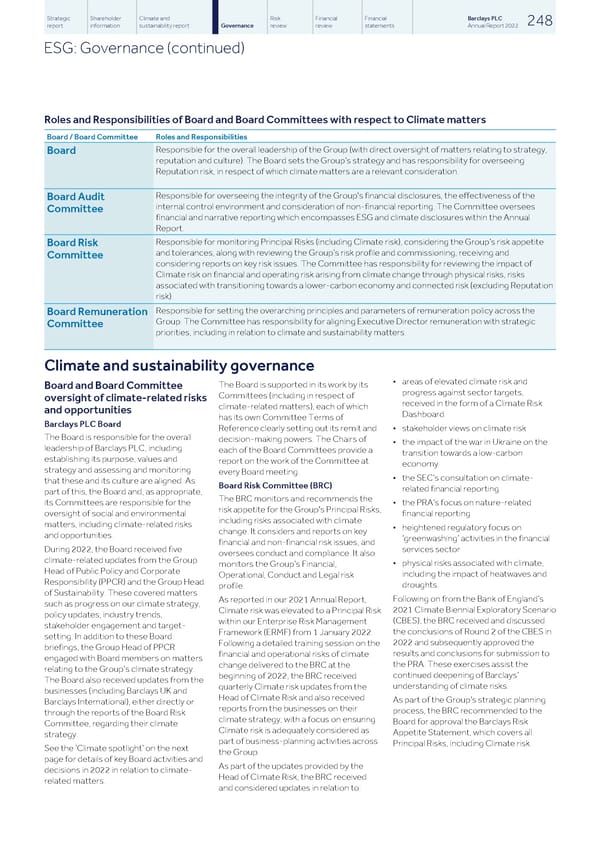

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 248 report information sustainability report Governance review review statements Annual Report 2022 ESG: Governance (continued) Roles and Responsibilities of Board and Board Committees with respect to Climate matters Board / Board Committee Roles and Responsibilities Responsible for the overall leadership of the Group (with direct oversight of matters relating to strategy, Board reputation and culture). The Board sets the Group’s strategy and has responsibility for overseeing Reputation risk, in respect of which climate matters are a relevant consideration. Responsible for overseeing the integrity of the Group's financial disclosures, the effectiveness of the Board Audit internal control environment and consideration of non-financial reporting. The Committee oversees Committee financial and narrative reporting which encompasses ESG and climate disclosures within the Annual Report. Responsible for monitoring Principal Risks (including Climate risk), considering the Group’s risk appetite Board Risk and tolerances, along with reviewing the Group’s risk profile and commissioning, receiving and Committee considering reports on key risk issues. The Committee has responsibility for reviewing the impact of Climate risk on financial and operating risk arising from climate change through physical risks, risks associated with transitioning towards a lower-carbon economy and connected risk (excluding Reputation risk). Responsible for setting the overarching principles and parameters of remuneration policy across the Board Remuneration Group. The Committee has responsibility for aligning Executive Director remuneration with strategic Committee priorities, including in relation to climate and sustainability matters. Climate and sustainability governance • areas of elevated climate risk and The Board is supported in its work by its Board and Board Committee progress against sector targets, Committees (including in respect of oversight of climate-related risks received in the form of a Climate Risk climate-related matters), each of which and opportunities Dashboard has its own Committee Terms of Barclays PLC Board Reference clearly setting out its remit and • stakeholder views on climate risk The Board is responsible for the overall decision-making powers. The Chairs of • the impact of the war in Ukraine on the leadership of Barclays PLC, including each of the Board Committees provide a transition towards a low-carbon establishing its purpose, values and report on the work of the Committee at economy strategy and assessing and monitoring every Board meeting. • the SEC’s consultation on climate- that these and its culture are aligned. As Board Risk Committee (BRC) related financial reporting part of this, the Board and, as appropriate, The BRC monitors and recommends the its Committees are responsible for the • the PRA’s focus on nature-related risk appetite for the Group's Principal Risks, oversight of social and environmental financial reporting including risks associated with climate matters, including climate-related risks • heightened regulatory focus on change. It considers and reports on key and opportunities. ‘greenwashing’ activities in the financial financial and non-financial risk issues, and During 2022, the Board received five services sector oversees conduct and compliance. It also climate-related updates from the Group • physical risks associated with climate, monitors the Group’s Financial, Head of Public Policy and Corporate including the impact of heatwaves and Operational, Conduct and Legal risk Responsibility (PPCR) and the Group Head droughts. profile. of Sustainability. These covered matters Following on from the Bank of England’s As reported in our 2021 Annual Report, such as progress on our climate strategy, 2021 Climate Biennial Exploratory Scenario Climate risk was elevated to a Principal Risk policy updates, industry trends, (CBES), the BRC received and discussed within our Enterprise Risk Management stakeholder engagement and target- the conclusions of Round 2 of the CBES in Framework (ERMF) from 1 January 2022. setting. In addition to these Board 2022 and subsequently approved the Following a detailed training session on the briefings, the Group Head of PPCR results and conclusions for submission to financial and operational risks of climate engaged with Board members on matters the PRA. These exercises assist the change delivered to the BRC at the relating to the Group’s climate strategy. continued deepening of Barclays’ beginning of 2022, the BRC received The Board also received updates from the understanding of climate risks. quarterly Climate risk updates from the businesses (including Barclays UK and Head of Climate Risk and also received As part of the Group’s strategic planning Barclays International), either directly or reports from the businesses on their process, the BRC recommended to the through the reports of the Board Risk climate strategy, with a focus on ensuring Board for approval the Barclays Risk Committee, regarding their climate Climate risk is adequately considered as Appetite Statement, which covers all strategy. part of business-planning activities across Principal Risks, including Climate risk. See the ‘Climate spotlight’ on the next the Group. page for details of key Board activities and As part of the updates provided by the decisions in 2022 in relation to climate- Head of Climate Risk, the BRC received related matters. and considered updates in relation to:

Barclays PLC - Annual Report - 2022 Page 249 Page 251

Barclays PLC - Annual Report - 2022 Page 249 Page 251