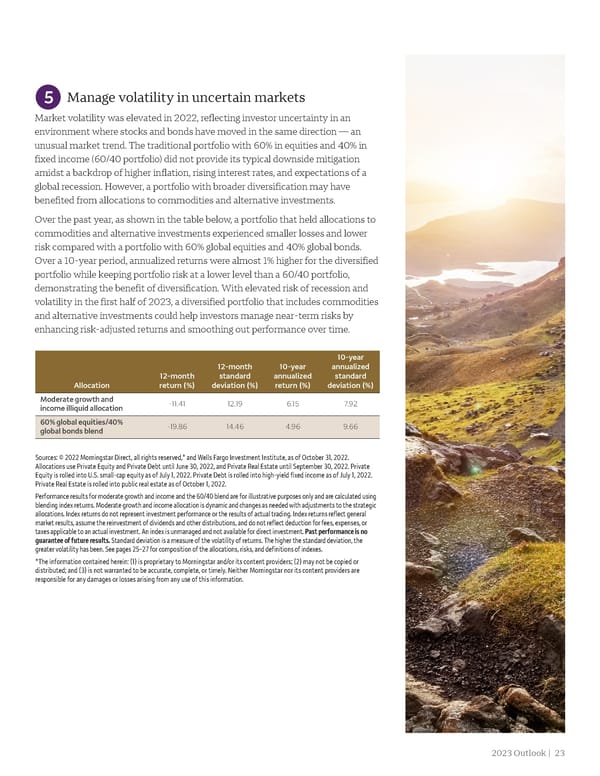

Manage volatility in uncertain markets 5 Market volatility was elevated in 2022, reflecting investor uncertainty in an environment where stocks and bonds have moved in the same direction — an unusual market trend. The traditional portfolio with 60% in equities and 40% in fixed income (60/40 portfolio) did not provide its typical downside mitigation amidst a backdrop of higher inflation, rising interest rates, and expectations of a global recession. However, a portfolio with broader diversification may have benefited from allocations to commodities and alternative investments. Over the past year, as shown in the table below, a portfolio that held allocations to commodities and alternative investments experienced smaller losses and lower risk compared with a portfolio with 60% global equities and 40% global bonds. Over a 10-year period, annualized returns were almost 1% higher for the diversified portfolio while keeping portfolio risk at a lower level than a 60/40 portfolio, demonstrating the benefit of diversification. With elevated risk of recession and volatility in the first half of 2023, a diversified portfolio that includes commodities and alternative investments could help investors manage near-term risks by enhancing risk-adjusted returns and smoothing out performance over time. 10-year 12-month 10-year annualized 12-month standard annualized standard Allocation return (%) deviation (%) return (%) deviation (%) Moderate growth and -11.41 12.19 6.15 7.92 income illiquid allocation 60% global equities/40% -19.86 14.46 4.96 9.66 global bonds blend Sources: © 2022 Morningstar Direct, all rights reserved,* and Wells Fargo Investment Institute, as of October 31, 2022. Allocations use Private Equity and Private Debt until June 30, 2022, and Private Real Estate until September 30, 2022. Private Equity is rolled into U.S. small-cap equity as of July 1, 2022. Private Debt is rolled into high-yield fixed income as of July 1, 2022. Private Real Estate is rolled into public real estate as of October 1, 2022. Performance results for moderate growth and income and the 60/40 blend are for illustrative purposes only and are calculated using blending index returns. Moderate growth and income allocation is dynamic and changes as needed with adjustments to the strategic allocations. Index returns do not represent investment performance or the results of actual trading. Index returns reflect general market results, assume the reinvestment of dividends and other distributions, and do not reflect deduction for fees, expenses, or taxes applicable to an actual investment. An index is unmanaged and not available for direct investment. Past performance is no guarantee of future results. Standard deviation is a measure of the volatility of returns. The higher the standard deviation, the greater volatility has been. See pages 25–27 for composition of the allocations, risks, and definitions of indexes. *The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. 2023 Outlook | 23

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 22 Page 24

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 22 Page 24