MA PFML Filing Process

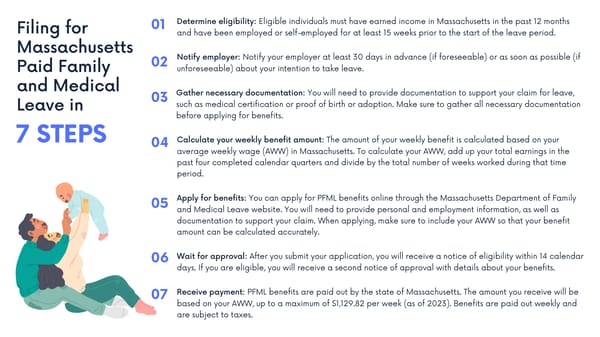

Determine eligibility: Eligible individuals must have earned income in Massachusetts in the past 12 months 01 Filing for and have been employed or self-employed for at least 15 weeks prior to the start of the leave period. Massachusetts Notify employer: Notify your employer at least 30 days in advance (if foreseeable) or as soon as possible (if 02 unforeseeable) about your intention to take leave. Paid Family and Medical Gather necessary documentation: You will need to provide documentation to support your claim for leave, 03 such as medical certification or proof of birth or adoption. Make sure to gather all necessary documentation Leave in before applying for benefits. 7 STEPS Calculate your weekly benefit amount: The amount of your weekly benefit is calculated based on your 04 average weekly wage (AWW) in Massachusetts. To calculate your AWW, add up your total earnings in the past four completed calendar quarters and divide by the total number of weeks worked during that time period. Apply for benefits: You can apply for PFML benefits online through the Massachusetts Department of Family 05 and Medical Leave website. You will need to provide personal and employment information, as well as documentation to support your claim. When applying, make sure to include your AWW so that your benefit amount can be calculated accurately. Wait for approval: After you submit your application, you will receive a notice of eligibility within 14 calendar 06 days. If you are eligible, you will receive a second notice of approval with details about your benefits. Receive payment: PFML benefits are paid out by the state of Massachusetts. The amount you receive will be 07 based on your AWW, up to a maximum of $1,129.82 per week (as of 2023). Benefits are paid out weekly and are subject to taxes.

MA PFML Filing Process

MA PFML Filing Process