As a young VC trying to understand the inner workings and financing of startups, my first year has been crammed full of reading tech articles, books, Hacker News, Quora entries, and watching Ustream and YouTube clips. While there is a large amount of helpful information for entrepreneurs seeking funding, I haven't found many thorough descriptions of what goes on from the VC side when evaluating companies. Last week, Apsalar announced their funding round, and I thought it might provide a good example of how we go about looking at a company from initial contact, to doing due diligence, to solidifying an agreement on working together. I cover the first two parts of this process (namely, initial review and due diligence) in this post and will follow up in the coming weeks with a second post regarding the negotiations and final structuring of our investment.

Our first contact with Apsalar came through an entrepreneur whose previous company we had invested in. He served as an advisor to Apsalar and told us about the company because he felt there might be a good fit. We had an initial call with Michael Oiknine, the founder and CEO, where it quickly became clear that he knew the space and appeared to be on to something big. That led to a series of further calls and the proverbial pitch deck landing on my desk.

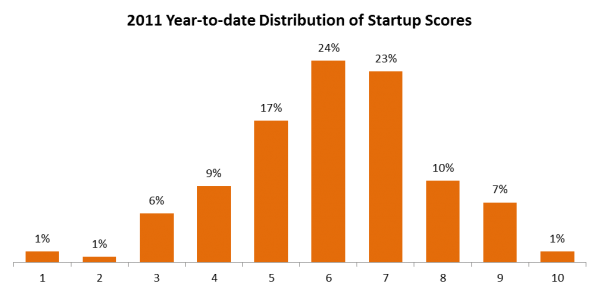

In any given quarter we are typically looking at upwards of 80 companies that have been referred to us by people in our network. Given the volume, we try to apply a simple rating system to help us consider which startups are a good fit with our investment focus. After doing an initial scan of pitch documents, I generally rate companies on 10 rather loose criteria as a litmus test to see if there is a good fit:

- Early Stage (most of our investments fall under Seed/Series A/Series B)

- Geography (we spend a lot of time with our startups so the focus is on Silicon Valley)

- Industry Fit (is it a market we understand and can give helpful assistance in?)

- Competition (size, strength, reach, and technology differences of other industry players)

- Business Model (has to be one that we believe in)

- Momentum (user traction, partnership agreements, and industry recognition)

- Market Size (focus on the size of the total addressable market for the problem being solved)

- Defensibility (this can be IP, specialized skills/knowledge requirements, any unfair advantage)

- Team (what are their past experiences, domain knowledge, and group passion/chemistry?)

- Bill Dodds Wow Factor (named after a Thomvest veteran, this is the "did it have that additional 'umph' that gets you excited about the company?")

While this list isn't perfect or comprehensive, it generally allows us to quickly test if there is a good fit with Thomvest. There are exceptions to the rule, but going back over a year's worth of prospect data, there has not been an investment we have done that hasn't scored in the top tiers (8-10).

It's rare that a company gets full points on this scale for an early stage startup, and Apsalar was one of those rare cases that scored a perfect 10. The team was raising their first institutional round, is located in San Francisco, and is doing mobile and software: three quick points on our simple litmus test. The mobile analytics space seemed to be competitive, but no one had done effective mobile behavioral targeting, giving the company a first-mover advantage. We were able to analyze the business model and felt good about the strategy going forward. Apsalar's momentum was the hockey-stick you hear about but don't often see. The team had worked together for 10 years doing behavioral targeting online with their prior company that had a successful exit. This gave them the skills in addition to protectable IP around the methods for their mobile code. The Bill Dodds Wow Factor is a bit hard to quantify, but it can come from ridiculous traction, beautiful design, an entirely different take on how to do something that we wouldn't have thought of, and so forth. Apsalar's growth ramp was stunning, the visualizations of their data were slick, and the way they wanted to implement behavioral targeting had a unique approach that we hadn't seen.

We knew that investing in Apsalar was going to be very competitive, with the company already receiving term sheets from other investors. We crammed the review process into one week, in what can only be described as the VC equivalent of a hack-a-thon. More than a few sleepless nights were filled with solidifying our market overviews and forecasts, cranking out financial models to test startup assumptions, and doing back-channel reference calls. We like to know a great deal about the people we are considering working with, and usually spend a good amount of time sifting through Linkedin, Quora, Twitter, and Google to get to know them better. Linkedin lets me see who we mutually know and can lead to good reference checks. The trail of a CEO's Quora account history shows how they are thinking about their business, the types questions they spent the time to answer/upvote, and feedback that their opinions are receiving in the tech community. Their Twitter presence gives a glimpse into topics they generally cover and what kind of audience they tailor messaging toward: some use it as a networking tool, others chronicle their startup's progress, and others transcribe notes about things they find interesting. A simple Google search can yield some surprising findings as well. We found a defunct blog that the CTO wrote circa early 2000s that covered everything from book reviews to deep packet inspection. It gave us a sense for the brainpower behind the operations and led to some good topics for discussion once we met. We also found an old blog from the founding team's first company that detailed their unpleasant experience with another venture firm. It allowed us to focus around the specific ways we partner with startups to reassure that history wouldn't be repeating itself if the Apsalar team chose to work with us. Michael seemed to appreciate the efforts we had put into assessing the team and their approach. This helped us move the discussions further given the competitive dynamics involved with the financing round.

After getting a good sense for Michael and the Apsalar team, we met up at their offices in SF. The chemistry was great, our first hour-long meeting was very informative, and there was a great balance between really explaining what they were doing and the vision going forward. Don Butler, one of the Managing Directors here at Thomvest, and I walked out of that meeting feeling very positive on where they were headed. Once we shared our experience with the rest of the team, the real work began.

The next phase of diligence for us usually includes coming up with a comprehensive list of questions and asking references for feedback. I try to generally think of reference checks in 3 categories: Personal, Market Landscape, and Company-Specific.

We wanted to find out how good the team is, how they have behaved in certain situations, and what it is like to work with them.

Who: Contacts from the CEO, individuals in our network, and former team members and investors

Why: The team is key, and if they sued their past investor or bailed on the company as things were going south we would rather find out before jumping into a long-term partnership with them.

For Apsalar: We had meetings with two well-respected angel investors that had invested their own funds in the company, spoke with another few that knew Michael personally, and the checks all came back positive. In their prior company Kefta, the management team stuck through thick and thin until the company got to the point of being acquired. This showed us just how resilient the team was.

We like to speak with individuals who a) can tell us about how they see the industry evolving, b) have visibility into the competition, and c) can tell us where they plan to spend their dollars if they are potential customers of the company. This generally answers some of the bigger questions regarding how large we think a potential startup can become and what challenges it will face along the way.

Who: Startup CEOs, industry analysts, research articles, and industry luminaries

Why: We aren't operating countless hours day-to-day in every industry, but there are numerous individuals we trust who are. Some of the more interesting fact checks have come out of conversations with them.

For Apsalar: I attended a mobile conference and spoke with various publishers and experts. One of the individuals I was fortunate enough to get to know was Trip Hawkins, the founder of EA and Digital Chocolate. Given his long history and current role in both gaming and mobile, he was very insightful and gave me some great feedback on mobile analytics and where he saw the industry going. Many of the publishers Michael gave us had booths at the conference, and I was able to ask them what analytics services they used and where they thought the future of mobile advertising was headed. I kept a running Dropbox of all the mobile advertising and gaming research we could find along the way, which our team was also evaluating.

How is the product, the customer service, where are the gaps in product/market fit, if they were running the startup how would they adjust the strategy, what is the technology differentiation?

Who: Customers, technical experts, and industry contacts met at various mobile conferences

Why: This is the bucket that we emphasize most heavily, specifically when speaking with customer references. We have had some calls where the customers can't stop raving about a product even after we try to get off the phone...That gets us excited and has led us to be a part of some great companies along the way. We also don't always have the expertise to do a deep analysis on the technical feasibility and sometimes bring in someone who has extensive knowledge of a particular space or technology. Sometimes these experts give strong reviews coupled with a "do you mind if I co-invest alongside you..." That acts as a positive signal and gets us excited about a company.

For Apsalar: Each publisher whom we spoke with put Apsalar's offering above the many competitors they had benchmarked against, and were very impressed with the speed at which they were able to onboard the analytics offering.

In order to reduce eye fatigue, the next post will discuss how we came to a decision as a team, the details of how our negotiations went, and how we closed on a group of investors to work with as part of our investment syndicate.

StartUp Tools: Advice on Starting and Running a StartUp Page 50 Page 52

StartUp Tools: Advice on Starting and Running a StartUp Page 50 Page 52