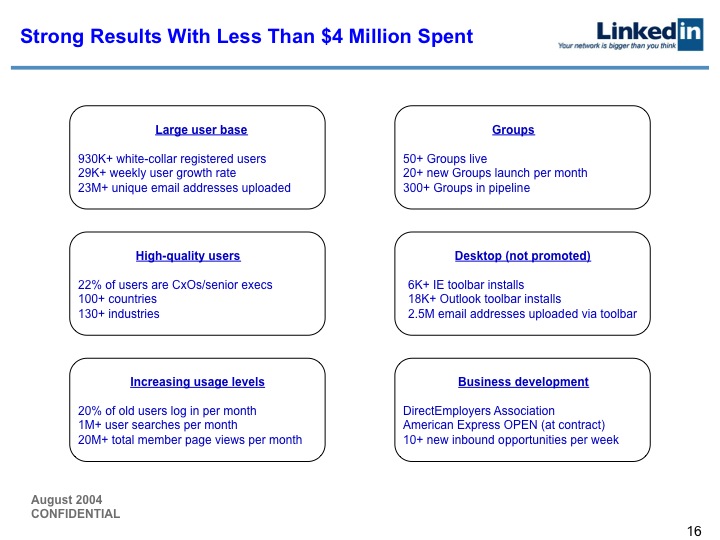

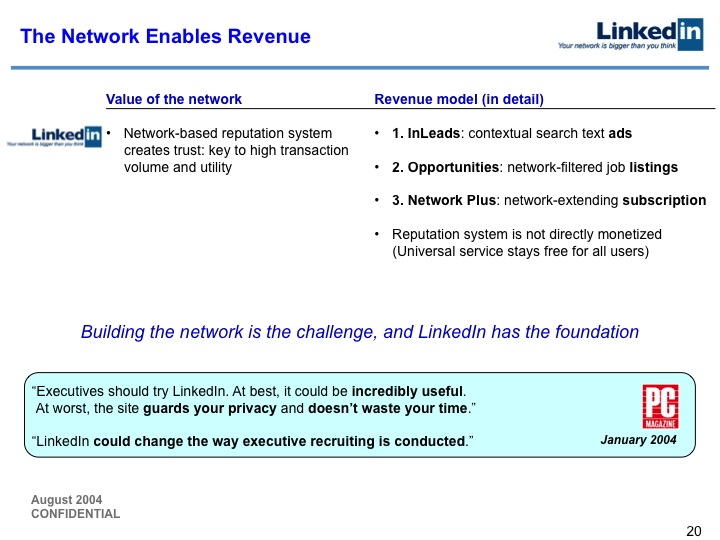

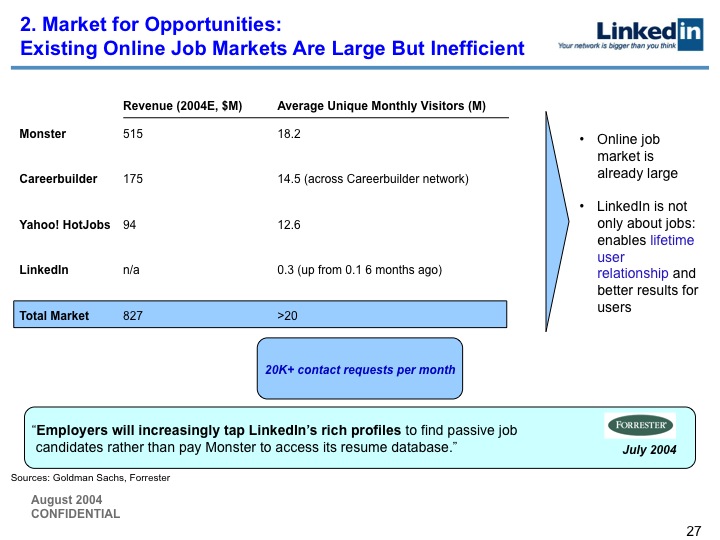

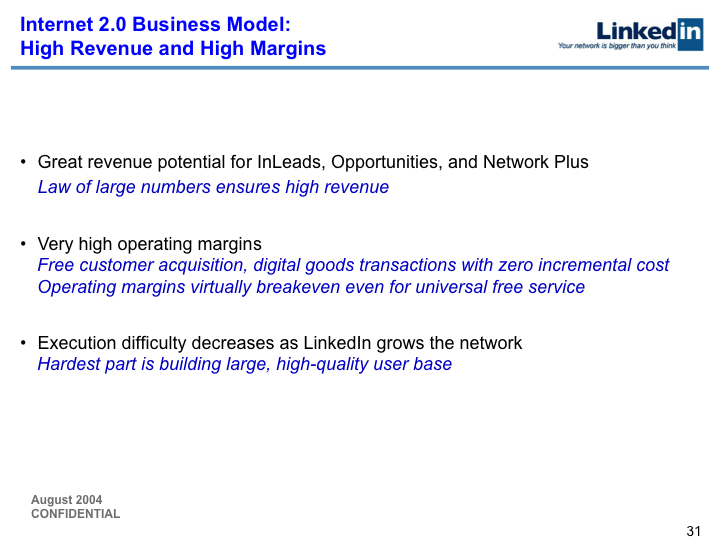

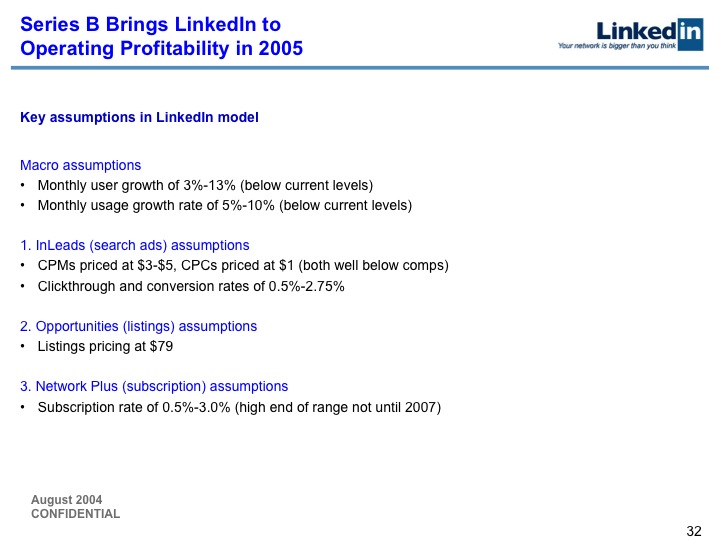

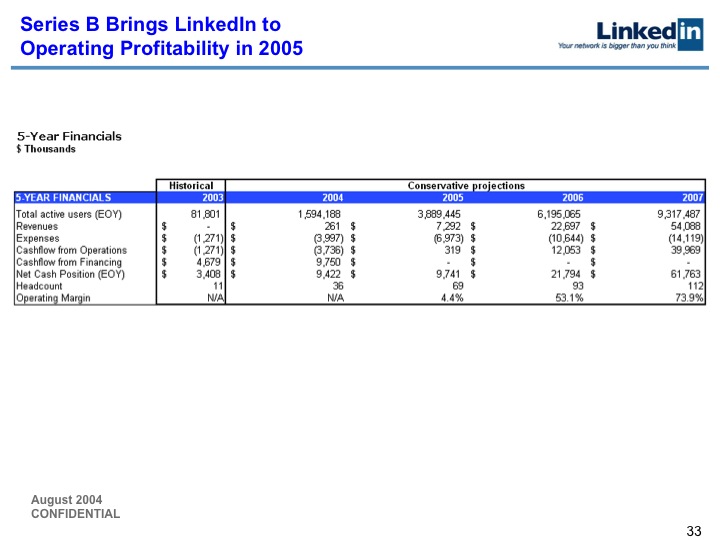

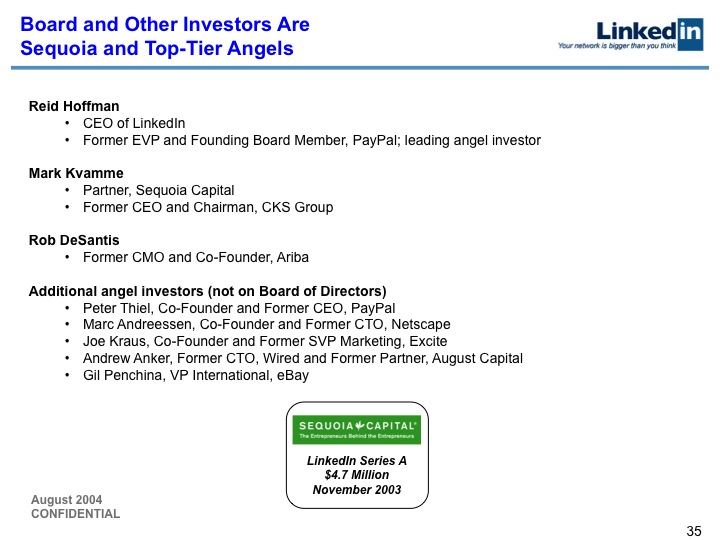

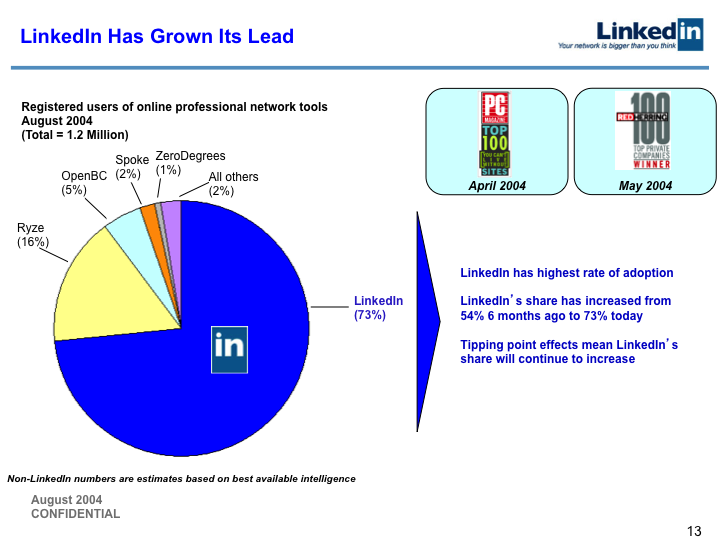

Today, LinkedIn seems like an obvious investment to have made in 2004. But at the time of the Series B financing, LinkedIn had spent its $4 million from Series A building a network that was much smaller than Friendster, MySpace, etc. We had no revenue, or even revenue-capable products.

The journey from founding, to multiple rounds of financing, to IPO, was not easy. All startups go through real Valley-of-the-Shadow moments, in which they wonder why they ever thought their business was a good idea. At LinkedIn, we had these moments. As an entrepreneur, I found David Sze and Greylock to be a tremendous ally through the process. And, David had the vision to invest in LinkedIn when it looked to most of the investing community like an odd niche.

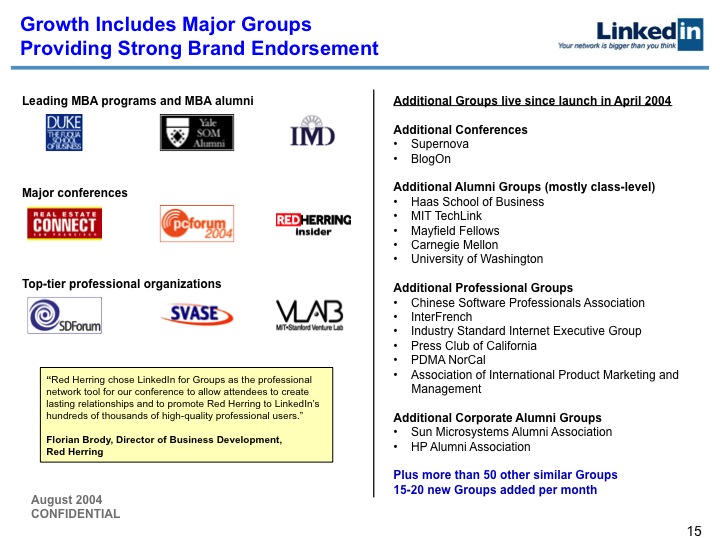

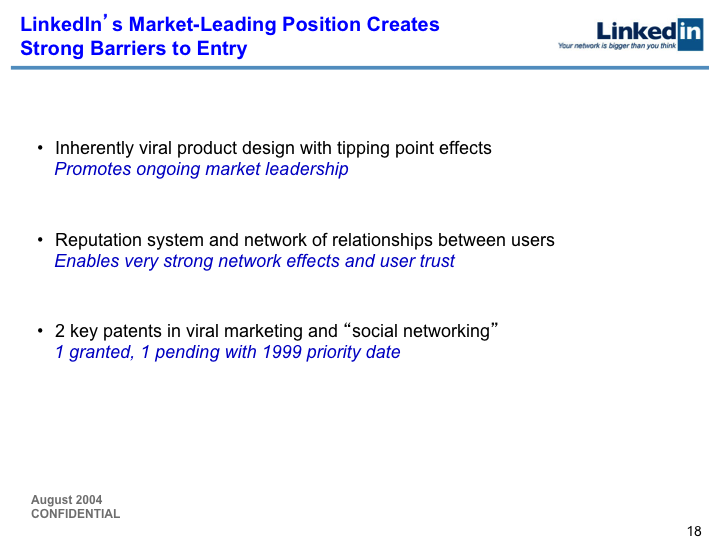

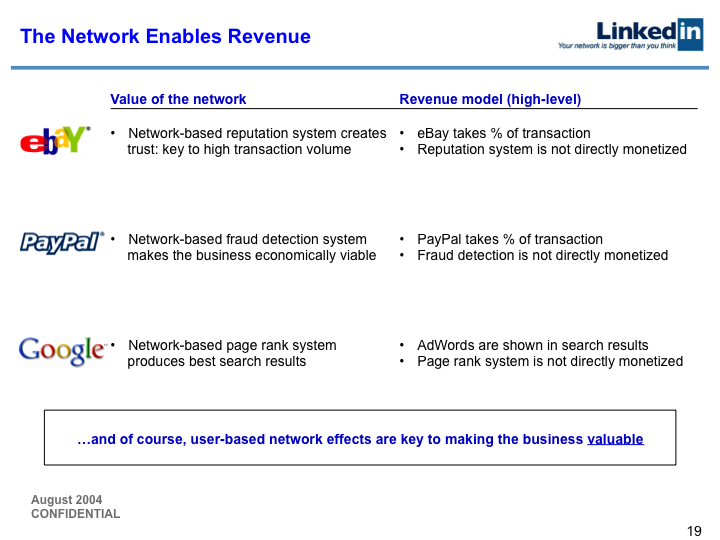

We changed some of the text to be less hyperbolically ambitious on slides 9, 12-14, 18, 19, 31, and 36. A public company should avoid publishing forward-looking projections and ambitions - even if they're from 2004. As an entrepreneur pitching a private company, it is of course critical to be forward-looking and ambitious.Thanks to Ian Alas and Ben Casnocha, among others, for their help and feedback.

How did I get Greylock on board in the first place? It started with this pitch deck. A good pitch helps get great investors, because it builds a strong relationship through clear communication and vision.

So good fortune building your own pitch deck. And I hope it marks the start of an exciting entrepreneurial journey.

StartUp Tools: Advice on Starting and Running a StartUp Page 45 Page 47

StartUp Tools: Advice on Starting and Running a StartUp Page 45 Page 47