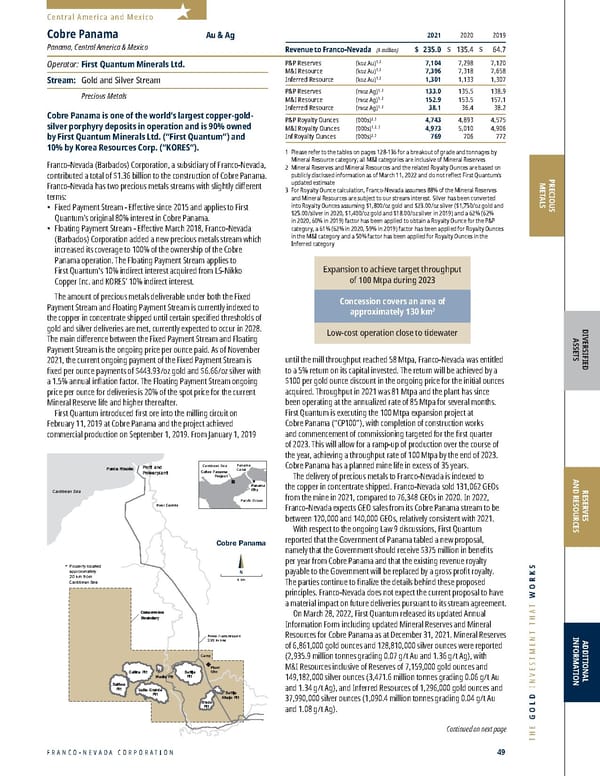

FRANCO-NEVADA CORPORATION 49 THE GOLD INVESTMENT THAT WORKS PRECIOUS METALS Camp Caribbean Sea Punta Rincón River Caimito N 4 km Cobre Panama Plant Site Concession Boundary Power Transmission 230 kv line Property located approximately 20 km from Caribbean Sea * Cobre Panama Project Panama City Panama Canal Pacific Ocean Caribbean Sea Port and Powerplant Balboa Pit Colina Pit Valle Grande Pit Botija Pit Brazo Pit Medio Pit Botija Abajo Pit 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ 235.0 $ 135.4 $ 64.7 P&P Reserves (koz Au) 1, 2 7,104 7,298 7,120 M&I Resource (koz Au) 1, 2 7,396 7,318 7,658 Inferred Resource (koz Au) 1, 2 1,301 1,133 1,307 P&P Reserves (moz Ag) 1, 2 133.0 135.5 138.9 M&I Resource (moz Ag) 1, 2 152.9 153.5 157.1 Inferred Resource (moz Ag) 1, 2 38.1 36.4 38.2 P&P Royalty Ounces (000s) 2, 3 4,743 4,893 4,575 M&I Royalty Ounces (000s) 1, 2, 3 4,973 5,010 4,906 Inf Royalty Ounces (000s) 2, 3 769 706 772 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 Miner al Reserves and Mineral Resources and the related Royalty Ounces are based on publicly disclosed information as of March 11, 2022 and do not reflect First Quantum’s updated estimate 3 For Ro yalty Ounce calculation, Franco-Nevada assumes 88% of the Mineral Reserves and Mineral Resources are subject to our stream interest. Silver has been converted into Royalty Ounces assuming $1,800/oz gold and $23.00/oz silver ($1,750/oz gold and $25.00/silver in 2020, $1,400/oz gold and $18.00/oz silver in 2019) and a 62% (62% in 2020, 60% in 2019) factor has been applied to obtain a Royalty Ounce for the P&P category, a 61% (62% in 2020, 59% in 2019) factor has been applied for Royalty Ounces in the M&I category and a 50% factor has been applied for Royalty Ounces in the Inferred category until the mill throughput reached 58 Mtpa, Franco-Nevada was entitled to a 5% return on its capital invested. The return will be achieved by a $100 per gold ounce discount in the ongoing price for the initial ounces acquired. Throughput in 2021 was 81 Mtpa and the plant has since been operating at the annualized rate of 85 Mtpa for several months. First Quantum is executing the 100 Mtpa expansion project at Cobre Panama (“CP100”), with completion of construction works and commencement of commissioning targeted for the first quarter of 2023. This will allow for a ramp-up of production over the course of the year, achieving a throughput rate of 100 Mtpa by the end of 2023. Cobre Panama has a planned mine life in excess of 35 years. The delivery of pr ecious metals to Franco-Nevada is indexed to the copper in concentrate shipped. Franco-Nevada sold 131,062 GEOs from the mine in 2021, compared to 76,348 GEOs in 2020. In 2022, Franco-Nevada expects GEO sales from its Cobre Panama stream to be between 120,000 and 140,000 GEOs, relatively consistent with 2021. With r espect to the ongoing Law 9 discussions, First Quantum reported that the Government of Panama tabled a new proposal, namely that the Government should receive $375 million in benefits per year from Cobre Panama and that the existing revenue royalty payable to the Government will be replaced by a gross profit royalty. The parties continue to finalize the details behind these proposed principles. Franco-Nevada does not expect the current proposal to have a material impact on future deliveries pursuant to its stream agreement. On Mar ch 28, 2022, First Quantum released its updated Annual Information Form including updated Mineral Reserves and Mineral Resources for Cobre Panama as at December 31, 2021. Mineral Reserves of 6,861,000 gold ounces and 128,810,000 silver ounces were reported (2,935.9 million tonnes grading 0.07 g/t Au and 1.36 g/t Ag), with M&I Resources inclusive of Reserves of 7,159,000 gold ounces and 149,182,000 silver ounces (3,471.6 million tonnes grading 0.06 g/t Au and 1.34 g/t Ag), and Inferred Resources of 1,296,000 gold ounces and 37,990,000 silver ounces (1,090.4 million tonnes grading 0.04 g/t Au and 1.08 g/t Ag). Continued on next page DIVERSIFIED ASSETS RESERVES AND RESOURCES ADDITIONAL INFORMATION Cobre Panama Au & Ag Panama, Central America & Mexico Operator: First Quantum Minerals Ltd. Stream: Gold and Silver Stream Precious Metals Cobre Panama is one of the world’s largest copper-gold- silver porphyry deposits in operation and is 90% owned by First Quantum Minerals Ltd. (“First Quantum”) and 10% by Korea Resources Corp. (“KORES”). Franco-Nevada (Barbados) Corporation, a subsidiary of Franco-Nevada, contributed a total of $1.36 billion to the construction of Cobr e Panama. Franco-Nevada has two precious metals streams with slightly different terms: • Fix ed Payment Stream - Effective since 2015 and applies to First Quantum’s original 80% interest in Cobre Panama. • Floating Payment Str eam - Effective March 2018, Franco-Nevada (Barbados) Corporation added a new precious metals stream which increased its coverage to 100% of the ownership of the Cobre Panama operation. The Floating Payment Stream applies to First Quantum 's 10% indirect interest acquired from LS-Nikko Copper Inc. and KORES’ 10% indirect interest. The amount of pr ecious metals deliverable under both the Fixed Payment Stream and Floating Payment Stream is currently indexed to the copper in concentrate shipped until certain specified thresholds of gold and silver deliveries are met, currently expected to occur in 2028. The main difference between the Fixed Payment Stream and Floating Payment Stream is the ongoing price per ounce paid. As of November 2021, the current ongoing payment of the Fixed Payment Stream is fixed per ounce payments of $443.93/oz gold and $6.66/oz silver with a 1.5% annual inflation factor. The Floating Payment Stream ongoing price per ounce for deliveries is 20% of the spot price for the curr ent Mineral Reserve life and higher thereafter. First Quantum intr oduced first ore into the milling circuit on February 11, 2019 at Cobre Panama and the project achieved commercial production on September 1, 2019. From January 1, 2019 Expansion to achieve target throughput of 100 Mtpa during 2023 Concession covers an area of approximately 130 km 2 Low-cost operation close to tidewater Central America and Mexico Millmerran Red October Henty Mt Keith Duketon Yandal (Bronzewing/Julius) King Vol Bowen Basin South Kalgoorlie (Mt Martin) Flying Fox Australia Subika (Ahafo) Tasiast Sabodala Edikan MWS Perama Hill Kiziltepe Karma Sissingue Pandora Franco-Nevada Australia Office Agate Creek White Dam Séguéla Edna May Higginsville (Lake Cowan) Aphrodite Matilda (Wiluna) Agnew (Vivien) South Kalgoorlie (New Celebration/ Mt Marion Lithium) Cue Gold (Day Dawn) Agi Dagi ̆ ̆ Producing Advanced Producing (Energy) Cobre Panama Guadalupe-Palmarejo Producing

Franco-Nevada 2022 Asset Handbook Page 48 Page 50

Franco-Nevada 2022 Asset Handbook Page 48 Page 50