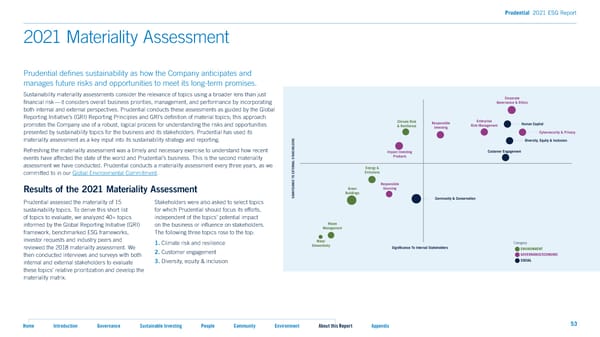

Prudential 2021 ESG Report 2021 Materiality Assessment Prudential de昀椀nes sustainability as how the Company anticipates and manages future risks and opportunities to meet its long-term promises. Sustainability materiality assessments consider the relevance of topics using a broader lens than just Corporate 昀椀nancial risk — it considers overall business priorities, management, and performance by incorporating Governance & Ethics both internal and external perspectives. Prudential conducts these assessments as guided by the Global Reporting Initiative’s (GRI) Reporting Principles and GRI’s de昀椀nition of material topics; this approach promotes the Company use of a robust, logical process for understanding the risks and opportunities Climate Risk Responsible Enterprise Human Capital & Resilience Investing Risk Management presented by sustainability topics for the business and its stakeholders. Prudential has used its Cybersecurity & Privacy materiality assessment as a key input into its sustainability strategy and reporting. Diversity, Equity & Inclusion Refreshing the materiality assessment was a timely and necessary exercise to understand how recent Impact Investing Customer Engagement events have affected the state of the world and Prudential’s business. This is the second materiality AKEHOLDERS Products assessment we have conducted. Prudential conducts a materiality assessment every three years, as we Energy & committed to in our Global Environmental Commitment. Emissions Responsible Results of the 2021 Materiality Assessment Green Sourcing Buildings SIGNIFICANCE TO EXTERNAL ST Community & Conservation Prudential assessed the materiality of 15 Stakeholders were also asked to select topics sustainability topics. To derive this short list for which Prudential should focus its efforts, of topics to evaluate, we analyzed 40+ topics independent of the topics’ potential impact informed by the Global Reporting Initiative (GRI) on the business or in昀氀uence on stakeholders. Waste framework, benchmarked ESG frameworks, The following three topics rose to the top: Management investor requests and industry peers and 1. Climate risk and resilience Water Category reviewed the 2018 materiality assessment. We Stewardship Signi1cance To Internal Stakeholders 2. Customer engagement ENVIRONMENT then conducted interviews and surveys with both GOVERNANCE/ECONOMIC internal and external stakeholders to evaluate 3. Diversity, equity & inclusion SOCIAL these topics’ relative prioritization and develop the materiality matrix. Home Introduction Governance Sustainable Investing People Community Environment About this Report Appendix 53

2021 ESG Report Page 52 Page 54

2021 ESG Report Page 52 Page 54