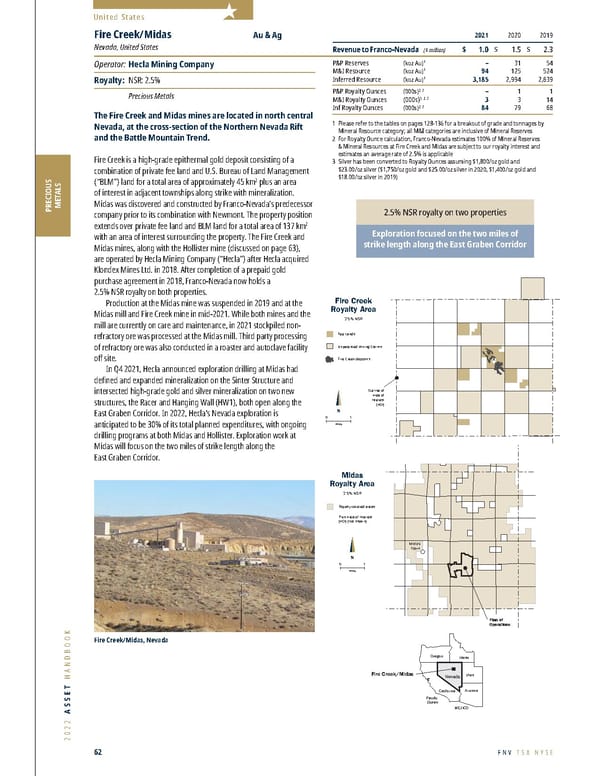

2022 ASSET HANDBOOK 62 FNV TSX NYSE United States PRECIOUS METALS 2.5% NSR royalty on two properties Exploration focused on the two miles of strike length along the East Graben Corridor 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ 1.0 $ 1.5 $ 2.3 P&P Reserves (koz Au) 1 – 31 54 M&I Resource (koz Au) 1 94 125 524 Inferred Resource (koz Au) 1 3,185 2,994 2,639 P&P Royalty Ounces (000s) 2, 3 – 1 1 M&I Royalty Ounces (000s) 1, 2, 3 3 3 14 Inf Royalty Ounces (000s) 2, 3 84 79 68 Fire Creek/Midas Au & Ag Nevada, United States Operator: Hecla Mining Company Royalty: NSR: 2.5% Precious Metals The Fire Creek and Midas mines are located in north central Nevada, at the cross-section of the Northern Nevada Rift and the Battle Mountain Trend. Fire Creek is a high-grade epithermal gold deposit consisting of a combination of private fee land and U.S. Bureau of Land Management (“BLM”) land for a total area of approximately 45 km 2 plus an area of interest in adjacent townships along strike with mineralization. Midas was discovered and constructed by Franco-Nevada’s predecessor company prior to its combination with Newmont. The property position extends over private fee land and BLM land for a total area of 137 km 2 with an area of interest surrounding the property. The Fire Creek and Midas mines, along with the Hollister mine (discussed on page 63), are operated by Hecla Mining Company (“Hecla”) after Hecla acquired Klondex Mines Ltd. in 2018. After completion of a prepaid gold purchase agreement in 2018, Franco-Nevada now holds a 2.5% NSR royalty on both properties. Pr oduction at the Midas mine was suspended in 2019 and at the Midas mill and Fire Creek mine in mid-2021. While both mines and the mill are currently on care and maintenance, in 2021 stockpiled non- refractory ore was processed at the Midas mill. Third party processing of refractory ore was also conducted in a roaster and autoclave facility off site. In Q4 2021, Hecla announced e xploration drilling at Midas had defined and expanded mineralization on the Sinter Structure and intersected high-grade gold and silver mineralization on two new structures, the Racer and Hanging Wall (HW1), both open along the East Graben Corridor. In 2022, Hecla's Nevada exploration is anticipated to be 30% of its total planned expenditures, with ongoing drilling programs at both Midas and Hollister. Exploration work at Midas will focus on the two miles of strike length along the East Graben Corridor. N Miles 0 1 Fire Creek Royalty Area 2.5% NSR Fee Lands Unpatented Mining Claims Fire Creek deposits Outline of Area of Interest (AOI) Plan of Operations N Miles 0 1 Midas Town Midas Royalty Area 2.5% NSR Royalty covered areas Plus Area of Interest (AOI) (not shown) Fire Creek/Midas Pacific Ocean Oregon Idaho Utah Nevada California Arizona MEXICO 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Ro yalty Ounce calculation, Franco-Nevada estimates 100% of Mineral Reserves & Mineral Resources at Fire Creek and Midas are subject to our royalty interest and estimates an average rate of 2.5% is applicable 3 Silver has been converted to Ro yalty Ounces assuming $1,800/oz gold and $23.00/oz silver ($1,750/oz gold and $25.00/oz silver in 2020, $1,400/oz gold and $18.00/oz silver in 2019) Fire Creek/Midas, Nevada

Franco-Nevada 2022 Asset Handbook Page 61 Page 63

Franco-Nevada 2022 Asset Handbook Page 61 Page 63