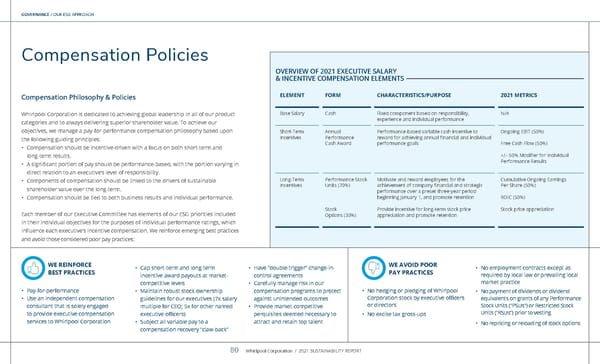

GOVERNANCE / OUR ESG APPROACH Compensation Policies Compensation Philosophy & Policies Whirlpool Corporation is dedicated to achieving global leadership in all of our product categories and to always delivering superior shareholder value. To achieve our objectives, we manage a pay-for-performance compensation philosophy based upon the following guiding principles: • Compensation should be incentive-driven with a focus on both short-term and long-term results. • A significant portion of pay should be performance-based, with the portion varying in direct relation to an executive’s level of responsibility. • Components of compensation should be linked to the drivers of sustainable shareholder value over the long-term. • Compensation should be tied to both business results and individual performance. Each member of our Executive Committee has elements of our ESG priorities included in their individual objectives for the purposes of individual performance ratings, which influence each executive’s incentive compensation. We reinforce emerging best practices and avoid those considered poor pay practices: ELEMENT FORM CHARACTERISTICS/PURPOSE 2021 METRICS Base Salary Cash Fixed component based on responsibility, experience and individual performance N/A Short-Term Incentives Annual Performance Cash Award Performance-based variable cash incentive to reward for achieving annual financial and individual performance goals Ongoing EBIT (50%) Free Cash Flow (50%) +/– 50% Modifier for Individual Performance Results Long-Term Incentives Performance Stock Units (70%) Stock Options (30%) Motivate and reward employees for the achievement of company financial and strategic performance over a preset three-year period beginning January 1, and promote retention Provide incentive for long-term stock price appreciation and promote retention Cumulative Ongoing Earnings Per Share (50%) ROIC (50%) Stock price appreciation OVERVIEW OF 2021 EXECUTIVE SALARY & INCENTIVE COMPENSATION ELEMENTS • Pay-for-performance • Use an independent compensation consultant that is solely engaged to provide executive compensation services to Whirlpool Corporation • Cap short-term and long-term incentive award payouts at market- competitive levels • Maintain robust stock ownership guidelines for our executives (7x salary multiple for CEO; 5x for other named executive officers) • Subject all variable pay to a compensation recovery “claw-back” • Have “double-trigger” change-in- control agreements • Carefully manage risk in our compensation programs to protect against unintended outcomes • Provide market-competitive perquisites deemed necessary to attract and retain top talent WE AVOID POOR PAY PRACTICES • No hedging or pledging of Whirlpool Corporation stock by executive officers or directors • No excise tax gross-ups WE REINFORCE BEST PRACTICES • No employment contracts except as required by local law or prevailing local market practice • No payment of dividends or dividend equivalents on grants of any Performance Stock Units (“PSUs”) or Restricted Stock Units (“RSUs”) prior to vesting • No repricing or reloading of stock options Whirlpool Corporation / 2021 SUSTAINABILITY REPORT 80

Whirlpool Sustainability Report Page 79 Page 81

Whirlpool Sustainability Report Page 79 Page 81