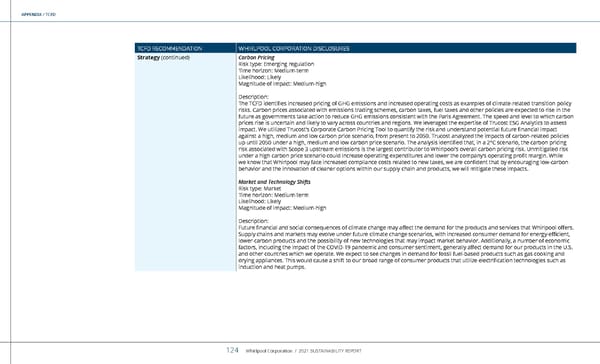

APPENDIX / TCFD TCFD RECOMMENDATION WHIRLPOOL CORPORATION DISCLOSURES Strategy (continued) Carbon Pricing Risk type: Emerging regulation Time horizon: Medium-term Likelihood: Likely Magnitude of impact: Medium-high Description: The TCFD identifies increased pricing of GHG emissions and increased operating costs as examples of climate-related transition policy risks. Carbon prices associated with emissions trading schemes, carbon taxes, fuel taxes and other policies are expected to rise in the future as governments take action to reduce GHG emissions consistent with the Paris Agreement. The speed and level to which carbon prices rise is uncertain and likely to vary across countries and regions. We leveraged the expertise of Trucost ESG Analytics to assess impact. We utilized Trucost’s Corporate Carbon Pricing Tool to quantify the risk and understand potential future financial impact against a high, medium and low carbon price scenario, from present to 2050. Trucost analyzed the impacts of carbon-related policies up until 2050 under a high, medium and low carbon price scenario. The analysis identified that, in a 2°C scenario, the carbon pricing risk associated with Scope 3 upstream emissions is the largest contributor to Whirlpool’s overall carbon pricing risk. Unmitigated risk under a high carbon price scenario could increase operating expenditures and lower the company’s operating profit margin. While we know that Whirlpool may face increased compliance costs related to new taxes, we are confident that by encouraging low-carbon behavior and the innovation of cleaner options within our supply chain and products, we will mitigate these impacts. Market and Technology Shifts Risk type: Market Time horizon: Medium-term Likelihood: Likely Magnitude of impact: Medium-high Description: Future financial and social consequences of climate change may affect the demand for the products and services that Whirlpool offers. Supply chains and markets may evolve under future climate change scenarios, with increased consumer demand for energy-efficient, lower-carbon products and the possibility of new technologies that may impact market behavior. Additionally, a number of economic factors, including the impact of the COVID-19 pandemic and consumer sentiment, generally affect demand for our products in the U.S. and other countries which we operate. We expect to see changes in demand for fossil fuel-based products such as gas cooking and drying appliances. This would cause a shift to our broad range of consumer products that utilize electrification technologies such as induction and heat pumps. Whirlpool Corporation / 2021 SUSTAINABILITY REPORT 124

Whirlpool Sustainability Report Page 123 Page 125

Whirlpool Sustainability Report Page 123 Page 125