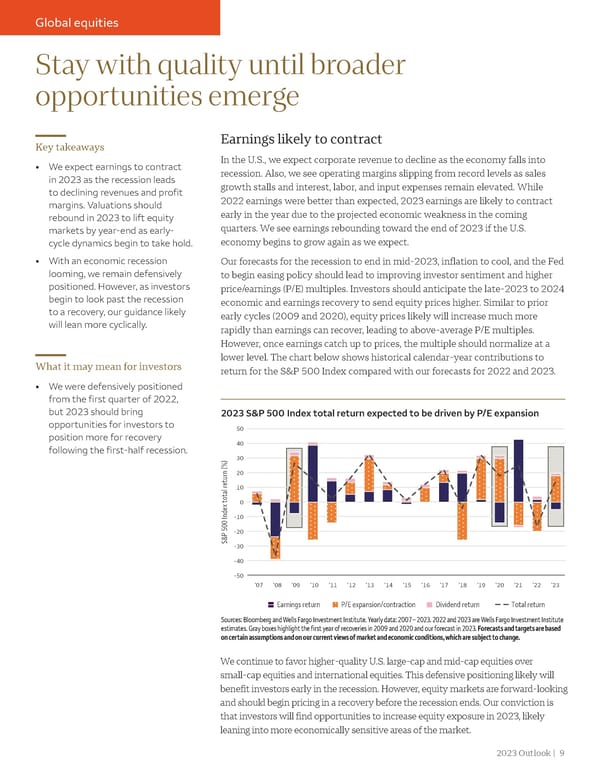

Global equities Stay with quality until broader opportunities emerge Key takeaways Earnings likely to contract • We expect earnings to contract In the U.S., we expect corporate revenue to decline as the economy falls into in 2023 as the recession leads recession. Also, we see operating margins slipping from record levels as sales to declining revenues and profit growth stalls and interest, labor, and input expenses remain elevated. While margins. Valuations should 2022 earnings were better than expected, 2023 earnings are likely to contract rebound in 2023 to lift equity early in the year due to the projected economic weakness in the coming markets by year-end as early- quarters. We see earnings rebounding toward the end of 2023 if the U.S. cycle dynamics begin to take hold. economy begins to grow again as we expect. • With an economic recession Our forecasts for the recession to end in mid-2023, inflation to cool, and the Fed looming, we remain defensively to begin easing policy should lead to improving investor sentiment and higher positioned. However, as investors price/earnings (P/E) multiples. Investors should anticipate the late-2023 to 2024 begin to look past the recession economic and earnings recovery to send equity prices higher. Similar to prior to a recovery, our guidance likely early cycles (2009 and 2020), equity prices likely will increase much more will lean more cyclically. rapidly than earnings can recover, leading to above-average P/E multiples. However, once earnings catch up to prices, the multiple should normalize at a lower level. The chart below shows historical calendar-year contributions to What it may mean for investors return for the S&P 500 Index compared with our forecasts for 2022 and 2023. • We were defensively positioned from the first quarter of 2022, but 2023 should bring 2023 S&P 500 Index total return expected to be driven by P/E expansion opportunities for investors to 50 position more for recovery 40 following the first-half recession. 30 20 10 0 -10 -20 S&P 500 Index total return (%)-30 -40 -50 ’07 ’08 ’09 ’10 ’11 ’12 ’13 ’14 ’15 ’16 ’17 ’18 ’19 ’20 ’21 ’22 ’23 Earnings return P/E expansion/contraction Dividend return Total return Sources: Bloomberg and Wells Fargo Investment Institute. Yearly data: 2007 – 2023. 2022 and 2023 are Wells Fargo Investment Institute estimates. Gray boxes highlight the first year of recoveries in 2009 and 2020 and our forecast in 2023. Forecasts and targets are based on certain assumptions and on our current views of market and economic conditions, which are subject to change. We continue to favor higher-quality U.S. large-cap and mid-cap equities over small-cap equities and international equities. This defensive positioning likely will benefit investors early in the recession. However, equity markets are forward-looking and should begin pricing in a recovery before the recession ends. Our conviction is that investors will find opportunities to increase equity exposure in 2023, likely leaning into more economically sensitive areas of the market. 2023 Outlook | 9

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 8 Page 10

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 8 Page 10