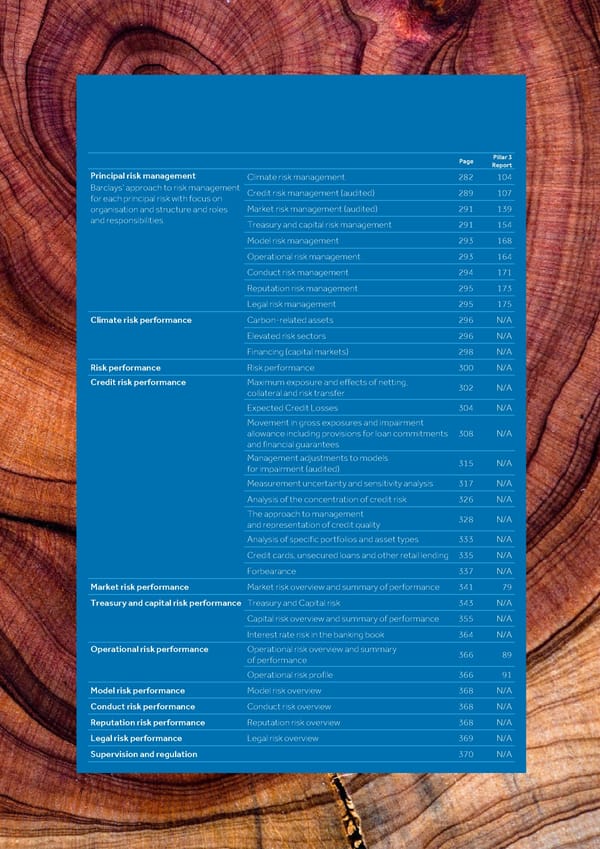

Pillar 3 Page Report Principal risk management Climate risk management 282 104 Barclays’ approach to risk management Credit risk management (audited) 289 107 for each principal risk with focus on Market risk management (audited) 291 139 organisation and structure and roles and responsibilities. Treasury and capital risk management 291 154 Model risk management 293 168 Operational risk management 293 164 Conduct risk management 294 171 Reputation risk management 295 173 Legal risk management 295 175 Climate risk performance Carbon-related assets 296 N/A Elevated risk sectors 296 N/A Financing (capital markets) 298 N/A Risk performance Risk performance 300 N/A Credit risk performance Maximum exposure and effects of netting, 302 N/A collateral and risk transfer Expected Credit Losses 304 N/A Movement in gross exposures and impairment allowance including provisions for loan commitments 308 N/A and financial guarantees Management adjustments to models 315 N/A for impairment (audited) Measurement uncertainty and sensitivity analysis 317 N/A Analysis of the concentration of credit risk 326 N/A The approach to management 328 N/A and representation of credit quality Analysis of specific portfolios and asset types 333 N/A Credit cards, unsecured loans and other retail lending 335 N/A Forbearance 337 N/A Market risk performance Market risk overview and summary of performance 341 79 Treasury and capital risk performance Treasury and Capital risk 343 N/A Capital risk overview and summary of performance 355 N/A Interest rate risk in the banking book 364 N/A Operational risk performance Operational risk overview and summary 366 89 of performance Operational risk profile 366 91 Model risk performance Model risk overview 368 N/A Conduct risk performance Conduct risk overview 368 N/A Reputation risk performance Reputation risk overview 368 N/A Legal risk performance Legal risk overview 369 N/A Supervision and regulation 370 N/A

Barclays PLC - Annual Report - 2022 Page 266 Page 268

Barclays PLC - Annual Report - 2022 Page 266 Page 268