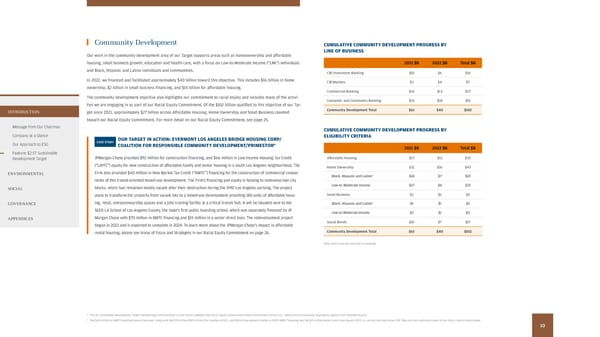

Community Development CUMULATIVE COMMUNITY DEVELOPMENT PROGRESS BY LINE OF BUSINESS Our work in the community development area of our Target supports areas such as homeownership and afordable housing, small business growth, education and health care, with a focus on Low-to-Moderate Income (“LMI”) individuals 2021 $B 2022 $B Total $B and Black, Hispanic and Latino individuals and communities. CIB Investment Banking $10 $6 $16 In 2022, we fnanced and facilitated approximately $40 billion toward this objective. This includes $16 billion in home CIB Markets $3 $4 $7 ownership, $2 billion in small business fnancing, and $15 billion for afordable housing. Commercial Banking $14 $13 $27 The community development objective also highlights our commitment to racial equity and includes many of the activi- Consumer and Community Banking $33 $18 $51 ties we are engaging in as part of our Racial Equity Commitment. Of the $102 billion qualifed to this objective of our Tar- INTRODUCTION get since 2021, approximately $27 billion across Afordable Housing, Home Ownership and Small Business counted Community Development Total $61 $40 $102 toward our Racial Equity Commitment. For more detail on our Racial Equity Commitment, see page 25. Message from Our Chairman CUMULATIVE COMMUNITY DEVELOPMENT PROGRESS BY Company at a Glance OUR TARGET IN ACTION: EVERMONT LOS ANGELES BRIDGE HOUSING CORP/ ELIGIBILITY CRITERIA Our Approach to ESG CASE STUDY 4 COALITION FOR RESPONSIBLE COMMUNITY DEVELOPMENT/PRIMESTOR 2021 $B 2022 $B Total $B Feature: $2.5T Sustainable Development Target JPMorgan Chase provided $92 million for construction fnancing, and $66 million in Low Income Housing Tax Credit Afordable Housing $17 $15 $33 (“LIHTC”) equity for new construction of afordable family and senior housing in a south Los Angeles neighborhood. The Home Ownership $31 $16 $47 ENVIRONMENTAL Firm also provided $40 million in New Market Tax Credit (“NMTC”) fnancing for the construction of commercial compo- 3 $14 $7 $22 Black, Hispanic and Latino nents of this transit-oriented mixed-use development. The Firm’s fnancing and equity is helping to redevelop two city blocks, which had remained mostly vacant after their destruction during t he 1992 Los Angeles uprising. The project Low-to-Moderate Income $17 $8 $25 SOCIAL plans to transform the property from vacant lots to a mixed-use development providing 180 units of afordable hous- Small Business $2 $2 $5 ing, retail, entrepreneurship spaces and a jobs training facility at a critical transit hub. It will be situated next to the 3 $1 $1 $2 GOVERNANCE Black, Hispanic and Latino SEED LA School of Los Angeles County, the state’s frst public boarding school, which was separately fnanced by JP Low-to-Moderate Income $2 $1 $3 APPENDICES Morgan Chase with $70 million in NMTC fnancing and $15 million in a senior direct loan. The redevelopment project began in 2022 and is expected to complete in 2024. To learn more about the JPMorgan Chase’s impact in afordable Social Bonds $10 $7 $17 rental housing, please see Areas of Focus and Strategies in our Racial Equity Commitment on page 26. Community Development Total $61 $40 $102 Note: Totals may not sum due to rounding. 3 Per our Sustainable Development Target methodology, refected here is total dollars; whereas the Racial Equity Commitment refects incremental dollars (i.e., annual results measured as progress against 2019 baseline results). 4 The $40 million in NMTC fnancing toward Evermont, along with the $70 million ($42 million frst tranche in 2021, and $28 million second tranche in 2022) NMTC fnancing and the $15 million senior direct loan toward SEED LA, are not included in our SDT. They are only captured as part of our Racial Equity Commitment. 10

2022 Environmental Social Governance Report Page 11 Page 13

2022 Environmental Social Governance Report Page 11 Page 13