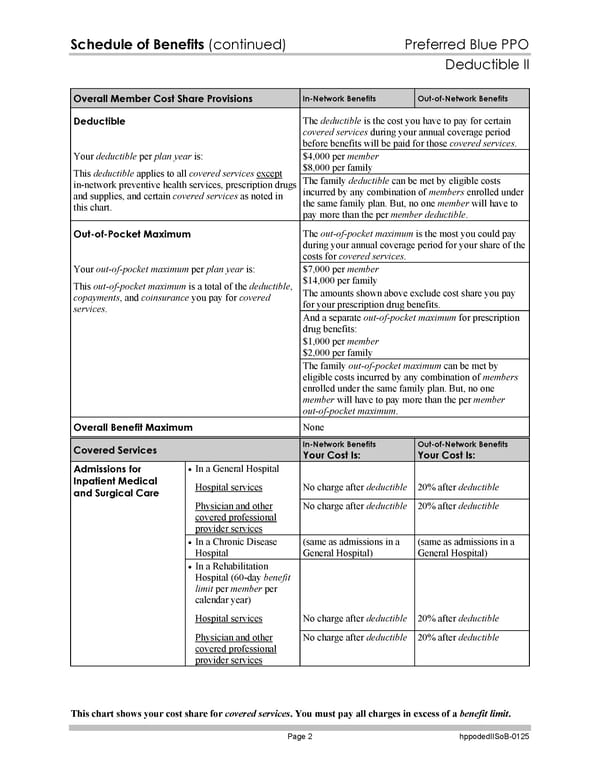

Schedule of Benefits (continued) Preferred Blue PPO Deductible II This chart shows your cost share for covered services. You must pay all charges in excess of a benefit limit. Page 2 hppodedIISoB-0125 Overall Member Cost Share Provisions In-Network Benefits Out-of-Network Benefits Deductible The deductible is the cost you have to pay for certain covered services during your annual coverage period before benefits will be paid for those covered services. $4,000 per member $8,000 per family Your deductible per plan year is: This deductible applies to all covered services except in-network preventive health services, prescription drugs and supplies, and certain covered services as noted in this chart. The family deductible can be met by eligible costs incurred by any combination of members enrolled under the same family plan. But, no one member will have to pay more than the per member deductible. Out-of-Pocket Maximum The out-of-pocket maximum is the most you could pay during your annual coverage period for your share of the costs for covered services. $7,000 per member $14,000 per family The amounts shown above exclude cost share you pay for your prescription drug benefits. And a separate out-of-pocket maximum for prescription drug benefits: $1,000 per member $2,000 per family Your out-of-pocket maximum per plan year is: This out-of-pocket maximum is a total of the deductible, copayments, and coinsurance you pay for covered services. The family out-of-pocket maximum can be met by eligible costs incurred by any combination of members enrolled under the same family plan. But, no one member will have to pay more than the per member out-of-pocket maximum. Overall Benefit Maximum None Covered Services In-Network Benefits Your Cost Is: Out-of-Network Benefits Your Cost Is: In a General Hospital Hospital services No charge after deductible 20% after deductible Physician and other covered professional provider services No charge after deductible 20% after deductible In a Chronic Disease Hospital (same as admissions in a General Hospital) (same as admissions in a General Hospital) In a Rehabilitation Hospital (60-day benefit limit per member per calendar year) Hospital services No charge after deductible 20% after deductible Admissions for Inpatient Medical and Surgical Care Physician and other covered professional provider services No charge after deductible 20% after deductible

Subscriber Certificate and Rider Documentation Page 128 Page 130

Subscriber Certificate and Rider Documentation Page 128 Page 130