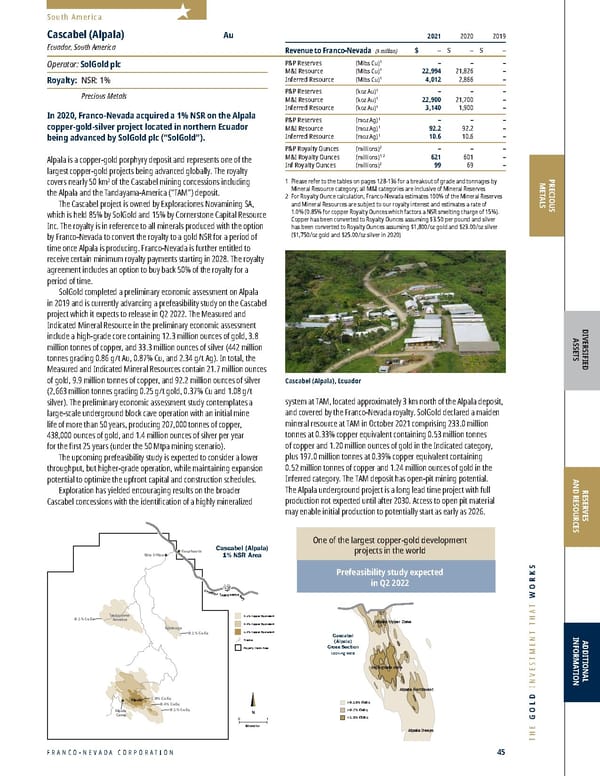

FRANCO-NEVADA CORPORATION 45 THE GOLD INVESTMENT THAT WORKS In 2020, Franco-Nevada acquired a 1% NSR on the Alpala copper-gold-silver project located in northern Ecuador being advanced by SolGold plc (“SolGold”). Alpala is a copper-gold porphyry deposit and represents one of the largest copper-gold projects being advanced globally. The royalty covers nearly 50 km 2 of the Cascabel mining concessions including the Alpala and the Tandayama-America (“TAM”) deposit. The Cascabel pr oject is owned by Exploraciones Novamining SA, which is held 85% by SolGold and 15% by Cornerstone Capital Resource Inc. The royalty is in reference to all minerals produced with the option by Franco-Nevada to convert the royalty to a gold NSR for a period of time once Alpala is producing. Franco-Nevada is further entitled to receive certain minimum royalty payments starting in 2028. The royalty agreement includes an option to buy back 50% of the royalty for a period of time. SolGold completed a pr eliminary economic assessment on Alpala in 2019 and is currently advancing a prefeasibility study on the Cascabel project which it expects to release in Q2 2022. The Measured and Indicated Mineral Resource in the preliminary economic assessment include a high-grade core containing 12.3 million ounces of gold, 3.8 million tonnes of copper, and 33.3 million ounces of silver (442 million tonnes grading 0.86 g/t Au, 0.87% Cu, and 2.34 g/t Ag). In total, the Measured and Indicated Mineral Resources contain 21.7 million ounces of gold, 9.9 million tonnes of copper, and 92.2 million ounces of silver (2,663 million tonnes grading 0.25 g/t gold, 0.37% Cu and 1.08 g/t silver). The preliminary economic assessment study contemplates a large-scale underground block cave operation with an initial mine life of more than 50 years, producing 207,000 tonnes of copper, 438,000 ounces of gold, and 1.4 million ounces of silver per year for the first 25 years (under the 50 Mtpa mining scenario). The upcoming pr efeasibility study is expected to consider a lower throughput, but higher-grade operation, while maintaining expansion potential to optimize the upfront capital and construction schedules. Explor ation has yielded encouraging results on the broader Cascabel concessions with the identification of a highly mineralized 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ – $ – $ – P&P Reserves (Mlbs Cu) 1 – – – M&I Resource (Mlbs Cu) 1 22,994 21,826 – Inferred Resource (Mlbs Cu) 1 4,012 2,866 – P&P Reserves (koz Au) 1 – – – M&I Resource (koz Au) 1 22,900 21,700 – Inferred Resource (koz Au) 1 3,140 1,900 – P&P Reserves (moz Ag) 1 – – – M&I Resource (moz Ag) 1 92.2 92.2 – Inferred Resource (moz Ag) 1 10.6 10.6 – P&P Royalty Ounces (millions) 2 – – – M&I Royalty Ounces (millions) 1, 2 621 601 – Inf Royalty Ounces (millions) 2 99 69 – 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Ro yalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Reserves and Mineral Resources are subject to our royalty interest and estimates a rate of 1.0% (0.85% for copper Royalty Ounces which factors a NSR smelting charge of 15%). Copper has been converted to Royalty Ounces assuming $3.50 per pound and silver has been converted to Royalty Ounces assuming $1,800/oz gold and $23.00/oz silver ($1,750/oz gold and $25.00/oz silver in 2020) Cascabel (Alpala) Au Ecuador, South America Operator: SolGold plc Royalty: NSR: 1% Precious Metals South America PRECIOUS METALS DIVERSIFIED ASSETS RESERVES AND RESOURCES ADDITIONAL INFORMATION system at TAM, located approximately 3 km north of the Alpala deposit, and covered by the Franco-Nevada royalty. SolGold declared a maiden mineral resource at TAM in October 2021 comprising 233.0 million tonnes at 0.33% copper equivalent containing 0.53 million tonnes of copper and 1.20 million ounces of gold in the Indicated category , plus 197.0 million tonnes at 0.39% copper equivalent containing 0.52 million tonnes of copper and 1.24 million ounces of gold in the Inferred category. The TAM deposit has open-pit mining potential. The Alpala underground project is a long lead time project with full production not expected until after 2030. Access to open pit material may enable initial production to potentially start as early as 2026. Cascabel (Alpala), Ecuador One of the largest copper-gold development projects in the world Prefeasibility study expected in Q2 2022 Alpala Northwest High-grade core Alpala Upper Zone Alpala Deeps >0.15% CuEq >0.7% CuEq >1.5% CUEq Cascabel (Alpala) Cross Section Looking West N 0 1 Kilometer Hwy Transverse Frontier 0.1% Copper Equivalent 0.4% Copper Equivalent 1.0% Copper Equivalent Tracks Royalty Claim Area Alpala Rocafuerte Alpala Camp Tandayama America Aguinaga 1.0% CuEq 0.1% CuEq 0.4% CuEq 0.1% CuEq 0.1% CuEq Site Office Cascabel (Alpala) 1% NSR Area

Franco-Nevada 2022 Asset Handbook Page 44 Page 46

Franco-Nevada 2022 Asset Handbook Page 44 Page 46