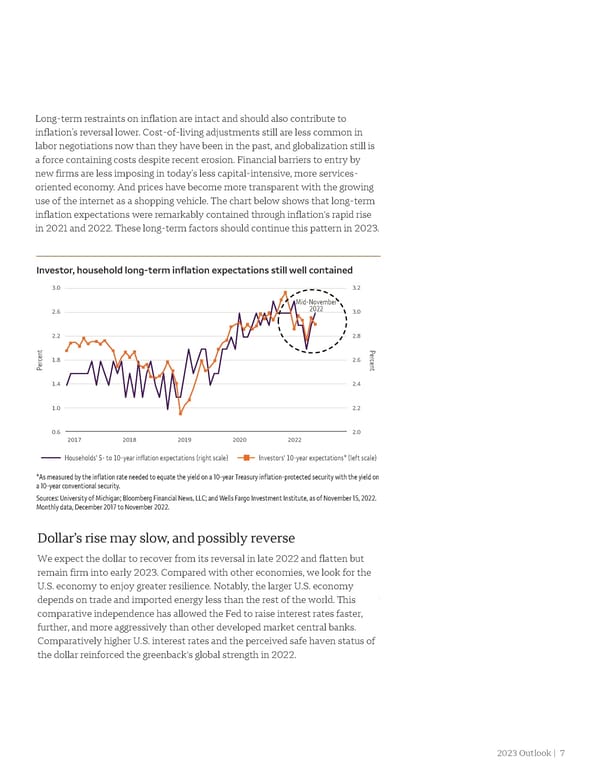

Long-term restraints on inflation are intact and should also contribute to inflation’s reversal lower. Cost-of-living adjustments still are less common in labor negotiations now than they have been in the past, and globalization still is a force containing costs despite recent erosion. Financial barriers to entry by new firms are less imposing in today’s less capital-intensive, more services- oriented economy. And prices have become more transparent with the growing use of the internet as a shopping vehicle. The chart below shows that long-term inflation expectations were remarkably contained through inflation's rapid rise in 2021 and 2022. These long-term factors should continue this pattern in 2023. Investor, household long-term inflation expectations still well contained 3.0 3.2 Mid-November 2.6 2022 3.0 2.2 2.8 Percent 1.8 2.6 Percent 1.4 2.4 1.0 2.2 0.6 2.0 2017 2018 2019 2020 2022 Households' 5- to 10-year inflation expectations (right scale) Investors' 10-year expectations* (left scale) *As measured by the inflation rate needed to equate the yield on a 10-year Treasury inflation-protected security with the yield on a 10-year conventional security. Sources: University of Michigan; Bloomberg Financial News, LLC; and Wells Fargo Investment Institute, as of November 15, 2022. Monthly data, December 2017 to November 2022. Dollar’s rise may slow, and possibly reverse We expect the dollar to recover from its reversal in late 2022 and flatten but remain firm into early 2023. Compared with other economies, we look for the U.S. economy to enjoy greater resilience. Notably, the larger U.S. economy depends on trade and imported energy less than the rest of the world. This comparative independence has allowed the Fed to raise interest rates faster, further, and more aggressively than other developed market central banks. Comparatively higher U.S. interest rates and the perceived safe haven status of the dollar reinforced the greenback's global strength in 2022. 2023 Outlook | 7

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 6 Page 8

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 6 Page 8