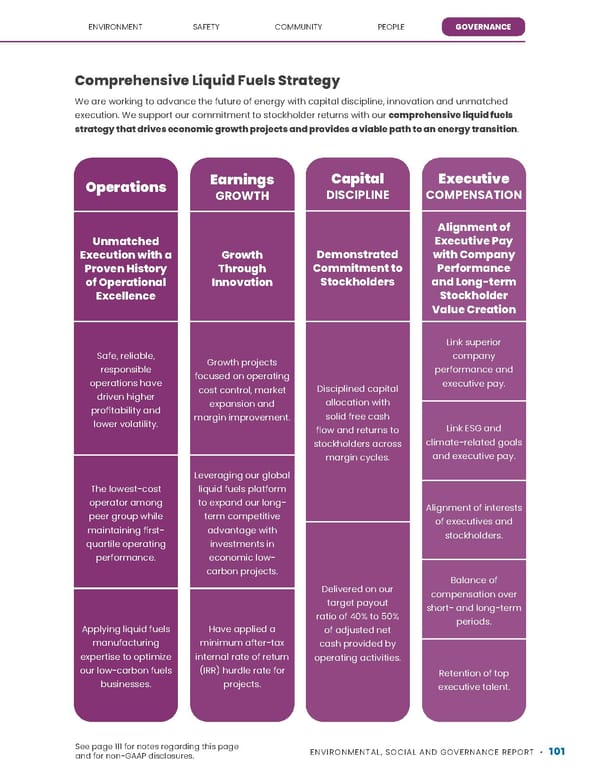

ENVIRONMENTAL, SOCIAL AND GOVERNANCE REPORT • 101 SAFETY COMMUNITY PEOPLE GOVERNANCE ENVIRONMENT Comprehensive Liquid Fuels Strategy We are working to advance the future of energy with capital discipline, innovation and unmatched execution. We support our commitment to stockholder returns with our comprehensive liquid fuels strategy that drives economic growth projects and provides a viable path to an energy transition . Capital DISCIPLINE Demonstrated Commitment to Stockholders Disciplined capital allocation with solid free cash flow and returns to stockholders across margin cycles. Delivered on our target payout ratio of 40% to 50% of adjusted net cash provided by operating activities. Earnings GROWTH Growth Through Innovation Growth projects focused on operating cost control, market expansion and margin improvement. Leveraging our global liquid fuels platform to expand our long- term competitive advantage with investments in economic low- carbon projects. Have applied a minimum after-tax internal rate of return (IRR) hurdle rate for projects. Operations Unmatched Execution with a Proven History of Operational Excellence Safe, reliable, responsible operations have driven higher profitability and lower volatility. The lowest-cost operator among peer group while maintaining first- quartile operating performance. Applying liquid fuels manufacturing expertise to optimize our low-carbon fuels businesses. Executive COMPENSATION Alignment of Executive Pay with Company Performance and Long-term Stockholder Value Creation Link superior company performance and executive pay. Link ESG and climate-related goals and executive pay. Alignment of interests of executives and stockholders. Balance of compensation over short- and long-term periods. Retention of top executive talent. See page 111 for notes regarding this page and for non-GAAP disclosures.

Valero ESG Report Page 100 Page 102

Valero ESG Report Page 100 Page 102