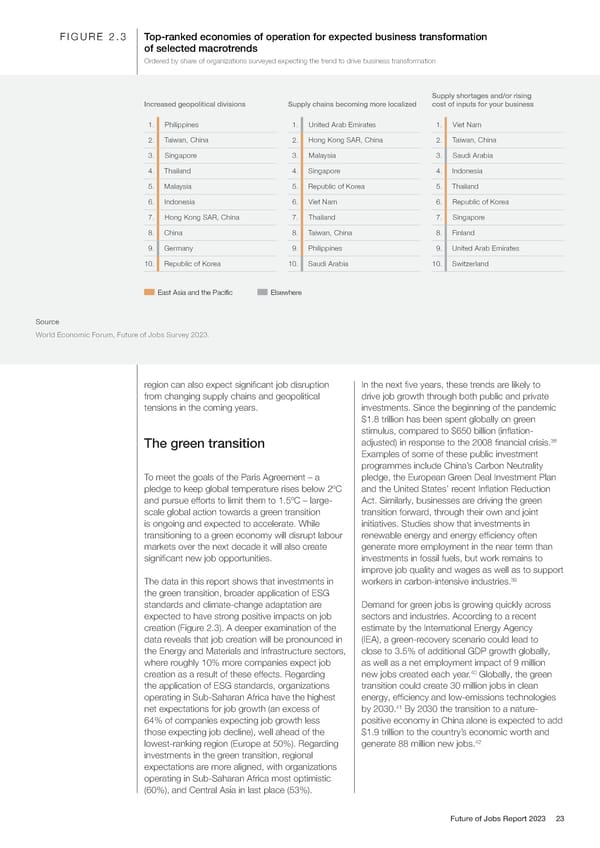

FIGURE 2.3 Top-ranked economies of operation for expected business transformation of selected macrotrends Ordered by share of organizations surveyed expecting the trend to drive business transformation Supply shortages and/or rising Increased geopolitical divisions Supply chains becoming more localized cost of inputs for your business 1. Philippines 1. United Arab Emirates 1. Viet Nam 2. Taiwan, China 2. Hong Kong SAR, China 2. Taiwan, China 3. Singapore 3. Malaysia 3. Saudi Arabia 4. Thailand 4. Singapore 4. Indonesia 5. Malaysia 5. Republic of Korea 5. Thailand 6. Indonesia 6. Viet Nam 6. Republic of Korea 7. Hong Kong SAR, China 7. Thailand 7. Singapore 8. China 8. Taiwan, China 8. Finland 9. Germany 9. Philippines 9. United Arab Emirates 10. Republic of Korea 10. Saudi Arabia 10. Switzerland East Asia and the Pacific Elsewhere Source World Economic Forum, Future of Jobs Survey 2023. region can also expect significant job disruption In the next five years, these trends are likely to from changing supply chains and geopolitical drive job growth through both public and private tensions in the coming years. investments. Since the beginning of the pandemic $1.8 trillion has been spent globally on green stimulus, compared to $650 billion (inflation- 38 The green transition adjusted) in response to the 2008 financial crisis. Examples of some of these public investment programmes include China’s Carbon Neutrality To meet the goals of the Paris Agreement – a pledge, the European Green Deal Investment Plan pledge to keep global temperature rises below 2ºC and the United States’ recent Inflation Reduction and pursue efforts to limit them to 1.5ºC – large- Act. Similarly, businesses are driving the green scale global action towards a green transition transition forward, through their own and joint is ongoing and expected to accelerate. While initiatives. Studies show that investments in transitioning to a green economy will disrupt labour renewable energy and energy efficiency often markets over the next decade it will also create generate more employment in the near term than significant new job opportunities. investments in fossil fuels, but work remains to improve job quality and wages as well as to support 39 The data in this report shows that investments in workers in carbon-intensive industries. the green transition, broader application of ESG standards and climate-change adaptation are Demand for green jobs is growing quickly across expected to have strong positive impacts on job sectors and industries. According to a recent creation (Figure 2.3). A deeper examination of the estimate by the International Energy Agency data reveals that job creation will be pronounced in (IEA), a green-recovery scenario could lead to the Energy and Materials and Infrastructure sectors, close to 3.5% of additional GDP growth globally, where roughly 10% more companies expect job as well as a net employment impact of 9 million creation as a result of these effects. Regarding new jobs created each year.40 Globally, the green the application of ESG standards, organizations transition could create 30 million jobs in clean operating in Sub-Saharan Africa have the highest energy, efficiency and low-emissions technologies 41 net expectations for job growth (an excess of by 2030. By 2030 the transition to a nature- 64% of companies expecting job growth less positive economy in China alone is expected to add those expecting job decline), well ahead of the $1.9 trillion to the country’s economic worth and 42 lowest-ranking region (Europe at 50%). Regarding generate 88 million new jobs. investments in the green transition, regional expectations are more aligned, with organizations operating in Sub-Saharan Africa most optimistic (60%), and Central Asia in last place (53%). Future of Jobs Report 2023 23

The Future of Jobs Report 2023 Page 22 Page 24

The Future of Jobs Report 2023 Page 22 Page 24