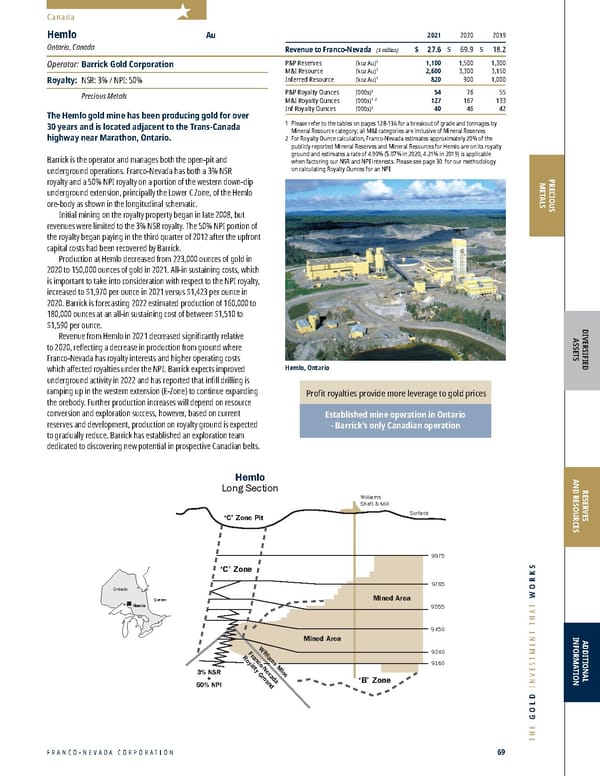

FRANCO-NEVADA CORPORATION 69 THE GOLD INVESTMENT THAT WORKS Hemlo Long Section ‘C’ Zone Pit Williams Shaft & Mill Surface Mined Area 3% NSR + 50% NPI ‘C’ Zone ‘B’ Zone 9975 9765 9555 9450 9240 9160 Mined Area Williams Mine Franco-Nevada Royalty Ground Hemlo Quebec Ontario Canada PRECIOUS METALS DIVERSIFIED ASSETS RESERVES AND RESOURCES ADDITIONAL INFORMATION 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ 27.6 $ 69.9 $ 18.2 P&P Reserves (koz Au) 1 1,100 1,500 1,300 M&I Resource (koz Au) 1 2,600 3,300 3,150 Inferred Resource (koz Au) 1 820 900 1,000 P&P Royalty Ounces (000s) 2 54 76 55 M&I Royalty Ounces (000s) 1, 2 127 167 133 Inf Royalty Ounces (000s) 2 40 46 42 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Ro yalty Ounce calculation, Franco-Nevada estimates approximately 20% of the publicly reported Mineral Reserves and Mineral Resources for Hemlo are on its royalty ground and estimates a rate of 4.90% (5.07% in 2020, 4.21% in 2019) is applicable when factoring our NSR and NPI interests. Please see page 30 for our methodology on calculating Ro yalty Ounces for an NPI Hemlo Au Ontario, Canada Operator: Barrick Gold Corporation Royalty: NSR: 3% / NPI: 50% Precious Metals The Hemlo gold mine has been producing gold for over 30 years and is located adjacent to the Trans-Canada highway near Marathon, Ontario. Barrick is the operator and manages both the open-pit and underground operations. Franco-Nevada has both a 3% NSR royalty and a 50% NPI royalty on a portion of the western down-dip underground extension, principally the Lower C Zone, of the Hemlo ore-body as shown in the longitudinal schematic. Initial mining on the r oyalty property began in late 2008, but revenues were limited to the 3% NSR royalty. The 50% NPI portion of the royalty began paying in the third quarter of 2012 after the upfront capital costs had been recovered by Barrick. Pr oduction at Hemlo decreased from 223,000 ounces of gold in 2020 to 150,000 ounces of gold in 2021. All-in sustaining costs, which is important to take into consideration with respect to the NPI royalty, increased to $1,970 per ounce in 2021 versus $1,423 per ounce in 2020. Barrick is forecasting 2022 estimated production of 160,000 to 180,000 ounces at an all-in sustaining cost of between $1,510 to $1,590 per ounce. Re venue from Hemlo in 2021 decreased significantly relative to 2020, reflecting a decrease in production from ground where Franco-Nevada has royalty interests and higher operating costs which affected royalties under the NPI. Barrick expects improved underground activity in 2022 and has reported that infill drilling is ramping up in the western extension (E-Zone) to continue expanding the orebody. Further production increases will depend on resource conversion and exploration success, however, based on current reserves and development, production on royalty ground is expected to gradually reduce. Barrick has established an exploration team dedicated to discovering new potential in prospective Canadian belts. Profit royalties provide more leverage to gold prices Established mine operation in Ontario - Barrick’s only Canadian operation Hemlo, Ontario

Franco-Nevada 2022 Asset Handbook Page 68 Page 70

Franco-Nevada 2022 Asset Handbook Page 68 Page 70