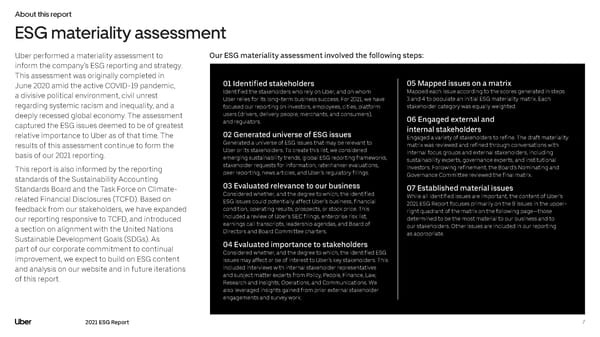

About this report ESG materiality assessment Uber performed a materiality assessment to Our ESG materiality assessment involved the following steps: inform the company’s ESG reporting and strategy. This assessment was originally completed in June 2020 amid the active COVID-19 pandemic, 01 Identified stakeholders 05 Mapped issues on a matrix a divisive political environment, civil unrest Identified the stakeholders who rely on Uber, and on whom Mapped each issue according to the scores generated in steps Uber relies for its long-term business success. For 2021, we have 3 and 4 to populate an initial ESG materiality matrix. Each regarding systemic racism and inequality, and a focused our reporting on investors, employees, cities, platform stakeholder category was equally weighted. deeply recessed global economy. The assessment users (drivers, delivery people, merchants, and consumers), 06 Engaged external and captured the ESG issues deemed to be of greatest and regulators. relative importance to Uber as of that time. The 02 Generated universe of ESG issues internal stakeholders Engaged a variety of stakeholders to refine. The draft materiality results of this assessment continue to form the Generated a universe of ESG issues that may be relevant to matrix was reviewed and refined through conversations with basis of our 2021 reporting. Uber or its stakeholders. To create this list, we considered internal focus groups and external stakeholders, including emerging sustainability trends, global ESG reporting frameworks, sustainability experts, governance experts, and institutional This report is also informed by the reporting stakeholder requests for information, rater/ranker evaluations, investors. Following refinement, the Board’s Nominating and peer reporting, news articles, and Uber’s regulatory filings. Governance Committee reviewed the final matrix. standards of the Sustainability Accounting 03 Evaluated relevance to our business Standards Board and the Task Force on Climate- 07 Established material issues related Financial Disclosures (TCFD). Based on Considered whether, and the degree to which, the identified While all identified issues are important, the content of Uber’s ESG issues could potentially affect Uber’s business, financial 2021 ESG Report focuses primarily on the 9 issues in the upper- feedback from our stakeholders, we have expanded condition, operating results, prospects, or stock price. This right quadrant of the matrix on the following page—those our reporting responsive to TCFD, and introduced included a review of Uber’s SEC filings, enterprise risk list, determined to be the most material to our business and to a section on alignment with the United Nations earnings call transcripts, leadership agendas, and Board of our stakeholders. Other issues are included in our reporting Directors and Board Committee charters. as appropriate. Sustainable Development Goals (SDGs). As 04 Evaluated importance to stakeholders part of our corporate commitment to continual Considered whether, and the degree to which, the identified ESG improvement, we expect to build on ESG content issues may affect or be of interest to Uber’s key stakeholders. This and analysis on our website and in future iterations included interviews with internal stakeholder representatives of this report. and subject matter experts from Policy, People, Finance, Law, Research and Insights, Operations, and Communications. We also leveraged insights gained from prior external stakeholder engagements and survey work. 2021 ESG Report 7

Uber ESG Report Page 6 Page 8

Uber ESG Report Page 6 Page 8