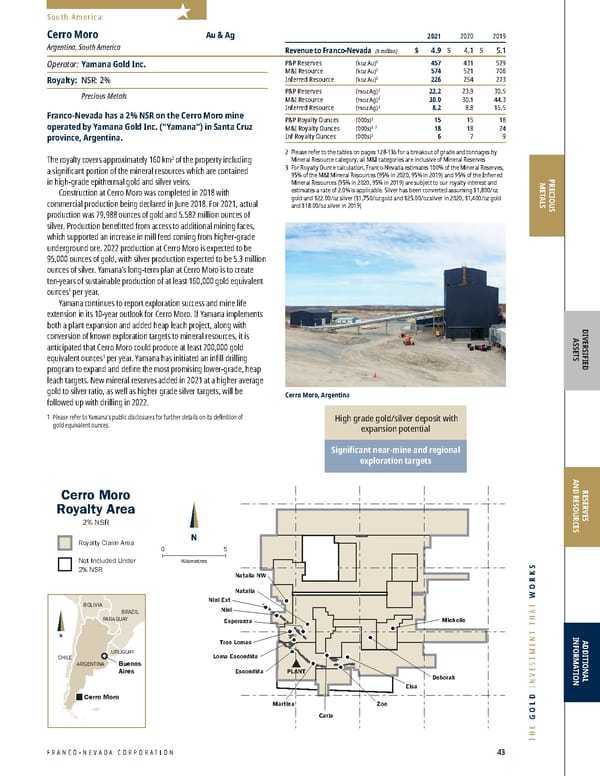

FRANCO-NEVADA CORPORATION 43 THE GOLD INVESTMENT THAT WORKS Cerro Moro Royalty Area 2% NSR Royalty Claim Area Not Included Under 2% NSR N Kilometres 0 5 Michelle Zoe Deborah Martina Tres Lomas Esperanza Loma Escondida N Buenos Aires Cerro Moro CHILE ARGENTINA BRAZIL BOLIVIA URUGUAY PARAGUAY Carla Elsa Escondida Nini Nini Ext Natalia Natalia NW PLANT Franco-Nevada has a 2% NSR on the Cerro Moro mine operated by Yamana Gold Inc. (“Yamana”) in Santa Cruz province, Argentina. The royalty covers approximately 160 km 2 of the property including a significant portion of the mineral resources which are contained in high-grade epithermal gold and silver veins. Construction at Cerr o Moro was completed in 2018 with commercial production being declared in June 2018. For 2021, actual production was 79,988 ounces of gold and 5.582 million ounces of silver. Production benefitted from access to additional mining faces, which supported an increase in mill feed coming from higher-grade underground ore. 2022 production at Cerro Moro is expected to be 95,000 ounces of gold, with silver production expected to be 5.3 million ounces of silver. Yamana’s long-term plan at Cerro Moro is to create ten-years of sustainable production of at least 160,000 gold equivalent ounces 1 per year. Y amana continues to report exploration success and mine life extension in its 10-year outlook for Cerro Moro. If Yamana implements both a plant expansion and added heap leach project, along with conversion of known exploration targets to mineral resources, it is anticipated that Cerro Moro could produce at least 200,000 gold equivalent ounces 1 per year. Yamana has initiated an infill drilling program to expand and define the most promising lower-grade, heap leach targets. New mineral reserves added in 2021 at a higher average gold to silver ratio, as well as higher grade silver targets, will be followed up with drilling in 2022. 1 Please r efer to Yamana’s public disclosures for further details on its definition of gold equivalent ounces. 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ 4.9 $ 4.1 $ 5.1 P&P Reserves (koz Au) 2 457 431 529 M&I Resource (koz Au) 2 574 521 706 Inferred Resource (koz Au) 2 226 254 273 P&P Reserves (moz Ag) 2 22.2 23.9 30.5 M&I Resource (moz Ag) 2 30.0 30.1 44.3 Inferred Resource (moz Ag) 2 8.2 8.8 15.5 P&P Royalty Ounces (000s) 3 15 15 18 M&I Royalty Ounces (000s) 2, 3 18 18 24 Inf Royalty Ounces (000s) 3 6 7 9 2 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 3 For Ro yalty Ounce calculation, Franco-Nevada estimates 100% of the Mineral Reserves, 95% of the M&I Mineral Resources (95% in 2020, 95% in 2019) and 95% of the Inferred Mineral Resources (95% in 2020, 95% in 2019) are subject to our royalty interest and estimates a rate of 2.0% is applicable. Silver has been converted assuming $1,800/oz gold and $22.00/oz silver ($1,750/oz gold and $25.00/oz silver in 2020, $1,400/oz gold and $18.00/oz silver in 2019) Cerro Moro Au & Ag Argentina, South America Operator: Yamana Gold Inc. Royalty: NSR: 2% Precious Metals South America PRECIOUS METALS DIVERSIFIED ASSETS RESERVES AND RESOURCES ADDITIONAL INFORMATION High grade gold/silver deposit with expansion potential Significant near-mine and regional exploration targets Cerro Moro, Argentina

Franco-Nevada 2022 Asset Handbook Page 42 Page 44

Franco-Nevada 2022 Asset Handbook Page 42 Page 44