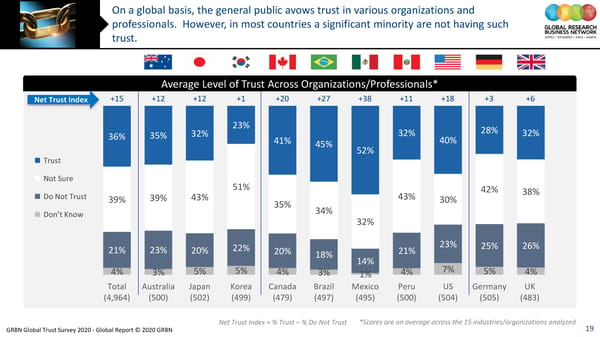

On a global basis, the general public avows trust in various organizations and professionals. However, in most countries a significant minority are not having such trust. Average Level of Trust Across Organizations/Professionals* Net Trust Index +15 +12 +12 +1 +20 +27 +38 +11 +18 +3 +6 32% 23% 32% 28% 32% 36% 35% 41% 45% 40% 52% Trust Not Sure 51% Do Not Trust 39% 43% 43% 42% 38% 39% 35% 30% Don’t Know 34% 32% 21% 23% 20% 22% 20% 21% 23% 25% 26% 18% 14% 4% 3% 5% 5% 4% 3% 1% 4% 7% 5% 4% Total Australia Japan Korea Canada Brazil Mexico Peru US Germany UK (4,964) (500) (502) (499) (479) (497) (495) (500) (504) (505) (483) Net Trust Index = % Trust – % Do Not Trust *Scores are an average across the 15 industries/organizations analyzed GRBN Global Trust Survey 2020 - Global Report © 2020 GRBN 19

GRBN Global Trust Survey 2020 - Global Report © 2020 GRBN Page 18 Page 20

GRBN Global Trust Survey 2020 - Global Report © 2020 GRBN Page 18 Page 20