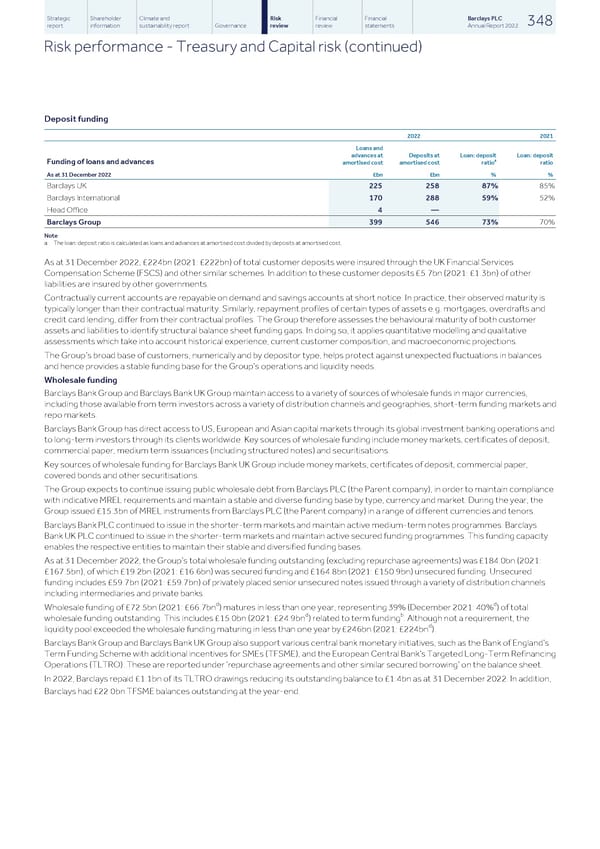

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 348 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Treasury and Capital risk (continued) Deposit funding 2022 2021 Loans and advances at Deposits at Loan: deposit Loan: deposit a Funding of loans and advances amortised cost amortised cost ratio ratio As at 31 December 2022 £bn £bn % % Barclays UK 225 258 87 % 85 % Barclays International 170 288 59 % 52 % Head Office 4 — Barclays Group 399 546 73 % 70 % Note a The loan: deposit ratio is calculated as loans and advances at amortised cost divided by deposits at amortised cost. As at 31 December 2022, £224bn (2021: £222bn) of total customer deposits were insured through the UK Financial Services Compensation Scheme (FSCS) and other similar schemes. In addition to these customer deposits £5.7bn (2021: £1.3bn) of other liabilities are insured by other governments. Contractually current accounts are repayable on demand and savings accounts at short notice. In practice, their observed maturity is typically longer than their contractual maturity. Similarly, repayment profiles of certain types of assets e.g. mortgages, overdrafts and credit card lending, differ from their contractual profiles. The Group therefore assesses the behavioural maturity of both customer assets and liabilities to identify structural balance sheet funding gaps. In doing so, it applies quantitative modelling and qualitative assessments which take into account historical experience, current customer composition, and macroeconomic projections. The Group’s broad base of customers, numerically and by depositor type, helps protect against unexpected fluctuations in balances and hence provides a stable funding base for the Group’s operations and liquidity needs. Wholesale funding Barclays Bank Group and Barclays Bank UK Group maintain access to a variety of sources of wholesale funds in major currencies, including those available from term investors across a variety of distribution channels and geographies, short-term funding markets and repo markets. Barclays Bank Group has direct access to US, European and Asian capital markets through its global investment banking operations and to long-term investors through its clients worldwide. Key sources of wholesale funding include money markets, certificates of deposit, commercial paper, medium term issuances (including structured notes) and securitisations. Key sources of wholesale funding for Barclays Bank UK Group include money markets, certificates of deposit, commercial paper, covered bonds and other securitisations. The Group expects to continue issuing public wholesale debt from Barclays PLC (the Parent company), in order to maintain compliance with indicative MREL requirements and maintain a stable and diverse funding base by type, currency and market. During the year, the Group issued £15.3bn of MREL instruments from Barclays PLC (the Parent company) in a range of different currencies and tenors. Barclays Bank PLC continued to issue in the shorter-term markets and maintain active medium-term notes programmes. Barclays Bank UK PLC continued to issue in the shorter-term markets and maintain active secured funding programmes. This funding capacity enables the respective entities to maintain their stable and diversified funding bases. As at 31 December 2022, the Group’s total wholesale funding outstanding (excluding repurchase agreements) was £184.0bn (2021: £167.5bn), of which £19.2bn (2021: £16.6bn) was secured funding and £164.8bn (2021: £150.9bn) unsecured funding. Unsecured funding includes £59.7bn (2021: £59.7bn) of privately placed senior unsecured notes issued through a variety of distribution channels including intermediaries and private banks. d d Wholesale funding of £72.5bn (2021: £66.7bn ) matures in less than one year, representing 39% (December 2021: 40% ) of total d b wholesale funding outstanding. This includes £15.0bn (2021: £24.9bn ) related to term funding . Although not a requirement, the d liquidity pool exceeded the wholesale funding maturing in less than one year by £246bn (2021: £224bn ). Barclays Bank Group and Barclays Bank UK Group also support various central bank monetary initiatives, such as the Bank of England’s Term Funding Scheme with additional incentives for SMEs (TFSME), and the European Central Bank’s Targeted Long-Term Refinancing Operations (TLTRO). These are reported under ‘repurchase agreements and other similar secured borrowing’ on the balance sheet. In 2022, Barclays repaid £1.1bn of its TLTRO drawings reducing its outstanding balance to £1.4bn as at 31 December 2022. In addition, Barclays had £22.0bn TFSME balances outstanding at the year-end.

Barclays PLC - Annual Report - 2022 Page 349 Page 351

Barclays PLC - Annual Report - 2022 Page 349 Page 351