The Founders Pie Calculator

By Frank Demmler

Several weeks ago, we took a look at the founders pie. I noted that frequently the founding team divides 100% by the number of founders.

I also cautioned that this is the WRONG WAY!

I then went on to identify the factors that should be considered when making these decisions.

Since then, I have had several people tell me that while what I wrote certainly made sense, it wasnt very helpful.They said that when it came to rug cutting time, absent an alternative method, equal shares was the only method that seemed to be fair.

As a public service, I have invented a Founders Pie Calculator. As you will soon see, this calculator is not particularly profound.In fact, Im sure I havent invented it, but, at the same time, I have never seen it before. [Caution: perhaps theres a fatal flaw that I havent considered.]

Its primary benefits are that it provides a way to quantify the elements of the decision making process, and that it appears to be logical and fair.

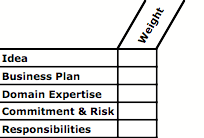

Lets revisit the factors that should be considered.

Idea

The company wouldnt exist if it werent for the original idea, and that is certainly worth something, BUT theres a lot of truth in the saying, A successful business is 1% inspiration, and 99% perspiration.

Business Plan Preparation

The development of an initial business plan is a surprisingly difficult and time-consuming effort. To pull together and organize all the thoughts of the founding team, filling in the blanks, identifying and reconciling the differences, and producing a document that captures the essence of the business and helps persuade banks, investors, board members, and others to support the company is a mammoth undertaking, as anyone who has done it will attest.

Again, the plan is a necessary element of starting the business, BUT execution against the plan is where the real value lies.

Domain Expertise

To what degree do you and your partners have meaningful experience in the business of your business? Knowing the industry, having relevant experience, and having a Rolodex full of accessible contacts can greatly improve the companys probability of success and speed its growth rate. Otherwise, it will take longer to get commercial traction and youll have to pay for these assets, usually by hiring someone and including equity in their compensation package.

Commitment and Risk

Youve probably heard the old saying that a chicken is involved with breakfast, but a pig is committed. Similarly, the founders who join the company full time and are committed to making it a success are much more valuable than founders who are going to sit on the sideline and be cheerleaders. In addition, the opportunity cost for those who join the company instead of pursuing a career is not trivial.

Responsibilities

Who is going to do what? Who is going to go stay up at night when you cant make tomorrows payroll? Where does the buck stop?

For each company, the relative importance of these elements is likely to be very different than that for another company.A company based upon new technology is highly dependent upon the idea.On the other hand, a new restaurant is not likely to be so unique that the idea is a major contributor to the restaurants ultimate success. If we were to evaluate the ideas on a scale of 0-to-10, the technology companys idea might be a 7 or 8,while the restaurant may be only 2 or 3.

Similarly, the relative importance of the business plan will vary.A company that has to raise external financing will need a plan that will assist fund raising efforts.If the founders are providing the start up capital, then the plan will be relatively less important.

I believe the same analysis can be productively applied to the other

elements.Not only can the

absolute evaluations be made (0-to-10), but they can be compared to one another

for make sure that their relative values are reasonable as well.

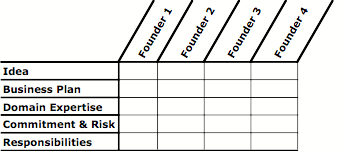

Each of the founders can be evaluated on these elements as well.Who did what to come up with the idea? Who contributed what to the business plan? Who has the industry connections? Who is joining the company? Who is accepting responsibility for raising investment capital? Who is responsible for bringing the product to market?

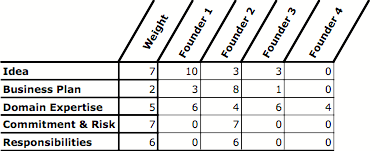

Lets look at a hypothetical example. Assume that we have a high technology start up spinning out of a university with four members of the founding team.

- The inventor who is recognized as the technology leader in his domain.

- The business guy who is bringing business and industry knowledge to the company.

- The technologist who has been the inventors right hand man.

- The research team member who happened to be at the right place at the right time, but hasnt and wont contribute much to the technology or the company.

If these were all first-time entrepreneurs, its likely that they would each get 25% of the companys stock, because its fair.

Lets take a look at what the Founders Pie Calculator says. First we evaluate each of the factors on their relative importance and each of the founding team members contribution to each on a scale of 0-to-10.

Next, we multiply each of the founders values by the factors value to calculate weighted scores. Add up the numbers for each founder, sum those totals and determine the relative percentages. Do a sanity check to see if those numbers seem to make sense, and adjust them accordingly.

- Splitting up the founders pie is not a trivial undertaking.

- Rarely should it be split evenly, even though thats what many start-ups do.

- Consider the past, current, and future relative contributions of the founding team members to the ultimate success of the company.

- Employ the Founders Pie Calculator to create a quantified scenario of how the pie might be divided based upon these elements.

- Caution: while I have convinced myself that this is brilliant tool, and that the scenarios that Ive run through it have had logical outcomes, use this tool for guidance only.Do not depend upon it exclusively.

Frank Demmler is Associate Teaching Professor of Entrepreneurship at the Donald H. Jones Center for Entrepreneurship at the Tepper School of Business at Carnegie Mellon University. Previously he was president & CEO of the Future Fund, general partner of the Pittsburgh Seed Fund, co-founder & investment advisor to the Western Pennsylvania Adventure Capital Fund, as well as vice president, venture development, for The Enterprise Corporation of Pittsburgh.