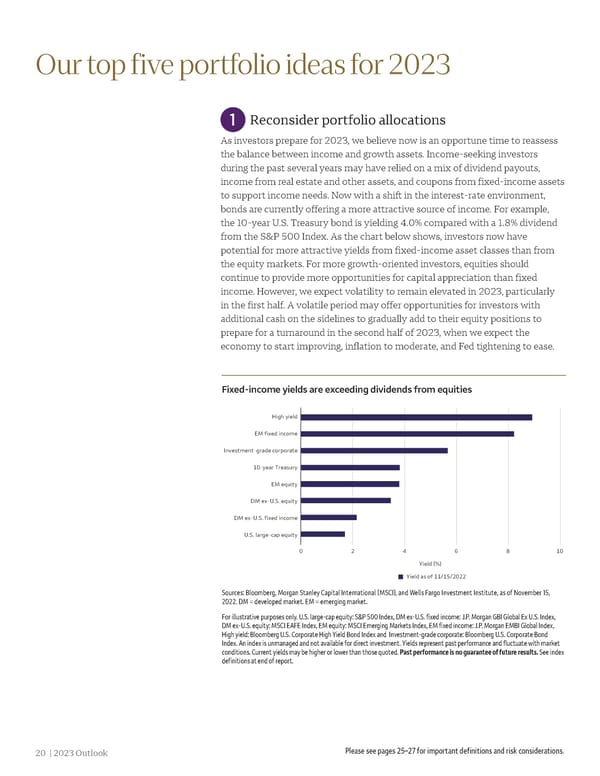

Our top five portfolio ideas for 2023 Reconsider portfolio allocations 1 As investors prepare for 2023, we believe now is an opportune time to reassess the balance between income and growth assets. Income-seeking investors during the past several years may have relied on a mix of dividend payouts, income from real estate and other assets, and coupons from fixed-income assets to support income needs. Now with a shift in the interest-rate environment, bonds are currently offering a more attractive source of income. For example, the 10-year U.S. Treasury bond is yielding 4.0% compared with a 1.8% dividend from the S&P 500 Index. As the chart below shows, investors now have potential for more attractive yields from fixed-income asset classes than from the equity markets. For more growth-oriented investors, equities should continue to provide more opportunities for capital appreciation than fixed income. However, we expect volatility to remain elevated in 2023, particularly in the first half. A volatile period may offer opportunities for investors with additional cash on the sidelines to gradually add to their equity positions to prepare for a turnaround in the second half of 2023, when we expect the economy to start improving, inflation to moderate, and Fed tightening to ease. Fixed-income yields are exceeding dividends from equities High yield EM fixed income Investment-grade corporate 10-year Treasury EM equity DM ex-U.S. equity DM ex-U.S. fixed income U.S. large-cap equity 0 2 4 6 8 10 Yield (%) Yield as of 11/15/2022 Sources: Bloomberg, Morgan Stanley Capital International (MSCI), and Wells Fargo Investment Institute, as of November 15, 2022. DM = developed market. EM = emerging market. For illustrative purposes only. U.S. large-cap equity: S&P 500 Index, DM ex-U.S. fixed income: J.P. Morgan GBI Global Ex U.S. Index, DM ex-U.S. equity: MSCI EAFE Index, EM equity: MSCI Emerging Markets Index, EM fixed income: J.P. Morgan EMBI Global Index, High yield: Bloomberg U.S. Corporate High Yield Bond Index and Investment-grade corporate: Bloomberg U.S. Corporate Bond Index. An index is unmanaged and not available for direct investment. Yields represent past performance and fluctuate with market conditions. Current yields may be higher or lower than those quoted. Past performance is no guarantee of future results. See index definitions at end of report. 20 | 2023 Outlook Please see pages 25–27 for important definitions and risk considerations.

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 19 Page 21

Wells Fargo 2023 Outlook: Recession, Recovery, and Rebound Page 19 Page 21