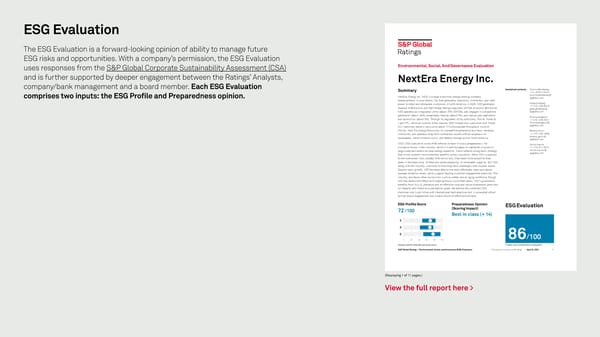

ESG Evaluation The ESG Evaluation is a forward-looking opinion of ability to manage future ESG risks and opportunities. With a company’s permission, the ESG Evaluation uses responses from the S&P Global Corporate Sustainability Assessment (CSA) Environmental, Social, And Governance Evaluation and is further supported by deeper engagement between the Ratings’ Analysts, NextEra Energy Inc. company/bank management and a board member. Each ESG Evaluation Summary Analytical contacts Corinne Bendersky +44-7816-149424 comprises two inputs: the ESG Pro昀椀le and Preparedness opinion. NextEra Energy Inc. (NEE) is a large diversified energy holding company corinne.bendersky@ spglobal.com headquartered in Juno Beach, Fla. that generates, transmits, distributes, and sells power to retail and wholesale customers in North America. In 2020, NEE generated Gabe Grosberg revenue of $18 billion and S&P Global Ratings-adjusted EBITDA of around $10 billion. +1-212-438-6043 gabe.grosberg @ NEE operates as a regulated utility (about 70% EBITDA), and engages in competitive spglobal.com generation (about 20%), proprietary trading (about 5%), and natural gas exploration Thomas Englerth and production (about 5%). Through its regulated utility subsidiary, Florida Power & +1-212-438-0341 Light (FPL, which as a result of the January 2021 merger now subsumes Gulf Power thomas.englerth@ Co.) it provides electric services to about 11 million people throughout most of spglobal.com Florida. Next Era Energy Resources, its competitive generation business, develops, Beverly Gantt constructs, and operates long-term contracted assets with an emphasis on +1-212-438-1696 renewables, electric transmission, and battery storage across North America. beverly.gantt@ spglobal.com NEE’s ESG Evaluation score of 86 reflects its best-in-class preparedness for Caitlin Harris disruptive forces in the industry, which it is well equipped to capitalize on given its +1-415-317-5014 large scale and extensive clean energy expertise. It also reflects a long-term strategy caitlin.harris @ that drives systemic environmental benefits across industries. While NEE is exposed spglobal.com to environmental risks, notably GHG emissions, it has been more proactive than peers in decarbonizing its fleet and vastly expanding its renewable capacity. But NEE, along with the industry, continues to face long-term challenges over nuclear waste. Despite rapid growth, NEE has been able to maintain affordable rates and above- average reliability levels, which support leading customer engagement practices. The industry also faces other social risks, such as safety and an aging workforce, though NEE has been more effective mitigating these issues than peers. NEE’s governance benefits from its U.S. presence and an effective code and values framework premised on integrity and linked to sustainability goals. We believe the combined CEO- chairman role is not in line with international best practices but is somewhat offset by high board engagement and a track record of effective oversight. ESG Profile Score Preparedness Opinion ESG Evaluation 72 /100 (Scoring Impact) Best in class (+ 14) E S G 86/100 0 20 40 60 80 100 Company-specific attainable and actual scores A higher score indicates better sustainability S&P Global Ratings || Environmental, Social, and Governance (ESG) Evaluation This product is not a credit rating April 6, 2021 1 (Displaying 1 of 11 pages.) View the full report here >

ESG Evaluation SP Global (5) Page 3 Page 5

ESG Evaluation SP Global (5) Page 3 Page 5