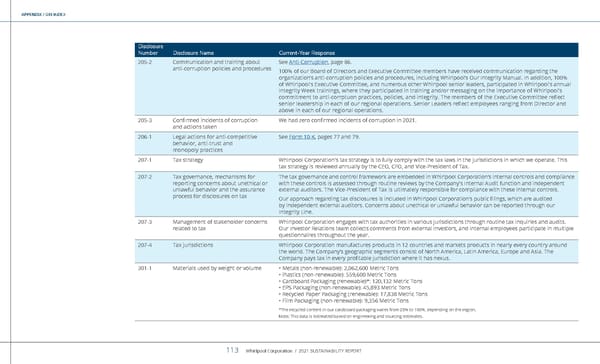

APPENDIX / GRI INDEX Disclosure Number Disclosure Name Current-Year Response 205-2 Communication and training about anti-corruption policies and procedures See Anti-Corruption , page 86. 100% of our Board of Directors and Executive Committee members have received communication regarding the organization’s anti-corruption policies and procedures, including Whirlpool’s Our Integrity Manual. In addition, 100% of Whirlpool's Executive Committee, and numerous other Whirlpool senior leaders, participated in Whirlpool's annual Integrity Week trainings, where they participated in training and/or messaging on the importance of Whirlpool's commitment to anti-corrptuon practices, policies, and integrity. The members of the Executive Committee reflect senior leadership in each of our regional operations. Senior Leaders reflect employees ranging from Director and above in each of our regional operations. 205-3 Confirmed incidents of corruption and actions taken We had zero confirmed incidents of corruption in 2021. 206-1 Legal actions for anti-competitive behavior, anti-trust and monopoly practices See Form 10-K , pages 77 and 79. 207-1 Tax strategy Whirlpool Corporation's tax strategy is to fully comply with the tax laws in the jurisdictions in which we operate. This tax strategy is reviewed annually by the CEO, CFO, and Vice-President of Tax. 207-2 Tax governance, mechanisms for reporting concerns about unethical or unlawful behavior and the assurance process for disclosures on tax The tax governance and control framework are embedded in Whirlpool Corporation’s internal controls and compliance with these controls is assessed through routine reviews by the Company's Internal Audit function and independent external auditors. The Vice-President of Tax is ultimately responsible for compliance with these internal controls. Our approach regarding tax disclosures is included in Whirlpool Corporation’s public filings, which are audited by independent external auditors. Concerns about unethical or unlawful behavior can be reported through our Integrity Line. 207-3 Management of stakeholder concerns related to tax Whirlpool Corporation engages with tax authorities in various jurisdictions through routine tax inquiries and audits. Our Investor Relations team collects comments from external investors, and internal employees participate in multiple questionnaires throughout the year. 207-4 Tax jurisdictions Whirlpool Corporation manufactures products in 12 countries and markets products in nearly every country around the world. The Company’s geographic segments consist of North America, Latin America, Europe and Asia. The Company pays tax in every profitable jurisdiction where it has nexus. 301-1 Materials used by weight or volume • Metals (non-renewable): 2,062,600 Metric Tons • Plastics (non-renewable): 559,600 Metric Tons • Cardboard Packaging (renewable)*: 120,132 Metric Tons • EPS Packaging (non-renewable): 45,893 Metric Tons • Recycled Paper Packaging (renewable): 17,838 Metric Tons • Film Packaging (non-renewable): 9,356 Metric Tons *The recycled content in our cardboard packaging varies from 25% to 100%, depending on the region. Note: This data is estimated based on engineering and sourcing estimates. Whirlpool Corporation / 2021 SUSTAINABILITY REPORT 113

Whirlpool Sustainability Report Page 112 Page 114

Whirlpool Sustainability Report Page 112 Page 114