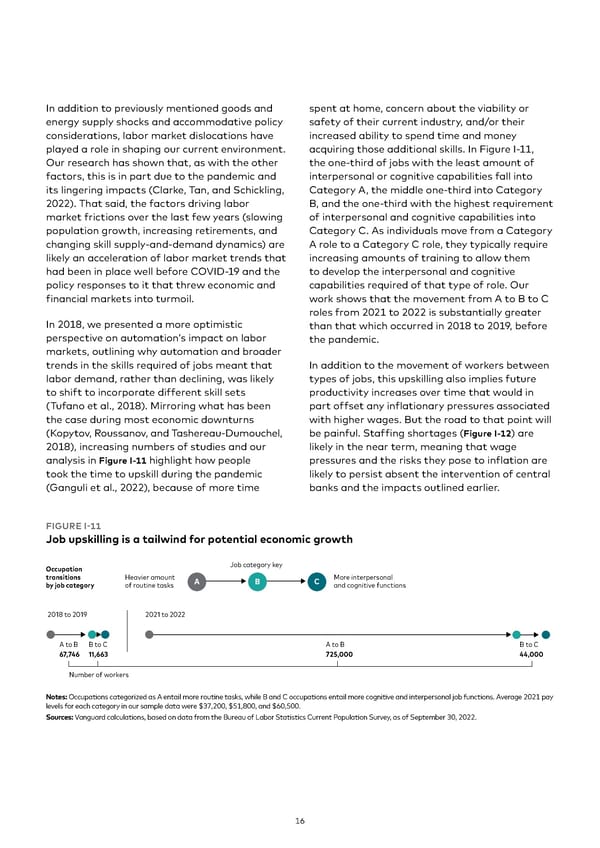

In addition to previously mentioned goods and spent at home, concern about the viability or energy supply shocks and accommodative policy safety of their current industry, and/or their considerations, labor market dislocations have increased ability to spend time and money played a role in shaping our current environment. acquiring those additional skills. In Figure I-11, Our research has shown that, as with the other the one-third of jobs with the least amount of factors, this is in part due to the pandemic and interpersonal or cognitive capabilities fall into its lingering impacts (Clarke, Tan, and Schickling, Category A, the middle one-third into Category 2022). That said, the factors driving labor B, and the one-third with the highest requirement market frictions over the last few years (slowing of interpersonal and cognitive capabilities into population growth, increasing retirements, and Category C. As individuals move from a Category changing skill supply-and-demand dynamics) are A role to a Category C role, they typically require likely an acceleration of labor market trends that increasing amounts of training to allow them had been in place well before COVID-19 and the to develop the interpersonal and cognitive policy responses to it that threw economic and capabilities required of that type of role. Our financial markets into turmoil. work shows that the movement from A to B to C roles from 2021 to 2022 is substantially greater In 2018, we presented a more optimistic than that which occurred in 2018 to 2019, before perspective on automation’s impact on labor the pandemic. markets, outlining why automation and broader trends in the skills required of jobs meant that In addition to the movement of workers between labor demand, rather than declining, was likely types of jobs, this upskilling also implies future to shift to incorporate different skill sets productivity increases over time that would in (Tufano et al., 2018). Mirroring what has been part offset any inflationary pressures associated the case during most economic downturns with higher wages. But the road to that point will (Kopytov, Roussanov, and Tashereau-Dumouchel, be painful. Staffing shortages (Figure I-12) are 2018), increasing numbers of studies and our likely in the near term, meaning that wage analysis in Figure I-11 highlight how people pressures and the risks they pose to inflation are took the time to upskill during the pandemic likely to persist absent the intervention of central (Ganguli et al., 2022), because of more time banks and the impacts outlined earlier. FIGURE I-11 Job upskilling is a tailwind for potential economic growth Occupation Job category key transitions Heavier amount A B C More interersona by job category of routine tasks an cognitive functions 2018 to 2019 2021 to 2022 A to B B to C A to B B to C 67,746 11,663 725,000 44,000 Number of workers Notes: Occupations categorized as A entail more routine tasks, while B and C occupations entail more cognitive and interpersonal job functions. Average 2021 pay levels for each category in our sample data were $37,200, $51,800, and $60,500. Sources: Vanguard calculations, based on data from the Bureau of Labor Statistics Current Population Survey, as of September 30, 2022. 16

Vanguard economic and market outlook for 2023 Page 15 Page 17

Vanguard economic and market outlook for 2023 Page 15 Page 17