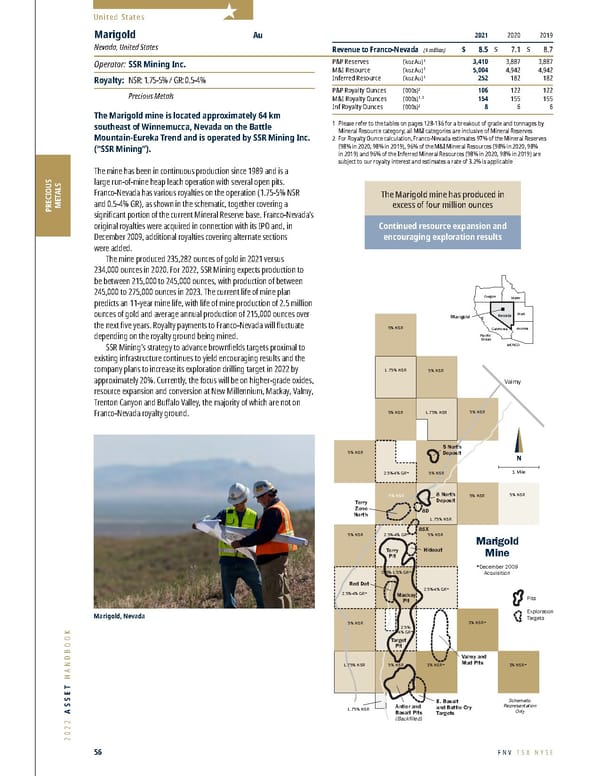

2022 ASSET HANDBOOK 56 FNV TSX NYSE United States PRECIOUS METALS 2021 2020 2019 Revenue to Franco-Nevada ($ million) $ 8.5 $ 7.1 $ 8.7 P&P Reserves (koz Au) 1 3,410 3,887 3,887 M&I Resource (koz Au) 1 5,004 4,942 4,942 Inferred Resource (koz Au) 1 252 182 182 P&P Royalty Ounces (000s) 2 106 122 122 M&I Royalty Ounces (000s) 1, 2 154 155 155 Inf Royalty Ounces (000s) 2 8 6 6 1 Please r efer to the tables on pages 128-136 for a breakout of grade and tonnages by Mineral Resource category; all M&I categories are inclusive of Mineral Reserves 2 For Ro yalty Ounce calculation, Franco-Nevada estimates 97% of the Mineral Reserves (98% in 2020, 98% in 2019), 96% of the M&I Mineral Resources (98% in 2020, 98% in 2019) and 96% of the Inferred Mineral Resources (98% in 2020, 98% in 2019) are subject to our royalty interest and estimates a rate of 3.2% is applicable Marigold Au Nevada, United States Operator: SSR Mining Inc. Royalty: NSR: 1.75-5% / GR: 0.5-4% Precious Metals The Marigold mine is located approximately 64 km southeast of Winnemucca, Nevada on the Battle Mountain-Eureka Trend and is operated by SSR Mining Inc. (“SSR Mining”). The mine has been in continuous production since 1989 and is a large run-of-mine heap leach operation with several open pits. Franco-Nevada has various royalties on the operation (1.75-5% NSR and 0.5-4% GR), as shown in the schematic, together covering a significant portion of the current Mineral Reserve base. Franco-Nevada’s original royalties were acquired in connection with its IPO and, in December 2009, additional royalties covering alternate sections were added. The mine pr oduced 235,282 ounces of gold in 2021 versus 234,000 ounces in 2020. For 2022, SSR Mining expects production to be between 215,000 to 245,000 ounces, with production of between 245,000 to 275,000 ounces in 2023. The current life of mine plan predicts an 11-year mine life, with life of mine production of 2.5 million ounces of gold and average annual production of 215,000 ounces over the next five years. Royalty payments to Franco-Nevada will fluctuate depending on the royalty ground being mined. SSR Mining’ s strategy to advance brownfields targets proximal to existing infrastructure continues to yield encouraging results and the company plans to increase its exploration drilling target in 2022 by approximately 20%. Currently, the focus will be on higher-grade oxides, resource expansion and conversion at New Millennium, Mackay, Valmy, Trenton Canyon and Buffalo Valley, the majority of which are not on Franco-Nevada royalty ground. The Marigold mine has produced in excess of four million ounces Continued resource expansion and encouraging exploration results N Valmy 5 North Deposit 8 North Deposit Terr y Pit Target Pit E. Basalt and Battle Cry Targets Antler and Basalt Pits (Backfilled) Marigold Mine Terr y Zone North 1.75% NSR 1.75% NSR 1.75% NSR 1.75% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 3% NSR* 3% NSR* 3% NSR* 2.5%-4% GR* 2.5%-4% GR* 2.5%-4% GR* 2.5%-4% GR* 2.5%- 4% GR* 5% NSR 1.75% NSR *December 2009 Acquisition Schematic Representation Only 1 Mile 0.5%-1.5% GR* Mackay Pit Valmy and Mud Pits Hideout 8D 8SX Pits Exploration Targets N Valmy 5 North Deposit 8 North Deposit Terr y Pit Target Pit E. Basalt and Battle Cry Targets Antler and Basalt Pits (Backfilled) Marigold Mine Terr y Zone North 1.75% NSR 1.75% NSR 1.75% NSR 1.75% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 5% NSR 3% NSR* 3% NSR* 3% NSR* 2.5%-4% GR* 2.5%-4% GR* 2.5%-4% GR* 2.5%-4% GR* 2.5%- 4% GR* 5% NSR 1.75% NSR *December 2009 Acquisition Schematic Representation Only 1 Mile 0.5%-1.5% GR* Mackay Pit Valmy and Mud Pits Hideout 8D 8SX Pits Exploration Targets Red Dot Red Dot Marigold Pacific Ocean Oregon Idaho Utah Nevada California Arizona MEXICO Marigold, Nevada

Franco-Nevada 2022 Asset Handbook Page 55 Page 57

Franco-Nevada 2022 Asset Handbook Page 55 Page 57