BUYER's guide

The Home Buyers Guide

BUYER'S GUIDE Let's find your ideal home! 214.836.0752 | [email protected] W W W . H O M E S A N D L A N D I N T E X A S . C O M INDEPENDENT Realty

BUYER'S GUIDE CONTENTS Welcome Meet Your Agent Our Commitment to You The Home Buying Process Preparing to Buy But 1st, Get Pre-Approved! Pre-Qualified vs Pre-Approved Which Loan is Right for You? Questions to Ask Lenders Trusted Lenders Home Loan Application Checklist Finding Your Dream Home House Wants & Needs List House Hunting Tips Making an Offer Negotiations Under Contract & In Escrow What Not to Do Final Steps Before Closing Homeowners Insurance Title Insurance Cleared to Close Closing Day Success Stories Trusted Vendors

WELCOME You are about to embark on the exciting journey of finding your ideal home. Whether it is your first home or your tenth home, we will make your home-buying experience fun and exciting. We can help you find the ideal home with the least amount of hassle. Purchasing a home is a very important decision and a big undertaking in your life. In fact, most people only choose a few homes in their lifetime. We are going to make sure that you are well equipped and armed with up-to-date information for your big decision. We are even prepared to guide you through every phase of the home-buying process. This presentation will give you helpful information and act as an invaluable guide for your home-buying journey. So let’s take an exciting journey together! I look forward to meeting your real estate needs every step of the way! ABOUT INDEPENDENT REALTY INDEPENDENT Realty in Texas it is locally owned and operated by Broker Stephen Etzel, who is also the Broker/Owner of Heritage Realty in Oklahoma and partner at Alliance Mortgage Texas. Steve has a Masters Degree in Bankruptcy and Tax Law and a currently he is Instructor - Curriculum Development - Autor at Real Estate Education Steve Etzel and Training and Instructor at National Association of BROKER Realtors and Texas Association of Realtors. LUMINITA CORDES - REALTOR® | INDEPENDENT Realty

MEET YOUR AGENT I have a passion for real estate, and assisting clients achieve their goals. Being a licensed Realtor® since 2020, my dedication is to you, my clients is to help you get the right information, make the right plan and be your trusted guide in buying or selling properties. I am a trusted and well trained professional, with extensive knowledge and experience in DFW market who strives to provide you with the best solution. There is dedication and effort I put into making sure that you receive quality service and amazing results. Let's Connect 214.836.0752 [email protected] 3728 Bandera Ranch RD, Roanoke, TX 76262 RealBrilliance.net HomesandLandinTexas.com P.O. BOX 671 Prosper, TX 75078 You can also find me on:

OUR COMMITMENT TO YOU 1.Provide you with Customer Service during the entire buying process including, taking the time to understand your wants, needs and expectations, returning your calls and emails the same day and being honest with you at all times. 2.Organize and schedule your home search process. 3.Discuss the benefits and drawbacks of each home in relation to your specific needs. 4.Provide you with ongoing updates on available homes. 5.Help you compare homes and make a decision. 6.Advise you on the terms and issues of the offer and fill out the purchase offer contract. 7.Present your offer and negotiate offers on your behalf. 8.Coordinate and supervise the preparation of all closing documents and guide you through the closing process. 9.Help you resolve any closing issues. 10.Coordinate move-in and assist with any post-closing issues. Let's Find Your New Home!

THE HOME BUYING PROCESS Get Your Meet with Keys! Agent Inspection Get Pre- & Appraisal Approved Under House Contract Shopping Make an Offer

PREPARING TO BUY SAVE FOR A DOWN PAYMENT CHECK YOUR CREDIT GET PRE-APPROVED FOR A HOME LOAN DETERMINE HOW MUCH YOU CAN SPEND

BUT 1ST, GET PRE-APPROVED! House shopping is an exciting time! Get pre-approved for a loan first so you can be ready to make an offer when you find a home you love.

PRE-QUALIFIED VS PRE-APPROVED What's the difference between being pre-qualified and pre-approved? Pre-Qualified In order to be pre-qualified, a lender may or may not check your credit score and won't require documentation, only going off what you tell them. This will give you an idea of what you could qualify for, but when you're serious about buying, you'll need to get pre-approved. Pre-Approved To be pre-approved, the lender will pull your credit and ask you for documentation to verify your finances. Before making an offer on a house, it is best to get pre-approved to show sellers your offer is serious and that a lender has already approved you for enough money to purchase the home.

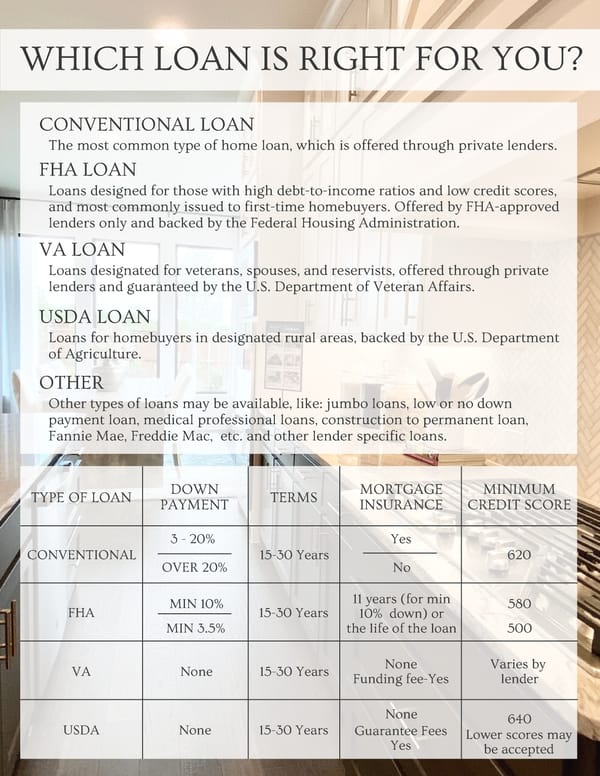

WHICH LOAN IS RIGHT FOR YOU? CONVENTIONAL LOAN The most common type of home loan, which is offered through private lenders. FHA LOAN Loans designed for those with high debt-to-income ratios and low credit scores, and most commonly issued to first-time homebuyers. Offered by FHA-approved lenders only and backed by the Federal Housing Administration. VA LOAN Loans designated for veterans, spouses, and reservists, offered through private lenders and guaranteed by the U.S. Department of Veteran Affairs. USDA LOAN Loans for homebuyers in designated rural areas, backed by the U.S. Department of Agriculture. OTHER Other types of loans may be available, like: jumbo loans, low or no down payment loan, medical professional loans, construction to permanent loan, Fannie Mae, Freddie Mac, etc. and other lender specific loans. DOWN MORTGAGE MINIMUM TYPE OF LOAN TERMS PAYMENT INSURANCE CREDIT SCORE 3 - 20% Yes CONVENTIONAL 15-30 Years 620 OVER 20% No 11 years (for min MIN 10% 580 FHA 15-30 Years 10% down) or MIN 3.5% the life of the loan 500 None Varies by VA None 15-30 Years Funding fee-Yes lender None 640 USDA None 15-30 Years Guarantee Fees Lower scores may Yes be accepted

QUESTIONS TO ASK WHEN CHOOSING A LENDER Interviewing lenders is an important step in determining what type of home loan is best for you. Not all lenders are the same, and the type of loans available, interest rates, and fees can vary. Here are some questions to consider when interviewing lenders: Which types of home loans do you offer? What will my interest and annual percentage rates be? Do I qualify for any special programs or discounts? What estimated closing costs can I expect to pay? What is your average loan processing time?

TRUSTED LENDERS ALLIANCE MORTGAGE / STEPHEN ETZEL (940) 209-0042 [email protected] https://www.alliancemortgagetx.com http://financing.lecordes.com SUPREME LENDING / JORDAN GAFFNEY 469-408-8088 [email protected] http://JordanGaffney.supremelendinglo.com LEGACY MUTUAL / KYRELL MILLER 972-457-3567 [email protected] https://legacymutual.com/officers/kyrell-miller FIND OUT IF YOU QUALIFY FOR A LOAN Take our short pre-approval survey here: http://financing.lecordes.com The information may change without notice

HOME LOAN APPLICATION DOCUMENTS CHECKLIST To determine loan eligibility, lenders typically require the following types of documents from each applicant: INCOME: Federal tax returns: last 2 years W-2s: last 2 years Pay stubs: last 2 months Any additional income documentation: pension, retirement, child support, Social Security/disability income award letters, etc ASSETS: Bank statements: 2 most recent checking and savings account statements 401(k) or retirement account statement and summary Other assets: statements and summaries of IRAs, stocks, bonds, etc. OTHER: Copy of driver's license or ID and Social Security card Addresses for the past 2-5 years and landlord's contact info if applicable Student loan statements: showing current and future payment amounts Documents relating to any of the following if applicable: divorce, bankruptcy, collections, judgements or pending lawsuits

FINDING YOUR IDEAL HOME Create a list of what you want in your new home. Include must haves as well as what you would like to have but aren't deal breakers.

HOUSE WANTS & NEEDS LIST Determine the features you are looking for in your ideal home and prioritize which items are most important to you. No house is perfect, but this will help us find the best match for you. TYPE OF HOME: Single Family Home Townhouse Condo CONDITION OF HOME: Move-In Ready Some Work Needed is OK Fixer Upper DESIRED FEATURES: (Circle) ____ Bedrooms ____ Bathrooms ____ Car Garage Small or Large Yard Ideal Square Footage: Desired Location/Neighborhood/School District: MUST HAVE WOULD LIKE TO HAVE

HOUSE HUNTING TIPS INVESTIGATE THE AREA Drive around neighborhoods that interest you to get a feel of the area, how the homes are cared for, what traffic is like, etc. ASK AROUND Talk to family, friends and co-workers to see if anyone might know of a house for sale in an area you're interested in. One of them may even know of someone that's thinking about selling but hasn't put the house on the market yet. KEEP AN OPEN MIND Finding your dream home isn't always an easy task! Have a priorities list but keep an open mind when viewing houses. TAKE PICTURES & NOTES When you visit multiple houses it gets difficult to remember specific details about each one. Take photos and notes while touring houses so that you can reference them later when comparing the properties that you've seen. BE READY TO MAKE AN OFFER When you find a home you want to buy, keep in mind there may be others interested in it as well. Be ready to make a solid offer quickly in order to have the best chance at getting that home.

MAKING AN OFFER When we have found a home that you're interested in buying, we will quickly and strategically place an offer. There are several factors to consider that can make your offer more enticing than other offers: PUT IN A COMPETITIVE OFFER We will decide on a reasonable offer price based on: Current market conditions Comparable properties recently sold in the area The property value of the house The current condition of the house PAY IN CASH VS. LOAN Paying in cash versus taking out a loan offers a faster closing timeline and less chances of issues arising, making it more appealing to sellers. PUT DOWN A LARGER DEPOSIT An offer that includes a larger earnest money deposit presents a more serious and competitive offer. ADD A PERSONAL TOUCH Include a letter to the sellers with your offer, letting them know what you love about their home. Adding this personal touch can give you an advantage over other offers by making yours stand out from the rest. OFFER A SHORTER CLOSING TIMELINE An offer with a shorter timeframe for closing is generally more attractive to sellers over one with an extended time period with a house sale contingency. A typical closing timeframe is 30-45 days.

NEGOTIATIONS A seller can accept or decline your offer, or come back with a counter offer. If they send you a counter offer, be prepared to negotiate to come up with reasonable terms for both parties. This process can go back and forth until an agreement is reached.

UNDER CONTRACT & IN ESCROW Once you and the seller have agreed on terms, a sales agreement is signed and the house is officially under contract and in escrow. Here are the steps that follow: PUT YOUR DEPOSIT INTO AN ESCROW ACCOUNT Your earnest money deposit will be put into an escrow account that is managed by a neutral third party (typically a title company or bank) who holds the money for the duration of the escrow period. They will manage all the funds and documents required for closing, and your deposit will go towards your down payment which is paid at closing. SCHEDULE A HOME INSPECTION Home inspections are optional but highly recommended to make sure that the home is in the condition for which it appears. Inspections are typically completed within 10-14 days after signing the sales agreement. RENEGOTIATE IF NECESSARY The home inspection will tell you if there are any dangerous or costly defects in the home that need to be addressed. You can then choose to either back out of the deal completely, ask for the seller to make repairs, or negotiate a lower price and handle the repairs yourself. COMPLETE YOUR MORTGAGE APPLICATION Once you've come to an agreement on the final offer, it's time to finalize your loan application and lock in your interest rate if you haven't done so already. You may need to provide additional documentation to your lender upon request. ORDER AN APPRAISAL An appraisal will be required by your lender to confirm that the home is indeed worth the loan amount. The appraisal takes into account factors such as similar property values, the home's age, location, size and condition to determine the current value of the property.

WHAT NOT TO DO DURING THE HOME BUYING PROCESS It's extremely important not do any of the following until after the home buying process is complete: Buy or Lease a Car Change Jobs Miss a Bill Payment Open a Line of Credit Move Money Around Make a Major Purchase Any of these types of changes could jeopardize your loan approval. It's standard procedure for lenders to also do a final credit check before closing.

FINAL STEPS BEFORE CLOSING Insurance Requirements Most lenders require both homeowner's insurance and title insurance. See following pages for more detailed information on each of these. Closing Disclosure At least 3 days before closing, lenders are required to provide you with a Closing Disclosure with your final loan terms and closing costs for you to review. Closing costs for the buyer typically range from 2-5% of the purchase price, which can include lender fees, lender's title insurance, and HOA dues if applicable. Final Walk through Within 48 hours of closing we will do a final walk through of the home before signing the final paperwork. This last step is to verify that no damage has been done to the property since the inspection, that any agreed upon repairs have been completed, and that nothing from the purchase agreement has been removed from the home. Next Step: Closing!

HOMEOWNERS INSURANCE WHY DO YOU NEED HOMEOWNERS INSURANCE? Homeowners insurance protects your home and possessions against damage and theft and is required by lenders before finalizing your loan. Policies vary and are completely customizable, so it's recommended to get quotes from multiple companies to compare price, coverage and limits. WHAT DOES THIS INSURANCE COVER? Homeowners insurance typically covers destruction and damage to the interior and exterior of a home due to things like fire, hurricanes, lightning, or vandalism. It also covers loss or theft of possessions, and personal liability for harm to others. WHAT DOESN'T IT COVER? Most policies do not cover flood or earthquake damage, and you may need to purchase an additional policy for this type of coverage. WHAT ARE POLICY RATES BASED ON? Rates are mostly determined by the insurer's risk that you will file a claim. The risk is based on your personal history of claims, frequency and severity of claims, past history of claims on the home, as well as the neighborhood statistics and the home's condition. HOW CAN YOU QUALIFY FOR DISCOUNTS? Many insurance companies offer discounts to seniors, and also to customers who have multiple policies with them, like auto or health insurance. Having a security system, smoke alarms and carbon monoxide detectors can also lower annual premium rates. When getting quotes, be sure to ask each company about their discounts and cost savings options.

TITLE INSURANCE WHAT IS TITLE INSURANCE? Title insurance protects the lender and/or homeowner from financial loss against claims regarding the legal ownership of a home. HOW DOES TITLE INSURANCE COVERAGE WORK? There are two types of title insurance: one for lenders and another for homeowners. Lender's title insurance is required by lenders but it does not cover you. A separate homeowners policy is needed to protect yourself from a claim on your home, and from being held financially responsible for possible unpaid property taxes from previous owners. IS A TITLE SEARCH SUFFICIENT? While most lenders require a title search, the title insurance ensures that if anything is missed during the search, those insured will be protected if any legal issues arise. HOW MUCH DOES TITLE INSURANCE COST? Title insurance policy premium is paid only once, at the closing of the sale and costs about 1% from the value of the home. The cost is based on the property’s sale value. TDI sets title insurance premiums. All title agents charge the same premium for property of the same value. But agents add charges to the premium, and the amount of the charges can vary by title agent.

CLEARED TO CLOSE Closing is the final step of the buying process. On the day of closing, both parties sign documents, funds are dispersed, and property ownership is formally transferred from the seller to the buyer.

CLOSING COSTS

DO-S AND DON'T-S

CLOSING DAY Congratulations, you made it to Closing! On the day of closing you'll be going over and signing the final paperwork, and submitting a cashier's check (or previously arranged wire transfer) to pay the remaining down payment and closing costs. ITEMS TO BRING TO CLOSING: Government Issued Photo ID Homeowner's Insurance Certificate Certified Funds or Cashier's Check Final Purchase Agreement Enjoy your new home!

VENDORS HOME INSPECTIONS CONTRACTOR FOUNDATION REPAIR Blue Line Home Inspections Striker Builds Structured Foundation BlueLineHomeInspections.com http://strikerbuilds.com structuredfoundation.com (469) 939-1033 (214) 856-0288 (469) 877-7009 PLUMBING HOME INSPECTIONS HOME INSPECTIONS Semper-Fi Home Insp... Beck's plumbing Trilogy Home Inspections SemperFiHomeInspections.com [email protected] BecksPlumbingRepairs.com (682) 351-2267 (940) 242-3377 (214) 307-3153 BLINDS | SHADES CARPET CLEANING HOME WARRANTY Best Shutters Direct Carpet Tech Super [email protected] http://carpettech.com hellosuper.com (951) 719-4227 (972) 658-4267 (214) 210-1106 PRESSURE WASHING FLOOR CARE HOME SECURITY NORTEX exterior services Floor Tech HAVAC nortexexteriorservices.com carpettech.com [email protected] (972) 332-1624 (972) 658-4267 (800) 969-3381 ROOFING LANDSCAPING LOCKSMITH Absolute Construction LR Landscaping BIG D KEY http://absoluteteam.net LrLandscapingnTx.com http://bigdkey.com (214) 459-7750 (469) 207-0267 (214) 233-0742 FINANCIAL SERVICES ROOFING WEB SERVICES James Campbell Ingrahm T Rock Contracting V1s10n Consulting Services jamesingrahm.nm.com TRockContracting.com [email protected] (870) 293-8141 (972) 259-0222 (901) 550-8222

SUCCESS STORIES Lumi is a perfect choice for your realtor. She is very attentive to every detail!!! - Hayley C.. Very professional, knowledgeable and prompt with responses and results. They really know their stuff! - Faith H. Best realtor we’ve ever worked with. Responsive, considerate, trustworthy and always prepared. He both sold our home, with excellent marketing and helped us purchase land. - Alexandra M.

Buy with Confidence 214.836.0752 | [email protected] W W W . H O M E S A N D L A N D I N T E X A S . C O M