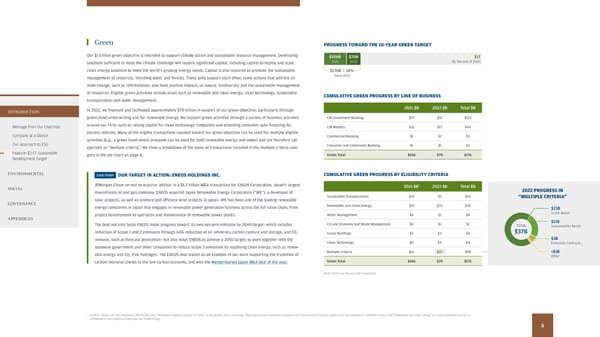

Green PROGRESS TOWARD THE 10-YEAR GREEN TARGET Our $1 trillion green objective is intended to support climate action and sustainable resource management. Developing $106B $70B $1T solutions sufcient to meet the climate challenge will require signifcant capital, including capital to deploy and scale 2021 2022 By the end of 2030 clean energy solutions to meet the world’s growing energy needs. Capital is also required to promote the sustainable $176B | 18% management of resources, including water and forests. These aims support each other; some actions that address cli- Since 2021 mate change, such as reforestation, also have positive impacts on nature, biodiversity and the sustainable management of resources. Eligible green activities include areas such as renewable and clean energy, clean technology, sustainable CUMULATIVE GREEN PROGRESS BY LINE OF BUSINESS transportation and water management. In 2022, we fnanced and facilitated approximately $70 billion in support of our green objective, particularly through 2021 $B 2022 $B Total $B INTRODUCTION green bond underwriting and for renewable energy. We support green activities through a variety of business activities CIB Investment Banking $72 $51 $123 Message from Our Chairman around our Firm, such as raising capital for clean technology companies and providing consumer auto fnancing for CIB Markets $32 $17 $49 Company at a Glance electric vehicles. Many of the eligible transactions counted toward our green objective can be used for multiple eligible Commercial Banking $1 $2 $3 activities (e.g., a green bond where proceeds can be used for both renewable energy and water) and are therefore cat- Our Approach to ESG egorized as “multiple criteria.” We show a breakdown of the types of transactions included in the multiple criteria cate- Consumer and Community Banking $1 $1 $2 Feature: $2.5T Sustainable gory in the pie chart on page 8. Green Total $106 $70 $176 Development Target ENVIRONMENTAL CASE STUDY OUR TARGET IN ACTION: ENEOS HOLDINGS INC. CUMULATIVE GREEN PROGRESS BY ELIGIBILITY CRITERIA JPMorgan Chase served as acquiror advisor in a $1.7 billion M&A transaction for ENEOS Corporation, Japan's largest 2021 $B2 2022 $B Total $B SOCIAL 2022 PROGRESS IN downstream oil and gas company. ENEOS acquired Japan Renewable Energy Corporation (“JRE”), a developer of Sustainable Transportation $22 $2 $24 “MULTIPLE CRITERIA” solar projects, as well as onshore and ofshore wind projects in Japan. JRE has been one of the leading renewable GOVERNANCE Renewable and Clean Energy $15 $20 $35 energy companies in Japan that engages in renewable power generation business across the full value chain, from $23B project development to operation and maintenance of renewable power plants. Water Management $6 $2 $8 Green Bonds APPENDICES $11B The deal not only helps ENEOS make progress toward its own net-zero emission by 2040 target—which includes Circular Economy and Waste Management $0 $1 $1 TOTAL Sustainability Bonds reduction of Scope 1 and 2 emissions through GHG reduction at oil refneries, carbon capture and storage, and CO $37B 2 Green Buildings $2 $4 $6 removal, such as forecast absorption—but also helps ENEOS to achieve a 2050 target: to work together with the $3B Clean Technology $0 $4 $4 Emissions Contracts Japanese government and other companies to reduce Scope 3 emissions by supplying clean energy, such as renew- able energy and CO -free hydrogen. The ENEOS deal stands as an example of our work supporting the transition of Multiple Criteria $61 $37 $98

2022 Environmental Social Governance Report Page 9 Page 11

2022 Environmental Social Governance Report Page 9 Page 11