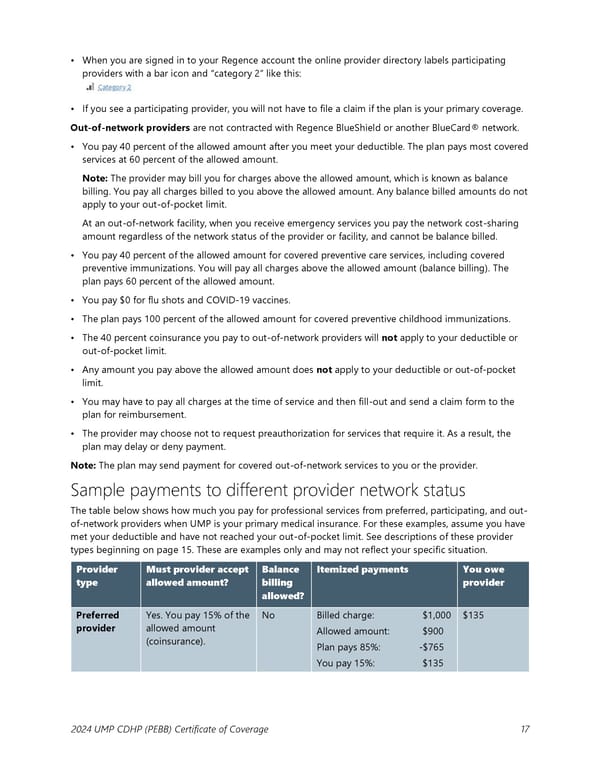

• When you are signed in to your Regence account the online provider directory labels participating providers with a bar icon and “category 2” like this: • If you see a participating provider, you will not have to file a claim if the plan is your primary coverage. Out-of-network providers are not contracted with Regence BlueShield or another BlueCard® network. • You pay 40 percent of the allowed amount after you meet your deductible. The plan pays most covered services at 60 percent of the allowed amount. Note: The provider may bill you for charges above the allowed amount, which is known as balance billing. You pay all charges billed to you above the allowed amount. Any balance billed amounts do not apply to your out-of-pocket limit. At an out-of-network facility, when you receive emergency services you pay the network cost-sharing amount regardless of the network status of the provider or facility, and cannot be balance billed. • You pay 40 percent of the allowed amount for covered preventive care services, including covered preventive immunizations. You will pay all charges above the allowed amount (balance billing). The plan pays 60 percent of the allowed amount. • You pay $0 for flu shots and COVID-19 vaccines. • The plan pays 100 percent of the allowed amount for covered preventive childhood immunizations. • The 40 percent coinsurance you pay to out-of-network providers will not apply to your deductible or out-of-pocket limit. • Any amount you pay above the allowed amount does not apply to your deductible or out-of-pocket limit. • You may have to pay all charges at the time of service and then fill-out and send a claim form to the plan for reimbursement. • The provider may choose not to request preauthorization for services that require it. As a result, the plan may delay or deny payment. Note: The plan may send payment for covered out-of-network services to you or the provider. Sample payments to different provider network status The table below shows how much you pay for professional services from preferred, participating, and out- of-network providers when UMP is your primary medical insurance. For these examples, assume you have met your deductible and have not reached your out-of-pocket limit. See descriptions of these provider types beginning on page 15. These are examples only and may not reflect your specific situation. Provider Must provider accept Balance Itemized payments You owe type allowed amount? billing provider allowed? Preferred Yes. You pay 15% of the No Billed charge: $1,000 $135 provider allowed amount Allowed amount: $900 (coinsurance). Plan pays 85%: -$765 You pay 15%: $135 2024 UMP CDHP (PEBB) Certificate of Coverage 17

UMP Consumer-Directed Health Plan (CDHP) COC (2024) Page 17 Page 19

UMP Consumer-Directed Health Plan (CDHP) COC (2024) Page 17 Page 19