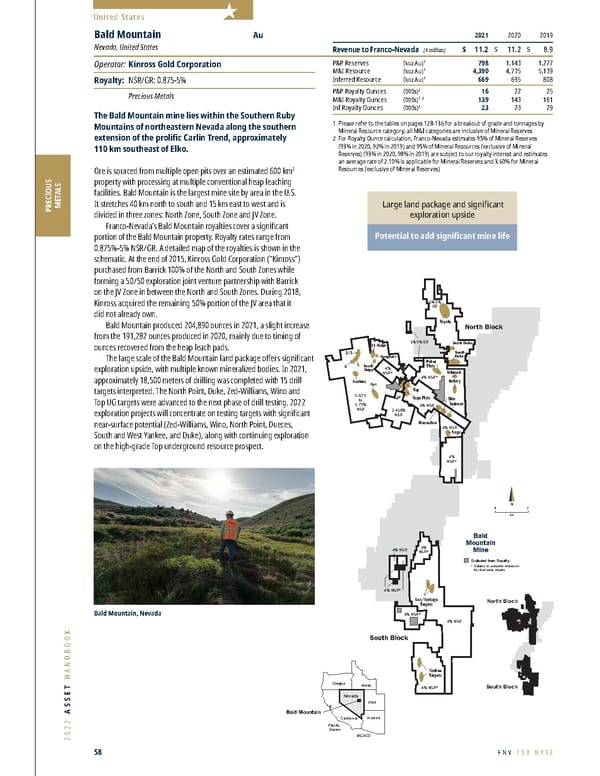

2022 ASSET HANDBOOK 58 FNV TSX NYSE Bald Mountain Mine North Block South Block Excluded from Royalty * Subject to possible reduction by third-party royalty Galaxy Poker Flats Bida Saga Yankee Targets Lux/Vantage Targets Top Sage Flats Belmont Horseshoe 4% NSR 4% NSR 4% NSR 4% NSR 4% NSR* 4% NSR* 4% NSR* 4% NSR* 4% NSR* 4% NSR* 4% NSR* 0.875 to 1.75% NSR 2.418% NSR Royale 1%-5% GR Redbird 5 1 LJ Ridge Banghart South Ridge Rat North Duke South Duke 2/3 1%-5% GR Winrock N Km 0 2 North Block South Block Bald Mountain Mine North Block South Block Excluded from Royalty * Subject to possible reduction by third-party royalty Galaxy Poker Flats Bida Saga Yankee Targets Lux/Vantage Targets Top Sage Flats Belmont Horseshoe 4% NSR 4% NSR 4% NSR 4% NSR 4% NSR* 4% NSR* 4% NSR* 4% NSR* 4% NSR* 4% NSR* 4% NSR* 0.875 to 1.75% NSR 2.418% NSR Royale 1%-5% GR Redbird 5 1 LJ Ridge Banghart South Ridge Rat North Duke South Duke 2/3 1%-5% GR Winrock N Km 0 2 North Block South Block Bald Mountain Pacific Ocean Oregon Idaho Utah Nevada California Arizona MEXICO United States PRECIOUS METALS 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ 11.2 $ 11.2 $ 8.9 P&P Reserves (koz Au) 1 798 1,143 1,277 M&I Resource (koz Au) 1 4,390 4,735 5,139 Inferred Resource (koz Au) 1 669 695 808 P&P Royalty Ounces (000s) 2 16 22 25 M&I Royalty Ounces (000s) 1, 2 139 143 161 Inf Royalty Ounces (000s) 2 23 23 29 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Ro yalty Ounce calculation, Franco-Nevada estimates 95% of Mineral Reserves (93% in 2020, 92% in 2019) and 95% of Mineral Resources (exclusive of Mineral Reserves) (93% in 2020, 98% in 2019) are subject to our royalty interest and estimates an average rate of 2.10% is applicable for Mineral Reserves and 3.60% for Mineral Resources (exclusive of Mineral Reserves) Bald Mountain Au Nevada, United States Operator: Kinross Gold Corporation Royalty: NSR/GR: 0.875-5% Precious Metals The Bald Mountain mine lies within the Southern Ruby Mountains of northeastern Nevada along the southern extension of the prolific Carlin Trend, approximately 110 km southeast of Elko. Ore is sourced from multiple open pits over an estimated 600 km 2 property with processing at multiple conventional heap leaching facilities. Bald Mountain is the largest mine site by area in the U.S. It stretches 40 km north to south and 15 km east to west and is divided in three zones: North Zone, South Zone and JV Zone. Fr anco-Nevada’s Bald Mountain royalties cover a significant portion of the Bald Mountain property. Royalty rates range from 0.875%-5% NSR/GR. A detailed map of the royalties is shown in the schematic. At the end of 2015, Kinross Gold Corporation (“Kinross”) purchased from Barrick 100% of the North and South Zones while forming a 50/50 exploration joint venture partnership with Barrick on the JV Zone in between the North and South Zones. During 2018, Kinross acquired the remaining 50% portion of the JV area that it did not already own. Bald Mountain pr oduced 204,890 ounces in 2021, a slight increase from the 191,282 ounces produced in 2020, mainly due to timing of ounces recovered from the heap leach pads. The lar ge scale of the Bald Mountain land package offers significant exploration upside, with multiple known mineralized bodies. In 2021, approximately 18,500 meters of drilling was completed with 15 drill targets interpreted. The North Point, Duke, Zed-Williams, Wino and Top UG targets were advanced to the next phase of drill testing. 2022 exploration projects will concentrate on testing targets with significant near-surface potential (Zed-Williams, Wino, North Point, Dueces, South and West Yankee, and Duke), along with continuing exploration on the high-grade Top underground resource prospect. Large land package and significant exploration upside Potential to add significant mine life Bald Mountain, Nevada

Franco-Nevada 2022 Asset Handbook Page 57 Page 59

Franco-Nevada 2022 Asset Handbook Page 57 Page 59